- A Roadmap To CRA Compliance and Financial Stability

- Navigating Change

- What's Happening

- CUSMA Review 2026 Primer

CUSMA Review 2026: What Canadian Small Business Owners Need to Know

A Primer for Self-Employed Canadians

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting ... and keep it simple. Consistency beats perfection.

Published: December 3, 2025 | Edited January 27, 2026

WHAT'S IN THIS ARTICLE:

CUSMA Basics | Why Now? | The Real Problem | What Headlines Miss | Three Scenarios | What's Being Negotiated | Bigger Picture | Your Business Impact | Action Steps | What To Watch | Bottom Line | Industry Positions | Types of Tariffs | Series Image Index

NEXT ARTICLE IN SERIES >> 30 Day Tariff Admin Reset

The mandatory CUSMA USMCA T-Mex six year review begins July 1, 2026

The mandatory CUSMA USMCA T-Mex six year review begins July 1, 2026If you've been hearing rumblings about CUSMA and wondering whether you should care, here's the short answer: yes, probably. Even if you don't think you export to the United States, this trade agreement likely affects your business more than you realize.

Let me walk you through what's happening, why it matters, and most importantly, what you can actually do about it.

Table of Contents

SERIES: Dealing With The New Normal of Tariffs

What's Happening

This series explains what's changing and how to plan, not panic.

When the USTR (US Trade Representative) hearings kicked off on December 3, 2025, over 170 witnesses testified to shape the US approach to the 2026 review. It is clear that U.S. trade policy is rupturing the old ways of doing business. This series helps Canadian solopreneurs navigate how to import, export, and price products in this new reality.

New to tariffs? Start with the Introductory Primer.

What Is CUSMA, Anyway?

CUSMA stands for the Canada-United States-Mexico Agreement. (In the US, they call it USMCA. Same deal, different name order.) It's the trade agreement that replaced NAFTA back in 2020, and it governs how goods and services move between our three countries.

Here's why it matters to you: 76% of Canada's goods exports go to the United States.[1 Beutel] That's not just big corporations. It's also the market for countless small businesses, whether they're selling directly to US customers, supplying Canadian companies that export, or competing with imports.

The agreement keeps most of those exports tariff-free. In fact, according to the Bank of Canada's estimates, about 100% of Canadian energy exports and 95% of other exports are CUSMA-compliant, which means they qualify for preferential treatment.[2 Beutel] Without CUSMA, those goods would face regular tariffs overnight.

Just a quick nod that CUSMA also covers intellectual property, professional mobility, and services trade, but most WFH solopreneurs won’t encounter the legal detail directly.

Why Is Everyone Talking About This Now?

CUSMA has a built-in review clause. Article 34.7 requires the three countries to conduct a formal joint review in year six which happens to be July 1, 2026.[3 Beutel] That's less than seven months away.

At that review, each country must decide: extend the agreement for another 16 years, or trigger annual reviews until it expires in 2036. Any country can also withdraw entirely with just six months' notice.[4 Beutel]

The consultations to prepare for this review just wrapped up in November 2025. Canada, the US, and Mexico all held public consultations asking businesses and stakeholders: What's working? What's not? What should we prioritize?

Now everyone's analyzing that feedback and preparing their negotiating positions for next summer.

The Real Problem: It's Not the Tariffs, It's the Uncertainty

Small business seeking alternative markets are looking to Canadian partners 67% of the time

Small business seeking alternative markets are looking to Canadian partners 67% of the timeHere's what sticks out for me about a CFIB (Canadian Federation of Independent Business) August 2025 survey of over 3,300 small business owners. 36% reported pausing new investments because of the trade war.[5 CFIB]

That might not sound catastrophic at first glance. But think about what "paused investment" actually means for a small business. It's the new software you didn't buy. The employee you didn't hire. The equipment upgrade you put off. Its growth deferred, perhaps indefinitely.

Here's what stood out to me. Most businesses aren't pausing because tariffs have already crushed them. They're pausing because 79% say unpredictable tariffs make it impossible to plan ahead.[5 CFIB] You can't plan when you don't know what the rules will be next year. You can't budget when the rules might change next month.

The CFIB survey results paint a picture of businesses caught in a squeeze:

- 63% are dealing with higher expenses

- 53% have seen profits drop

- 42% are facing supply chain disruptions

So you're watching costs climb and margins shrink. The logical move? Look for new suppliers, maybe explore other markets. But there's a catch. CFIB says one-third of small businesses have already moved away from U.S. suppliers or customers, and another third are considering it. That is NOT a small shift. It is two-thirds of businesses either pivoting or thinking about it.

As a small business owner, you are probably being advised to 'look at other markets'. It's a reality for many small businesses that they can't afford the legal, regulatory, and travel costs to explore other markets like the EU, Mexico, or Asia. That said, CFIB says that 34% pivoted to the EU, and 21% to Mexico.

Where are they turning? Mostly back home. Survey respondents seeking alternatives looked to Canada partners 67% of the time. That makes sense to me. There is less currency risk and no cross-border tariff drama. But it also means potentially higher costs or fewer options, depending on what you're sourcing.

Here's the real kicker in my opinion. 82% of surveyed businesses support returning tariff revenue to affected firms. Translation? Canada's own retaliatory tariffs ended up hurting them. It's not just the U.S. tariffs squeezing you. It's the friendly fire response too!

Perhaps the most telling number from the survey ... 75% of small business owners say the trade war has increased their stress levels. That's three out of four people running a business who are now dealing with an extra layer of anxiety that has nothing to do with serving customers or managing cash flow.

This isn't about politics. It's about the day-to-day reality of trying to run a business when the ground keeps shifting under your feet.

As one recent investment analysis put it, "It is not the tariff rates themselves but rather uncertainty over future U.S. trade policy that appears to be exerting the greatest pressure on the Canadian economy and labour market."[2 Beutel]

What the Headlines Don't Tell You: Effective vs. Headline Tariff Rates

You've probably seen scary headlines about 35% baseline tariffs, 50% on steel and aluminum, 25% on autos. Those numbers are real but they're not the whole story.

Here's what matters more to you ... your effective tariff rate ... what you actually pay after CUSMA exemptions.

"Canada has the lowest effective tariff rate for any trading partner of the United States," at approximately 5%, according to recent analysis. Even with all the tariff threats this year, that rate is expected to rise to only about 6%.[7 Beutel]

How? Because businesses have been scrambling to get CUSMA-compliant. They've been filling out the country-of-origin paperwork, documenting their supply chains, making sure they qualify for the exemptions. It's not glamorous work, but it's effective. That's the "cover" CUSMA provides.

The problem is that cover might not last if the 2026 review goes sideways.

Three Possible Scenarios for 2026

Trade policy experts have outlined three basic scenarios [8 Beutel] for how this could play out:

Scenario 1: Straightforward Renewal (Low Disruption)

All three countries agree to a modest package of updates and extend the agreement for another 16 years. Policy uncertainty drops, business investment picks up, and we all move on with our lives.

The expert's assessment say this scenario is highly unlikely given the current US administration's stance and the contentious issues on the table, don't count on this.

Scenario 2: Contentious Renegotiation (High Disruption)

The US threatens withdrawal, demands major concessions (changes to auto rules, dairy access, government procurement), and negotiations drag on. Investment gets deferred. Supply chains get destabilized. More sector-specific tariffs get imposed while everyone argues.

The expert's assessment say this scenario is most likely path, especially in the first half of 2026. Expect "hardline rhetoric and even threats of withdrawal dominating the discussion through the first half of 2026," followed by "a period of turbulent trade talks culminating in a deal."[8 Beutel]

Scenario 3: Lingering Uncertainty (Medium Disruption)

No one agrees to extend, so the deal keeps running but faces annual reviews until 2036. Talks drag on. Side deals get made instead of real renegotiation. The uncertainty that's already damaged the economy just... continues. Business investment stays slow. Hiring stays cautious. Supply chains gradually unwind.

The expert's assessment say this scenario has a low probability. The US administration generally prefers securing deals rather than prolonged ambiguity, and Canada desperately wants clarity.[8 Beutel]

What's Actually on the Negotiating Table?

Cross border issues likely to come up in CUSMA Review that might affect small businesses

Cross border issues likely to come up in CUSMA Review that might affect small businessesWithout getting into every technical detail, here are the issues most likely to come up that might affect small businesses:

- Digital Trade and Online Business

If you sell to US customers online, this matters. Issues include cross-border data flows, where you can store customer data, digital services taxes, and how e-commerce gets regulated. The original NAFTA didn't foresee the massive growth of digital trade. CUSMA tried to address it, but technology has evolved even since 2020.

- Rules of Origin

This determines whether your product qualifies as "made in North America" and gets preferential treatment. The big fight is in autos, but the principles apply elsewhere.

Here's where it gets tricky. There's growing concern about Chinese companies setting up manufacturing operations in Mexico (particularly for electric vehicles and auto parts) and potentially qualifying for CUSMA benefits without being subject to the same labor, environmental, or subsidy rules.[9 McCarthy Tétrault]

If you source materials or components from Mexico, this could affect you in two ways:

- Tighter origin verification means you might face more scrutiny proving where your inputs actually come from.

- New thresholds or exclusions means the U.S. may push for rules that explicitly exclude certain non-party inputs, even if they're manufactured in Mexico.

Even if you're not in automotive, here's an example of how rules of origin disputes create uncertainty that makes planning harder. The automotive sector is already dealing with the rules of origin issue. Canada and Mexico recently won a dispute over how regional value content is calculated (the "Super-Core" case), but the U.S. is expected to push back during the 2026 review.[9 McCarthy Tétrault]

- The $800 Duty-Free Exemption

Remember when earlier this year you could ship small orders to US customers duty-free under $800? That exemption was lost in the tariff disputes. (was only late August? It seems longer!) It might or might not come back. If you ship lots of small orders across the border, this matters.

Canada has won several dispute panels under CUSMA, including the Super-Core automotive case mentioned above as well as dairy quota disputes.[9 McCarthy Tétrault] But there is a big problem. The US has ignored the rulings by using Section 232 (national security) and emergency powers (IEEPA) to impose tariffs anyway, effectively bypassing the agreement.

Prime Minister Carney has said Canada will push to prevent future misuse of these legal tools.[9 McCarthy Tétrault] But if the agreement doesn't have teeth (if one party can just ignore the rules when it's convenient) then it's just paper.

This affects everyone because it determines whether the rules actually mean anything. If the U.S. can slap tariffs on steel, aluminum, or anything else by invoking "national security", then the predictability you're counting on doesn't exist.

- Issues That Probably Don't Affect Most Small Businesses

Dairy quota disputes, softwood lumber (unless you're in those industries), specific automotive manufacturing requirements. These get lots of headlines but aren't relevant to most work-from-home businesses.

Aluminum, steel, and copper may affect you indirectly through higher input costs. Truck tariffs might have a more direct impact if you rely on cross-border shipping.

If you’re a service provider (designer, coach, VA, consultant) working remotely with U.S. clients, trade tensions can still touch you via payment platforms, cross‑border tax rules, or client budgets. You're not shipping physical goods, but you're still operating in a cross-border environment where the rules can shift.

The Bigger Picture: Canada's Negotiating Position

Here's the uncomfortable truth: Canada needs this deal more than the US does.

We send 76% of our exports to the US. They send only 17% of their exports to us.[6 Beutel] That's an asymmetric relationship, and it shows in the negotiating leverage.

Making it more challenging, Canada dismantled its formal trade advisory system years ago (the Sectoral Advisory Groups on International Trade (SAGIT)) that used to give businesses real input into negotiations. The US kept theirs. So US negotiators walk into talks with detailed, confidential, sector-specific intelligence from 700+ industry experts. Canadian negotiators walk in with... public submissions.[10 CIGI]

As one trade expert put it: "One side will have a scalpel, the other, a blunt instrument."[10 CIGI]

That doesn't mean Canada will get steamrolled, but it does mean the negotiations will be challenging.

What This Means for Your Business (Your Business Impact)

Let's get practical. Here's what you're looking at:

In the short-term (next 6 months), uncertainty is likely to be extremely high with no active trade negotiations currently occurring.

- You probably read in the news that Trump froze trade talks in late October 2025 after the Ontario government ran a Ronald Reagan ad in the U.S., threatening additional 10% tariffs and stating talks won't resume for 'a long time.' It's the beginning of December and talks still haven't resumed.

- Multiple unresolved sectoral tariff issues (auto, steel, aluminum, lumber) remain in limbo.

- Separately, the formal USMCA review process is scheduled to begin July 1, 2026.

Refer to our earlier discussion for details on the three possible scenarios: straightforward renewal (low disruption), contentious renegotiation (high disruption), lingering uncertainty (medium disruption).

What You Can Do (Action Steps)

I'm a retired bookkeeper, not a tariff specialist. I’ve done my best to be accurate, but because I’m not a tariff expert, I may not have stated every complex nuance perfectly. I'm presenting this complex information to put the issue on the table and help you address it proactively. Think of these thoughts as a way to draw up a list of questions you might want to ask your accountant or trade advisor to help make that meeting productive. It's really hard to get the information you need when you don't know the questions to ask ... but you know your business best ... so make adjustments where you deem necessary.

It's time to do the work you control

It's time to do the work you controlHere's where you have control:

- Document your supply chain. Where do your materials, inventory, or supplies actually come from? If you import through Mexico, could any of it be Chinese in origin? You need to know this.

- Know your tariff classifications. Even if your products currently enter the US tariff-free, know what the classification codes are. If CUSMA weakens, you'll need this information fast.

- Track your US exposure separately. In your bookkeeping, make it easy to see how much of your revenue comes from US sales or depends on US supply chains. You need to understand your exposure. Something simple like using a separate income account for U.S. sales in your bookkeeping software (or tagging U.S. revenue using a separate income account for U.S. sales) will help you see at a glance what portion of your income could be affected.

Don’t forget exchange rate gains and losses. Trade tensions often move the CAD-USD rate. If you bill or get paid in U.S. dollars, CRA requires you to track your realized exchange gains and losses for your tax return preparations.

If you sell online to U.S. customers, remember that the $800 duty-free exemption is gone. Factor customs duties and brokerage fees into your pricing, or consider whether U.S. sales are still viable for your business. - Build flexibility into your planning. Don't bet everything on US market access staying exactly as it is. That doesn't mean abandon the US market. It means don't put all your eggs in that basket. Even if you don't have the financing to look for other markets, is there a way you can economically jump on the 'buy Canadian' bandwagon to prop up some of your lost US sales?

- Join your industry association. If there's a trade group for your sector, join it. They're monitoring these developments and have more voice than you do alone. Plus, they'll translate the technical stuff into what it means for your specific industry. The Canadian Federation of Independent Business (CFIB) supports and advocates for small businesses in Canada.

What You Can't Control

The negotiation outcome. Political theater. Tariff tweets. Whether the US threatens withdrawal. How long talks drag on.

Don't waste energy on these. Stay informed, but don't doom-scroll.

Building the Habit: Trade Awareness and What To Watch For

Here's how this fits into your monthly review routine. You know, that habit we're always talking about where you step back and look at the big picture of your business every three months?

Add one question to that review: "Has anything changed in our cross-border situation?"

Not daily checking. Not obsessive monitoring. Just a monthly "what's the status?" check. Here's how I think 2026 will go:

- Q1 2026 (January-March): The US Trade Representative's report to Congress was presented on December 16 and 17, 2025. The report indicates the level of assertiveness in the US position. Canada will collaborate with the U.S. to determine the scope of the review.

- Q2 2026 (April-June): Sectoral negotiations will heat up if an arrangement was settled during the first quarter. News will get noisy. Focus on what's actually being discussed, not political theater.

- Q3 2026 (July-September): The July 1 renewal officially starts. Extension? Annual reviews? Major changes? This is when you'll know what you're dealing with.

- Q4 2026 (October-December): Monitor the status of the negotiations. It can be a lengthy process. Does it look like we will get an extension? Annual reviews? Major changes? Withdrawal threats? This is when you'll know what you're dealing with. Assess impact and adjust your business strategy accordingly.

This is part of audit-ready thinking. It's not just about your books. It's about knowing your trade compliance, your supply chain, your exposure. When you do your monthly review, you're checking: "Has anything changed that affects how we operate?"

Consistency and progress beats perfection. You don't need to become a trade lawyer. You just need to stay aware enough that you're not blindsided.

I'll update this article as developments unfold. Bookmark it and check back.

The Bottom Line

The CUSMA review isn't going to make or break your business overnight. But the uncertainty around it might slow you down like it already has for 75% of Canadian businesses.

Let me be candid. Some businesses won't survive this. Not because of a poor entrepreneurship, but because of economic reality. COVID. Supply chain chaos. Inflation. Rising interest rates. And now potentially devastating tariffs on top of everything else. The hits keep on coming. There's only so much any business can absorb.

If you're in a tariff-vulnerable sector with thin margins and US-dependent revenue, you may face an impossible situation. That's not failure - that's facing forces beyond your control.

For others, there may be a path forward. It might require radical creativity - new markets, different products, complete business model changes. It won't be easy, and it won't be quick. But maintaining the status quo hoping everything goes back to the way it was before tariffs were imposed more and more likely a pipe dream.

Either way, you need to assess your situation objectively now. Not with false optimism, but with clear-eyed realism about your specific exposure, your financial runway, and your genuine options. Some will pivot successfully. Others will need to make hard decisions about exit strategies.

The best response isn't panic. It's awareness. If you're still standing after everything the last few years have thrown at you, you're tougher than you think.

Know what's happening. Understand your exposure. Document your situation. Build in some flexibility. And remember: even in the worst-case scenario, it will likely be a slow deterioration, not a sudden cliff. You have time to adapt if you're paying attention.

The agreement that keeps 76% of our exports flowing to the US is up for review. That matters. It doesn't have to be the end of the world. You can pivot. You just might have to be really creative on how you do that. It's just something you need to be aware of and prepared for.

Focus on what you can control: your books, your documentation, your habits, your flexibility. The rest will unfold as it unfolds.

I'll keep watching this and update you as things develop. For now, add "CUSMA status check" to your next monthly review, make sure you know where your supplies come from and where your sales go, and then get back to running your business.

You've got this.

Appendix A: Where Different Industries Stand on CUSMA

As the 2026 review approaches, various industries on both sides of the border have made their positions clear. If you're in one of these sectors, pay close attention. If not, the takeaway is even industries with deep pockets and lobbying power are facing uncertainty. You're not alone in feeling squeezed.

Here's a snapshot of who wants what according to reporting by the Canadian Press [11] and The Globe and Mail [12]:

Industries Pushing to Preserve CUSMA

- Automakers (Ford, GM, Stellantis) want Section 232 tariffs removed for North American vehicles.

- Manufacturers call CUSMA "vital" to competitiveness; note Canada and Mexico buy more U.S. goods than next 10 trading partners combined.

- Aerospace & Mining want secure access to Canadian critical minerals.

- Agriculture support trilateral trade (though some sectors want specific changes).

- Alcohol producers want to preserve market access but seek provisions against discriminatory provincial liquor board practices.

Industries Wanting Changes or Restrictions

- U.S. Steel wants steel tariffs to remain indefinitely.

- United Auto Workers (UAW) blames free trade for "crisis in blue-collar America"; wants explicit job-security provisions.

- Dairy producers want greater access to Canadian market (supply management remains contentious).

- Lumber producers ongoing softwood lumber disputes.

- Whiskey / Wine producers concerned about provincial liquor board discrimination and retaliatory removals of U.S. products.

Unexpected Impacts

- American Horse Council says sawdust pelleted bedding (Canadian lumber byproduct) jumped from $7.50 to $10.50.

- Can Manufacturers Institute say steel / aluminum tariffs making cans more expensive, raising grocery prices.

- National Farmers Union (U.S.) pushed back on the Trump administration's priority of forcing Canada to open its dairy market, arguing that "changing our trading partnership with Canada will not solve our nation's dairy problems." Rob Larew, the union's president, pointed to domestic issues as the real threat to family farms struggling with financial survival. Specifically "corporate consolidation and rising concentration in agricultural markets".

NFU's unexpected alignment suggests that sometimes the trade fight isn't really about the border. It's about who has power on each side of it.

The real squeeze might be coming from closer to home. Whether that's corporate consolidation in the U.S. or, for Canadian small businesses, interprovincial trade barriers that make it harder to sell across provincial lines than across the border.

For small businesses watching these negotiations, that's worth remembering. The biggest obstacles to your growth might not be in Washington or Ottawa. They might be right in your own backyard.

Appendix B: The Three Types of Tariffs (and The New 'Quota' Reality)

You might be wondering, "Aren't tariffs just tariffs?"

Not quite. In this current trade conflict, the US administration is using three different legal tools. Understanding the difference matters because each one affects your cash flow differently ... and each plays a different role in the upcoming 2026 CUSMA review.

1. IEEPA & The 'Universal' Tariffs (The De Minimis Killer)

IEEPA (International Emergency Economic Powers Act) is the law the US used to implement the broad "Liberation Tariffs" back in March 2025.

The current reality is the universal tariff is already here. Canada currently has a CUSMA shield that exempts us from these tariffs, but that shield has holes.

- Hole #1 is non-compliant goods). If you can't prove your goods are of 'CUSMA Origin' (Made in North America), you have been paying this tariff since March.

- Hole #2 is small packages. The end of the De Minimis exemption in August 2025 effectively removed the shield for small, undocumented shipments. Now, even small packages face these duties (or transitional flat fees) unless you provide full CUSMA documentation.

Right now, CUSMA is the only 'escape hatch'. If you can prove your goods are 'Made in North America', you can often avoid these new fees. But this shield is fragile as PM Carney keeps trying to explain. If CUSMA isn't renewed in 2026, that protection vanishes for everyone, not just small shippers.

There is some legal uncertainty around IEEPA tariffs. US courts have ruled these tariffs illegal, but they remain in force pending Supreme Court appeals. The US administration has signalled that even if they lose in court, they will simply find another legal tool to keep the tariffs in place.

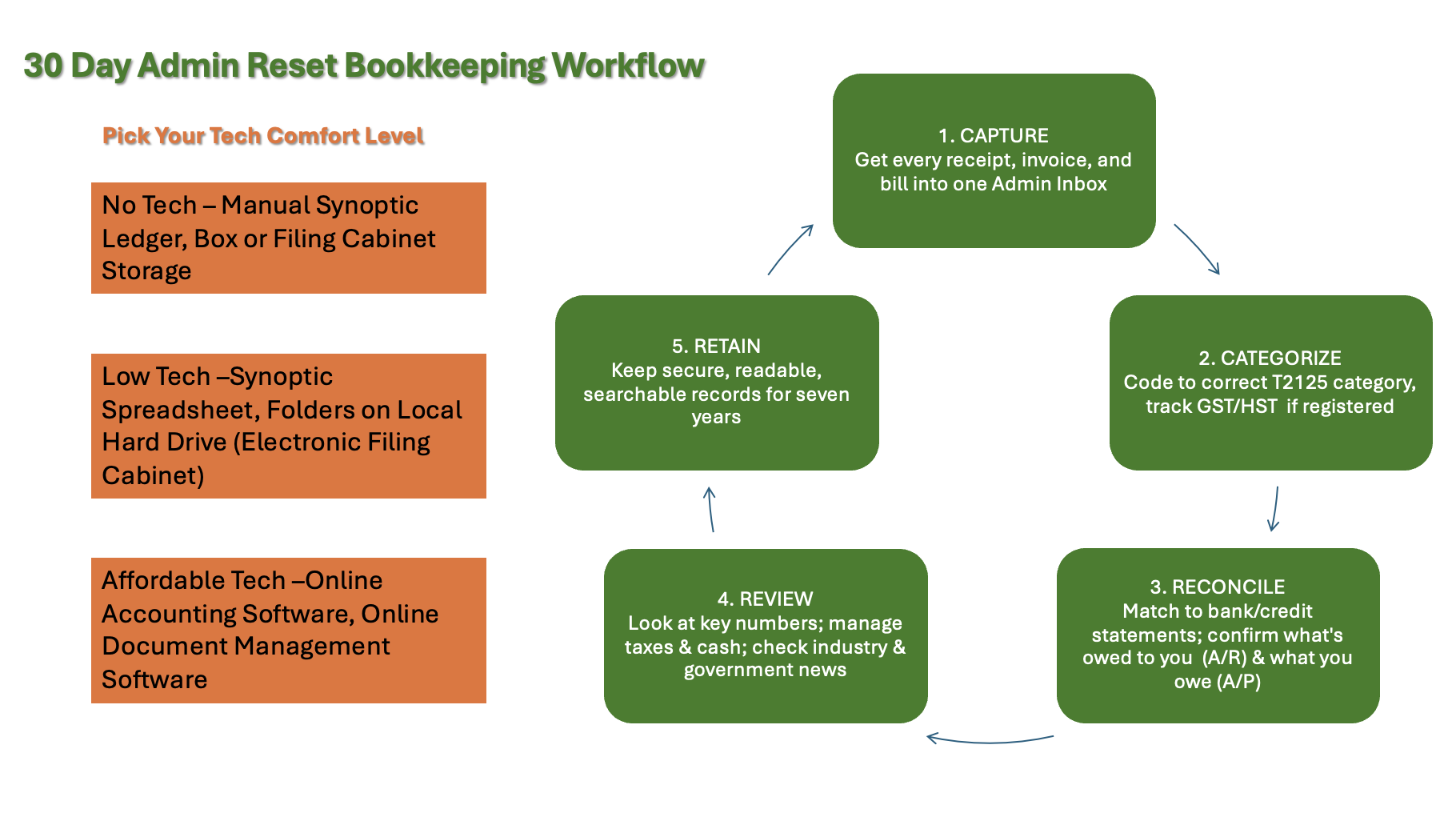

🦆 Habit Check

This is why your 'Capture' habit matters. Capture is week one in my 30 Day Admin Reset that works. If CUSMA is the only thing standing between you and the Universal Tariff, you need the paperwork to prove you qualify for it. You need to save every origin certificate from your suppliers. If you can't prove it's CUSMA compliant origin, you pay the US tax.

Learn More >> Create a Customs Compliance Binder

2. Anti-Dumping Tariffs: The "Unfair Trade" Tax

These are tariffs imposed when the US believes Canada (or other countries) is 'dumping' products below fair market value or subsidizing them unfairly.

Softwood lumber is the classic example for Canada (for China, it's steel). For decades, the US has charged duties on Canadian lumber because they dislike our stumpage fee system.

Now we are experiencing a 'Double Whammy'. Historically, this was the only tax on lumber. But as of October 2025, lumber is now facing these anti-dumping duties AND a Section 232 security tariff. It’s tax-on-top-of-tax.

🦆 Habit Check

Watch your 'Categorize' habit. Categorize is week two in my 30 Day Admin Reset that works. If you are in construction, don't just lump these costs under 'Materials'. Track the tariff surcharge separately so you know exactly how much to pass on to clients.

3. Section 232 'National Security' Tariffs

These are the heavy hitters. The US uses Section 232 to claim that relying on foreign imports for certain goods is a threat to their national security.

Section 232 tariffs are expanding regularly. It used to be just autos, steel and aluminum. But looking at the timeline from 2025, this has expanded aggressively to include copper, lumber, trucks and possibly pharmaceuticals.

The US justification has shifted from 'protecting factories' to 'protecting resilience'. They argue that relying on Canadian supply chains for critical infrastructure (like the trucks that deliver food) is a vulnerability they can't afford.

🦆 Habit Check

These tariffs hit specific sectors hard. Use your 'Monthly Review' to scan industry news. The Monthly Review is part of week four in my 30 Day Admin Reset that works. If you see 'Section 232' mentioned for your industry, don't assume prices will jump immediately. Wait until the formal notice has been issued.

4. The New Reality: Quotas (Managed Trade)

We are seeing a shift away from 'free trade' toward 'managed trade'. This often takes the form of Tariff Rate Quotas (TRQs), which we are already seeing with steel in Canada.

Real Life Example: The Steel Quota Blueprint

You don't have to look far to see this in action. Canada announced in November that it is tightening its own steel quotas effective December 26, 2025. We are weeks away from this new reality.

Canada set strict limits on steel imports based on 2024 volumes. For FTA partners like South Korea, the limit is 75% of previous levels. For non-FTA countries like China, it was slashed to just 20%.

Once that quarterly limit is reached, any additional steel faces an automatic 50% surtax.

The 'Carney Model' is limiting volume rather than just banning goods. If we have to tariffs and quotas with the US after the CUSMA review, here's hoping this model is the one the US uses during the 2026 CUSMA review to avoid harsher tariffs.

How it works

It’s a race. You can import a certain amount of product (the quota) duty-free. Once that limit is hit for the quarter, the price skyrockets. A massive surtax kicks in for every dollar over the limit.

The First-Come, First-Served Race

As we've seen with steel permits, once the quarterly quota is full, the price jumps instantly. So strategy becomes important. Coordinate with suppliers to ensure shipments clear customs before the quota fills up. It adds a layer of urgency to your inventory planning that didn't exist before.

🦆 Habit Check

Timing is everything. If you are ordering inventory late in the quarter, check the quota status first.

- The 15-Day Rule: Under the new steel rules, permits must be requested 15 days before arrival. If you are ordering inventory, you can't just ship it and hope for the best.

- The Trap: If you order from a US supplier (short transit time) and they ship immediately, your goods will beat the paperwork to the border. the massive surtax (because you don't have the permit yet) or the truck sits in a bonded warehouse for two weeks (accruing storage fees) waiting for the 15-day window to clear.

- The 'Feast or Famine' Cycle: Be prepared for a rush at the start of the quarter (as everyone races to use the quota) and a drought at the end (when the quota is full).

- The Strategy: You must apply for the permit BEFORE you authorize the supplier to ship. This requires tight coordination between your 'Capture' habit (getting the invoice early) and your logistics. Check the quota status at the start of the quarter. If the quota is 80% full, you might want to delay your order or expedite it to beat the window. This is a perfect task for your Monthly Review.

Sources

[1] Beutel Goodman Fixed Income Team, "Canada Under Cover: Canadian-U.S. Trade and the Future of the USMCA," Beutel Goodman & Company Ltd., 2025. Data from Statistics Canada, 2024.

[2] Ibid. Bank of Canada assumptions from October 2025 Monetary Policy Report.

[3] Ibid. Article 34.7 of CUSMA/USMCA.

[4] Ibid. Article 34.6 of CUSMA/USMCA.

[5] Marvin Cruz, "Impact of the U.S.-Canada trade war on businesses", CFIB, November 10, 2025

[6] Beutel Goodman Fixed Income Team, "Canada Under Cover: Canadian-U.S. Trade and the Future of the USMCA," Beutel Goodman & Company Ltd., 2025.

[7] Ibid. Analysis based on United States International Trade Commission (USITC) data as of July 2025.

[8] Ibid. Three scenarios framework: Straightforward Renewal, Contentious Renegotiation, and Lingering Uncertainty.

[9] McCarthy Tétrault, "Navigating the CUSMA Review Process: A Guide for Canadian Stakeholders", October 6, 2025

[10] Barry Appleton, "A Sovereign Advisory System for Canada: Rebuilding Strategic Foresight in Trade and Innovation," Centre for International Governance Innovation (CIGI), October 7, 2025. https://www.cigionline.org/articles/a-sovereign-advisory-system-for-canada/

[11] Kelly Geraldine Malone, "Dairy, whiskey, wine and steel: American industries weigh in on trade pact review," The Canadian Press, November 21, 2025.

[12] Rita Trichur, "From airlines to winemakers, U.S. businesses push Trump to preserve North American free trade," The Globe and Mail, November 21, 2025.

Additional Sources Consulted (Not Directly Cited)

These sources informed the article but weren't directly quoted:

- National Post interview with Laura Dawson, Future Borders Coalition, November 27, 2025. "Canada's trade resilience faces uncertainty as CUSMA renegotiation looms."

- C.D. Howe Institute Trade Crisis Working Group, "Don't Go in Weak. Canada Must Prepare Now for CUSMA Negotiations," Communiqué, May 23, 2025.

- Business consultation data as reported in summaries of Global Affairs Canada's 2024-2025 CUSMA review consultations. Original source: Global Affairs Canada, "What We Heard" reports, 2024-2025.