Why You Avoid Your Business Finances

(And How to Stop)

A simple, non-judgmental path to audit-ready habits, even if you’re overwhelmed

Lying awake at 2 a.m. worrying about your business finances?

Lying awake at 2 a.m. worrying about your business finances?By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting ... and keep it simple. Consistency beats perfection.

Published October 23, 2025 | Edited October 27, 2025

WHAT'S IN THIS ARTICLE

Fast Answers | Why You Avoid Your Finances | 1. The Avoidance Cycle | RAIN Method | Traffic Light Exercise | 2. 3 Money Worries That Break Habits | 3. The Habit That Fixes Everything | FAQ | 3.5 What Eating Well and Managing Money Have In Common | 4. When To Get Help | Key Takeaways | Appendix

NEXT IN SERIES >> Strategies For Juggling Endless Responsibilities

Why You Avoid Your Business Finances

If you're lying awake at 2 a.m. worrying about your business finances, you're not alone. According to SleepFoundation.org, 77% of people have lost sleep over money stress. (November 17, 2023) So you aren't alone.

When financial stress hits, many solopreneurs (or freelancers or self-employed - however you define yourself) do the opposite of what helps. They ignore the pile of receipts. They avoid opening their bookkeeping software. They put off reconciling accounts. The pattern keeps you stuck, stressed, and awake in the middle of the night.

I've written extensively about cash management systems that work—like Profit First and the Two-Bank Strategy. I've created a 30-Day CRA Compliance Reset that gets your books back on track. I've also written about how to get your books ready for your tax preparer if you've haven't touched your books for the whole year.

But none of those systems work if you can't bring yourself to look at your numbers in the first place.

This article addresses the emotional side of money management ... the part that determines whether you'll actually USE the systems available to you. Because knowledge without action doesn't put money in your pocket or keep you off the CRA's radar.

"Our financial behavior is often a result of our emotions and views on money. So if you understand those beliefs, you can understand your decisions and make better ones."

Saundra Davis, Certified Financial Behavior Specialist

1. The Avoidance Cycle (Why This Happens)

Understanding the psychology behind why smart business owners avoid their finances

I recently read an interesting article in Real Simple Magazine's 'The Money Issue' by Caitlin Carlson titled 'How We All Got So Emotional About Money—and What We Can Do About It'. Her main premise was money is never just about numbers. It's about emotions, beliefs, and behaviours learned throughout life. Understanding your emotional relationship with money helps you make better financial decisions. I'm going to explore Caitlin's article from the perspective of a Solopreneur in Canada.

Caitlin laid out four influences that have formed our thoughts and emotions about money. These influences create our emotional responses (stress, jealousy, guilt, happiness) when spending.

- Childhood formation - financial awareness develops early (5-year-olds have spending/saving opinions). Maybe you watched your parents stress over bills and now you avoid looking at vendor invoices.

- Generational influence - emotions and trauma pass through generations. If your grandparents lived through the Depression, that 'save everything, waste nothing' mindset might make you feel guilty about investing in business tools.

- Community and religion - some communities and religions promote minimalism or deprioritize wealth that may prevent investing due to spiritual beliefs about material gains. You might feel conflicted about raising prices or pursuing profit because it feels 'greedy'.

- Societal pressure - everything has a dollar value attached which may lead to comparison and a status-seeking drive financial behavior. This influence shows up when you compare your 10-year-old car to another solopreneur's new truck and wonder if you're 'successful enough' or 'how did he afford it'.

These four influences from Carlson's article apply directly to how Canadian solopreneurs manage their business finances. Let me show you how.

As a Canadian solopreneur, these emotional patterns don't stay in your personal life. They show up in your business decisions every single day. Put another way, your emotions and upbringing about money also influence how you manage your business finances.

If your parents fought about money, you might avoid financial conversations with your spouse about the business. If you grew up with scarcity, you might underprice your services or feel guilty about profit. If money was taboo in your family, you might feel uncomfortable asking clients to pay on time.

And here's the challenge. When business income IS your personal income, these emotional patterns get amplified. A slow month doesn't just mean business stress; it also means personal financial anxiety. An unexpected expense isn't just a business problem, it also affects your family's budget.

That's why so many solopreneurs avoid their bookkeeping. It's not laziness. It's emotional overwhelm. If money is stressing you and affecting your sleep, it's tough to motivate yourself to implement the behavioural cash management system put forth in Mike Michalowicz's Profit First book.

🦆 HEADS UP: if you are running your business where the lines are blurred between business income and personal finances, you will run into trouble if the CRA audits you.

Here's the truth. You can't implement Profit First if you won't look at your bank balance. You can't use the Two-Bank Strategy if reviewing your bank (or credit card) statement transactions makes you anxious and gives you a stomach ache.

The systems work. I know they work. But they only work if you can bring yourself to START.

That's why understanding WHY you avoid both your business and/or personal finances is the first step. Once you understand the emotional barrier, you can address HOW to break through it.

The RAIN Method for Bookkeeping Avoiders

The RAIN method was popularized by Tara Brach, PhD. It can help you turn off autopilot emotions around money and bring awareness to any situation.

- R: Recognize what is happening (I'm avoiding my bookkeeping.)

- A: Allow the existing feeling without judgment (It's okay that I'm scared to look.)

- I: Investigate with care. (What am I actually afraid of? Not knowing? Being behind? Owing money?)

- N: Nurture with self-compassion. (I'm going to look at my bank balances and transactions for just 5 minutes. That's all. I can handle 5 minutes.)

When you catch yourself, general questions to ask yourself to start the process are:

- Was this behavior or idea taught to me by someone else?

- Why am I doing this?

- Do I need to learn something as a result of my situation?

- What message would I rather tell myself?

Traffic Light Expense Review

Here's an exercise for you. View your last month's business expenses. This exercise will be easiest if you use your latest business bank statement. Color code each withdrawal on the bank statment.

🟢 Green = Necessary business expense and aligned with my business goals. No regrets.

🟡 Yellow = Questionable. Was this really necessary? Could I have spent less? Did I explore other options?

🔴 Red = Personal expenses that snuck into my business account OR subscriptions I forgot about or no longer need.

If you found you actually enjoyed this exercise (or found it surprisingly revealing), you are ready to dig deeper. Learn how to self diagnose your business health at bookkeeping-essentials.com. Just so you know, when you start exploring possibilities and options around how you are spending in your business, it's fun for most entrepreneurs. Why? Most entrepreneurs are creative people and end up leaning into the process once they get started.

What This Section Isn't

Before we go further ... this article isn't about diagnosing mental health issues or replacing therapy. If money stress is severely affecting your sleep, health, or relationships, please talk to a healthcare professional.

What this article DOES address is the normal-but-unhelpful avoidance patterns that keep smart business owners from maintaining their books. The kind of avoidance that's frustrating, not clinical.

"You can sink your head in the sand and hope it all works out, or you can look at your problems and start to fix them, one day at a time."

Alec Quaid, Certified Financial Planner

2. The Three Money Worries That Break Bookkeeping Habits

The fears that freeze solopreneurs in their tracks

Let's be clear, the following points aren't cash management problems. They're emotional barriers that PREVENT you from developing and USING a good cash management system in your business.

Jump to >> Worry #1 Worry #2 | Worry #3

Worry #1: Business Debt is Crushing Me (and I Don't Want to Look)

How bad is it really? You can't create a debt payoff plan without knowing your actual numbers.

How bad is it really? You can't create a debt payoff plan without knowing your actual numbers.TransUnion reported in February 2025 that the average Canadian carries a credit card balance of about $4,681 in 2024. For solopreneurs, that number is likely higher because business and personal expenses often blur together and the tariff trade tensions that began at the start of 2025 created uncertainty and exacerbated problematic cash flow issues.

For a Canadian solopreneur, business debt often includes one or more of the following:

- a line of credit (that keeps creeping up);

- a personal credit card 'set aside' for business (but the balance never seems to go down);

- possibly a business credit card (with interest you didn't plan for); and

- one or more CRA payment plans (that constant reminder you're behind and must do file your reporting requirements on time).

And here's what makes it worse: When you are avoiding your bookkeeping, you don't actually know how much you owe. The uncertainty is often scarier than the reality.

🦆 The Bookkeeping Habit Connection: You can't create a debt payoff plan without knowing your actual numbers. This is where your bookkeeping habit saves you.

Here's the beauty of the Profit First cash management system. Even if you are behind in your bookkeeping (remember you are going for consistency not perfection so no judgment), you still know your real financial position. Your cash buckets act like an unofficial version of your books. Not quite audit-ready but it helps you keep the doors open. You can see what's available for debt payments, what's allocated for taxes, whether you need to reign in your operating expenses, and what's truly profit ... just by looking at your various bank balances (buckets).

No more 9 p.m. panic wondering 'how bad is it really?'. Your bank account balances tell you the truth.

But here's what makes it even better: When you DO catch up your bookkeeping, you'll see the complete picture. Where the money came from, where it went, and what patterns you need to change. (It's called your cash rhythm.) That's where it creates a space so you can create a real debt elimination plan.

Implementing Profit First in your business helps you manage debt while building profit. Mike loves to talk about not falling for the survival trap where you build your business on debt instead of profit.

With 2025's tariff uncertainty that won't be going away if you are not CUSMA compliant, knowing your numbers isn't optional—it's survival. You need to figure out:

- Which suppliers are affected by tariffs.

- Whether you can absorb cost increases or need to raise prices.

- How much buffer you have if your customers slide into austerity mode and cut back.

My article on how tariffs impact Canadian small business walks you through the early warning signs to watch for.

Once you have a handle on your business debt (or if it's manageable), start building your personal buffer. My article on TFSA benefits for small business owners shows you how to create financial breathing room separate from your business volatility. Because when your personal finances feel stable, business stress doesn't hit as hard.

Worry #2. I Have No Idea Where My Money Goes

Grab some refreshment before you settle in for Money Mondays and Treasury Thursdays!

Grab some refreshment before you settle in for Money Mondays and Treasury Thursdays!JUMP TO

Step 1 | Step 2 | Step 3 | Step 4 | Step 5 | Step 6

In the same Real Simple Magazine issue, I came across another helpful article by Anna-Louise Jackson: 'Losing Sleep Over Money? Here's What Financial Planners Want You to Do First'. The article offers really great advice on how to approach your finances if you are feeling overwhelmed and frozen about what to do about it. She interviewed Elana Feinsmith, a certified financial therapist (yes apparently it is a thing!) and a certified financial planner.

Ms. Feinsmith offers this calming mantra: "Envision what it would feel like in the future once you've accomplished your goals. That can calm the nervous system."

When you're lying awake at 3 a.m. worrying about money, this technique actually works. Instead of spiraling into worst-case scenarios, picture yourself six months from now with organized books, a clear financial picture, and a debt repayment plan you're actually following.

So where to start?

Step 1: Face Your Debt Reality

You can't create a payoff plan if you don't know what you're dealing with. Set up a simple 'money date' with yourself. (In my 30-Day Admin Reset, I call these dates Money Mondays.)

- 30 minutes (or start with just 5 minutes if that's all you can handle).

- Coffee, tea, smooothie, or just plain water.

- A spreadsheet (or even a piece of paper).

- Just look. No judgment. Just awareness.

The point is to just start. That's often the hardest part.

Step 2: List All Your Debt in One Place

Gather everything:

- Business line of credit balance and interest rate

- Business credit card(s) - balance and rate

- Personal credit card used for business - balance and rate

- CRA payment plan(s) details (if applicable)

- Any other business loans

Write it all down. Yes, seeing it all together might be uncomfortable. But the anticipation is always worse than the reality. Now you know what you are dealing with.

Step 3: See Your Payoff Timeline

Use one of the Canadian banks' loan calculators or debt consolidation calculator to play with the numbers:

- What if you pay minimums only? (How long will it take?)

- What if you add an extra $100/month? ($200? $500?)

- Which debt costs you the most in interest?

This isn't about committing to anything yet. It's about seeing what's possible.

Step 4: Choose Your Payoff Strategy

Choose one of two payoff methods. Which one you choose depends on your personal style. Both are good but for different reasons.

Snowball method pays the debt with smallest balance first.

- Pro: Quick wins keep you motivated

- Pro: Seeing accounts go to $0 feels amazing

- Con: Might pay more interest overall

Avalanche method pays the highest interest rate debt first.

- Pro: Saves the most money long-term

- Pro: Mathematically optimal

- Con: Takes longer to see a balance disappear

🦆 The best strategy is the one you'll actually stick with.

Step 5: Find the Money for Extra Payments

Now that you know what you need to pay, where will that money come from?

This is where you look at your spending. Get your latest business bank statement (and personal bank statement if expenses are mixed). Do the Traffic Light Expense Review that I introduced earlier in this article if you didn't do it when I first mentioned it.

🟢 Green = Necessary business expense, aligned with my business goals, no regrets

🟡 Yellow = Questionable. Was this really necessary? Could I have spent less? Can I explore other options?

🔴 Red = Personal expenses that snuck into business account OR subscriptions I forgot about

🦆 The Bookkeeping Habit Connection: Look for the pattern. Where is your money going to things that don't help you achieve your goals? This is literally what categorizing expenses does. When you review your books regularly, you see patterns.

- That $200/month subscription you forgot about or no longer need? Cancel it. That's $2,400/year toward debt.

- The 'small' expenses that add up to $500/month? Cut half. That's $3,000/year toward debt.

- Personal expenses on your business card? S T O P. CRA frowns on this habit and it opens you up to an audit of your personal finances during a business audit. Open a separate personal account if you haven't already and take a regular pay draw from the business.

Step 6: Address Both Business AND Personal Spending

Here's the hard truth. If you're a solopreneur drowning in debt, you probably need to look at personal spending too because your business and personal finances are likely intertwined.

With tariff uncertainty making everything more expensive, cutting unnecessary spending isn't optional. It's S U R V I V A L.

My article on asking the right questions before you spend money can help you make better decisions going forward.

Worry #3: I'm Not Saving Enough (What You Need Is A Business Emergency Fund)

You can't save what you can't see!

You can't save what you can't see!Most financial advice talks about personal retirement. But as a solopreneur, you need a business emergency fund FIRST. Especially now, with tariff uncertainty.

In my TFSA Benefits For Small Business Owners article, I showed you how to build financial stability for your personal finances separate from the volatilities of your business profits ... or lack thereof. Let's look at how to do the same thing for your business.

In my article, A Simple Cash Management System For The Self-Employed In Canada, I walk you through a streamlined version of the Profit First method. Here's the broad overview of putting your cash on autopilot:

- Determine your TAP (target allocation percentages).

- Open six bank accounts. (Yes, really! Learn why it works.)

- Twice a month allocate your TAPs. (The 10th and 25th work well.)

- Pay yourself on a regular basis. ( I show you how to do this.)

- Take care of your quarterly transactions and review. (The maintenance that keeps it working.)

🦆 The Bookkeeping Habit Connection: You can't save what you can't see. When your books are current, you know your true profit not just your bank balance.

Here's why this matters. If you're using just one business bank account for everything, your bank balance lies. It includes money you owe for GST/HST, upcoming bills, and that big annual insurance payment coming up. You think you have $10,000, but $8,500 is already spoken for.

This is exactly why the Profit First system works so well. Each bank account has a specific purpose:

- Your Profit account shows what you can actually save or distribute.

- Your Tax account holds GST/HST and income tax money (so you're never scrambling at filing time).

- Your Owner's Pay account shows what you can take home and keeps your personal expenses out of the business.

- Your Operating Expenses account shows what's available for bill payments and running your business.

When your bookkeeping is current AND you're using Profit First, you have complete clarity. You know what you can afford to save because the money is already separated.

Even $50/week transferred to your Profit account (covers emergency fund or future growth or your owner's bonus) adds up to $2,600/year. Start small. Build momentum.

🦆 Your goal: Three months of operating expenses saved.

Why? Because when (not if) something unexpected happens (tariff impacts, supplier issues, slow season, equipment breakdown) you have breathing room. You can make good decisions instead of panic decisions.

Once your debt is paid off, route 50% of that payment to your business emergency fund. (In my cash management system, I call this your Future Growth account.)

This isn't pessimism. It's preparation. And in 2025's uncertain economy, it's S U R V I V A L.

Now you understand the three emotional barriers that keep you from managing your money. You've seen yourself in at least one (maybe all three) of these patterns. So what do you actually DO about it? That's what the next section is about ... the one habit that changes everything.

Don't try to fix everything. Don't aim for perfect books. Just build one habit that reduces the mystery around your money.

Bookkeeping-Essentials.ca

3. The Habit That Fixes Everything

Consistency beats perfection | Sustainable habits beat extreme measures

Does "Consistency Beats Perfection" Mean Sloppy Bookkeeping Is Okay?

No. No. No.

Here's what I actually mean. The habit of showing up consistently matters more than having a perfect system.

As Canadian financial expert Lesley-Anne Scorgie says: "Consistency is everything. Stick with these habits, and you'll see results. Don't, and you won't."

It's like going to the gym. You don't abandon your exercise routine because you had a busy week and couldn't go. The next week, you get right back at it.

Your bookkeeping works the same way. The system that works is the one you'll actually use ... consistently. Let's look at some 'habits' that work and those that don't:

✅ GREEN LIGHT Habits That Build Consistency (Choose what works for YOU)

- Bookkeeping weekly instead of daily. Use whatever rhythm lets you make informed decisions in your business.

- Using a spreadsheet instead of software if that's what you'll actually maintain on a consistent basis.

- Reconciling at month-end instead of in real-time. My preference is reconciling at month-end as data entry and reconciling are two different skill sets.

- Entering data manually or uploading it instead of using a bank feed. Personally I can't stand the texts in the middle of the night asking me to authorize the software updating the bank feed.

❌ RED LIGHT But 'Consistent' Doesn't Mean 'Wrong Is Okay'

Your books still need to be **accurate**. These aren't flexible:

- Recording personal expenses as business. (That's fraud, not imperfection.)

- Recording the full Costco receipt when some items were personal. (Code personal expenses to Owner's Draw, or better yet ... next time have personal items rung through separately and pay from your personal account.)

- Mixing business and personal in the same account. (This is like calling CRA and requesting them to please come and audit you!)

- Estimating amounts instead of using actual receipt totals. (There are strict rules for when this is allowed, and regular everyday purchases isn't one of them.)

- Skipping receipts if you're a GST/HST registrant. You can't claim input tax credits without them, so it's coming out of your pocket. (Your choice.) But here's my question. How do you make informed business decisions if you haven't included all your expenses? You think you are making a profit when it's just as possible your are losing your shirt! (no receipt = no input tax credit = money out of your pocket)

🦆The standard: Your books need to be accurate enough to make good decisions and survive an audit. They don't need to be colour-coded perfection, but they can't be fiction. Remember that garbage in, garbage out. You need good, accurate information to make informed business decisions.

Just know this. For every receipt you don't chase down, you're losing a tax deduction ... which means you're paying more income tax.

Learn more >> 13 Non-Deductible Business Expenses: Form T2125 For the Sole Proprietor in Canada

Now you understand the three emotional barriers that keep you from managing your money. You've probably recognized yourself in at least one (maybe all three) of these patterns.

So what do you actually DO about it?

Here's what I've learned after years of working with solopreneurs. The anticipation is always worse than the reality.

Yes, your books might be behind. Yes, you might owe money. Yes, you might need to make changes.

But once you KNOW, you can DO something about it.

The Problem with 'Just Start Somewhere'? You've probably heard advice like 'just pick one thing and start'. But which thing? File receipts? Categorize expenses? Update mileage logs? Reconcile accounts?

When you're overwhelmed, even choosing where to start creates paralysis. That's why I created the 30-Day CRA Compliance Reset.

Why a System Beats Random Habits?

The Reset isn't about doing everything perfectly. It's about building a sustainable routine that:

- Gets your books current (no more avoidance).

- Establishes weekly rhythms (like Money Mondays).

- Addresses the most important compliance issues first.

- Builds momentum through small, consistent actions.

- Reduces the mystery around your money.

It's designed specifically for solopreneurs who are behind, overwhelmed, or avoiding their bookkeeping.

What Does The 30-Day Reset Gives You? A clear path from 'I don't know where to start' to 'I have a routine that works'.

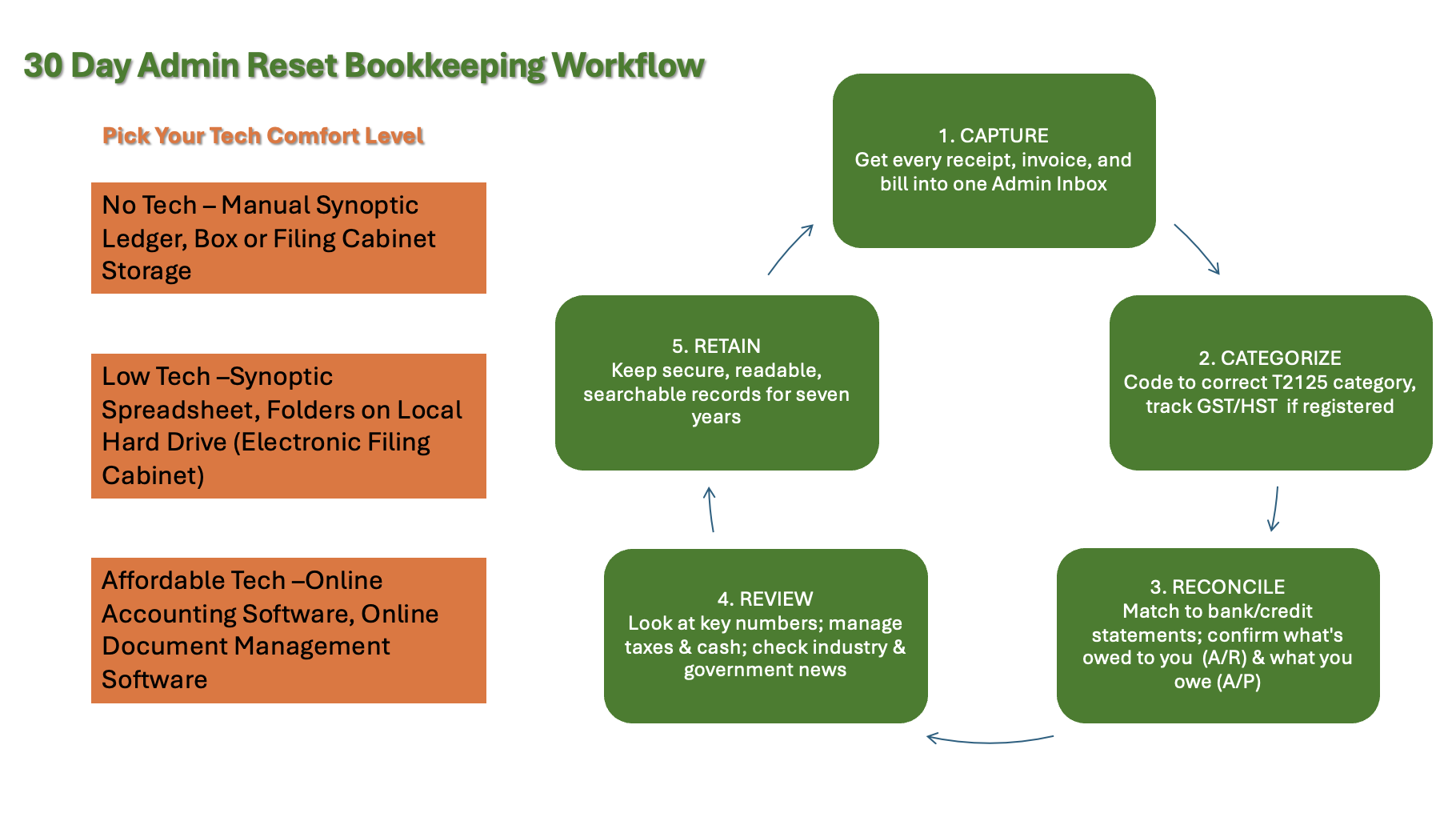

The 5-step process you will be creating.

The 5-step process you will be creating.You'll learn:

- How to gather and organize source documents. (Week 1)

- How to categorize expenses and file your source documents efficiently. (Week 2)

- How to reconcile accounts without panic. (Week 3)

- How to review and manage your cash and taxes (Week 4)

- ------------

- How to meet your CRA document storage requirements. (Week 5)

- How to establish ongoing maintenance habits. (Week 6 forward)

Each week builds on the last. By Day 30, you'll have:

- The most recent 2-3 weeks of data current in your accounting system.

- A sustainable weekly routine (so you don't fall behind again).

- A plan for chipping away at any backwork without overwhelm.

🦆 Here's the key: The Reset gets you CURRENT and keeps you current going forward. If you have months (or years) of backwork, you'll tackle that separately—a little bit each week—while maintaining your new routine.

You're not trying to fix everything in 30 days. You're building the habit that prevents future chaos.

But Here's What Comes BEFORE the Reset

You've done the emotional work in this article:

✅ You understand why you avoid. (RAIN method)

✅ You've faced your debt reality. (if applicable)

✅ You've reviewed your expenses. (Traffic Light method)

Before you dive into the 30-Day Reset, get your cash organized.

The Reset works best when your money is already flowing in an organized way. Otherwise, you're just tracking chaos.

🦆 Your next step: Set up a Simple Cash Management System. This puts your cash on autopilot with separate accounts and automatic allocations. Once your cash is organized, then you're ready for the 30-Day Reset to get your bookkeeping current and build your maintenance routine.

S T A R T H E R E.

If you're ready to break the avoidance cycle, start with doing the emotional work outlined in this article. It addresses all three emotional barriers we talked about:

- Debt worry? You'll see your real numbers and can create a plan.

- Money disappearing? You'll track where it goes and spot patterns.

- Not saving? You'll know your true profit and what you can set aside.

N E X T,

- If your cash is already organized (you're using Profit First or a similar system) → Go straight to the 30-Day CRA Compliance Reset.

- If your cash is still chaotic (one account for everything and money 'disappearing') → Start with seeing up this Simple Cash Management System. → Then move to the 30-Day Reset.

- If you're still feeling overwhelmed? I get it. Even thinking about a 30-day commitment might feel like too much right now ... so s t a r t s m a l l e r.

S T A R T S M A L L E R begin with ...

- This week, do just ONE thing. Look at your business bank account balance online or look at your last bank statement. Write down the balance. Work through RAIN. That's it. No judgment. Just awareness.

- Next week, look at last week's transactions. Just observe. No categorizing required. Work through RAIN. If you are up for it, do the traffic light exercise.

- The week after, compare this week's balance to two weeks ago. Notice the change. Work through RAIN.

These tiny steps break the avoidance cycle. Once you can look at your money without panic, you're ready for bigger systems.

🦆 Remember Consistency beats perfection.

You don't need perfect books. You need books you actually maintain. You need to know your numbers. You need to stop avoiding. This doesn't give you free license to categorize expenses intentionally!

The systems are here when you're ready:

- This article - Face the emotional barriers.

- Cash Management System - Organize your money flow so you learn its rhythm.

- 30-Day Reset - Get your books current and build your routine.

Take the next right step. That's all.

Here are answers to common questions about managing your business cash:

FAQ

I'm behind and overwhelmed. Where do I start?

I'm behind and overwhelmed. Where do I start?

If you are wanting to get your ducks in a row, start with week 1 of the 30 day reset. Week 1's goal is to create one place where all your business paperwork lands, and build the habit of actually using it. You're not fixing everything. You're building momentum.

If it's tax time and you're scrambling: I show you how to get your paperwork organized quickly for your tax preparer when you didn't touch your books all year.

How do I stop mixing personal and business spending?

How do I stop mixing personal and business spending?

Short answer: pay yourself a regular amount to cover your non-discretionary personal expenses.

Now let's look at what's really happening. You're pouring everything into the business because you want it to succeed. Taking a 'paycheque' feels like you're taking money away from the business. So you don't pay yourself officially ... until reality bears its ugly head and you have a personal bill comes due ... so you have to dip.

But here's the truth. If your business can't support you, it's not a business; it's an expensive hobby.

You deserve, yes deserve, to be paid for the work you do. Your business exists to support your life, not the other way around.

The fix isn't restriction. It's intention.

Pay yourself first, automatically, twice a month. Not what's 'left over' (there's never anything left over). A set amount that covers your basic needs, transferred before you pay other bills.

This isn't taking from your business. This IS your business working for you.

Here are two ways to start:

Option 1: How to Pay Yourself as a Business Owner — Set up regular transfers today.

Option 2: Simple Cash Management System — Automate your entire cash flow (owner's pay, taxes, profit, expenses) so paying yourself becomes non-negotiable.

When you pay yourself first, you stop operating from scarcity. You make better business decisions because you're not in survival mode. And you finally know your business's true operating costs because your pay is included (even if it is not a deductible expense).

Bottom line: You can't build a sustainable business on unpaid labor ... even if that labor is yours.

What's the fastest way to lower my money stress this week?

What's the fastest way to lower my money stress this week?

Short answer: Implement the Profit First cash management system so your money runs on autopilot.

A few hours of setup, then you can see your cash flow (taxes set aside, profit allocated, bills covered) just by logging into your bank. Clarity kills anxiety.

Why does this works? You're taking action instead of worrying. Once setup, the system makes decisions for you based on your targets (no more "should I spend this?"). And you'll immediately know where you stand financially every time you login and check your bank balances.

Do you want to understand why you were stressed in the first place? Read about [the three money worries that break habits] and [the avoidance cycle]. But the system works whether you understand the psychology or not.

Know your bank balance right now ... not what you think it is, what it actually is. Then set up the so you can see your cash flow (taxes set aside, profit allocated, bills covered) just by logging into your bank. Clarity kills anxiety.

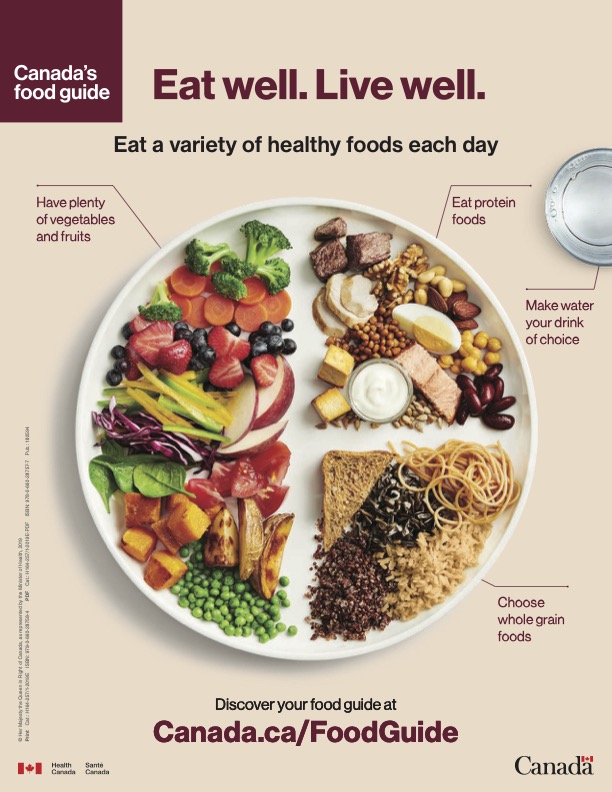

3.5 What Eating Well and Managing Money Have in Common

The plate method for nutrition. The bucket method for business finances. Same principle: organized diversity creates health.

The plate method for nutrition. The bucket method for business finances. Same principle: organized diversity creates health.7 Science-Backed Parallels You Can Use Today

Why are we talking about food in a bookkeeping article (and why it matters)?

I recently read a January 2, 2025 article from ZOE, a nutrition science company, titled "How to eat in 2025: 7 science-backed tips." [https://zoe.com/learn/how-to-eat-in-2025] As I read through the recommendations from Professors Tim Spector and Sarah Berry, I kept thinking: 'This is exactly what solopreneurs need to hear about their finances.'

Stay with me here.

Because poor diet and erratic routines can worsen stress and sleep—two things that make it harder to face your numbers. These quick comparisons borrow the food guidance from ZOE’s research and translate it into simple money habits you can start this week.

Why? Because both food and finances trigger the same avoidance behaviors:

- We know what we should do, but we don't do it.

- We feel overwhelmed by conflicting advice.

- We're surrounded by an environment designed to make us fail (ultra-processed food / bookkeeping systems with more features than we actually need).

- We need to remember consistency over perfection is the goal because small, sustainable changes beat extreme measures.

Plus, you probably know ... when you're stressed about money, you're probably not eating well either. And when you're not eating well, your brain doesn't have the energy to tackle financial decisions. So this is actually a two-for-one: better nutrition supports better financial management.

Important: This is general information, not medical advice.

Let's look at the 7 parallels:

The 7 Comparisons

1. Reduce Ultra-Processed Foods → Separate Personal and Business Finances

Just as ultra-processed foods blur the structure of real food, mixed business/personal finances blur your true financial picture. The food plate keeps categories clear ... your bank accounts

should separate income, expenses, and taxes.

- In nutrition

Ultra-processed foods (UPF) make up 60% of the average diet. These are foods with unrecognizable ingredients that don't resemble their original form. They're designed to bypass your fullness signals, causing you to overeat by up to 800 calories per day without realizing it. - In business finances

Mixed personal and business expenses are your financial "ultra-processed food." When everything runs through one account, you can't see what's really happening. Just like UPF hides the real food structure, mixed finances hide your true business health, raising your anxiety. - The fix

Separate accounts. Period. This is non-negotiable for CRA compliance and your own sanity. If you don't have a business account, run don't walk to your bank on your next Treasury Thursday. - The science

Studies show that reducing UPF by just 50% reduces mortality risk by 12.5%. Similarly, separating your finances immediately reduces financial anxiety because you can finally SEE what's happening and reduce the risk of an unfavourable CRA audit.

2. Give Yourself an Eating Window → Set Bookkeeping Hours (Then Stop)

- In nutrition

The average North American eating window is 16 hours (7am-11pm). Research shows that reducing this to 10-12 hours improves energy, mood, and reduces hunger without extreme restriction. Why? Your gut microbiome needs rest. A "cleanup crew" of different microbes comes out during fasting periods to repair and maintain gut health. - In business finances

Always-on financial anxiety is like eating around the clock ... your brain never gets a break. Set specific times for bookkeeping (like Money Mondays for 30-60 minutes and 15-30 minutes on Treasury Thursdays or Forecast Fridays), then STOP when time is up. - The fix

Schedule your Money Monday and Treasury Thursday windows. Outside that time, close the mental tab. Your brain needs recovery time too.

If you’re behind on your bookkeeping or setting up your cash system, add a temporary Setup Saturday date (or Tidy-Up Tuesday) for 45–60 minutes. Keep Money Monday for current bookkeeping work and Treasury Thursday for current cash monitoring. Retire Setup Saturday after 4–8 weeks once you’re current. - The science

Consistency matters more than perfection. Even a 12-hour 'financial fasting window' (not thinking about money) helps reduce chronic stress.

3. Calorie Counting Is Dead, Try The No Calorie Counting Diversity Diet → Build A Cash Management System That Lowers Decision Fatigue

- In nutrition

Calorie restriction fails long-term because your body adapts (metabolism slows, appetite increases). The new GLP-1 drugs (like Ozempic) work differently: they target brain satiety centers, removing decision fatigue around food. But here's the key: "You can't out-inject a bad diet." The drugs work best when combined with healthy food choices. The diversity diet is an inclusive diet with no calorie counting. - In business finances

Constantly micro managing or budgeting your finances (the financial equivalent of calorie counting) creates decision fatigue and often fails. Instead, automate your cash management using systems. Set up automatic transfers to separate accounts (Operating, Profit, Tax, Owner's Pay). The decision is made ONCE a quarter, then runs on autopilot. - The fix

Set up TAP (Target Allocation Percentages) and automatic transfers. Technology removes daily willpower battles.

Having trouble starting? On Treasury Thursday, open one of the six cash buckets and set it up with an automated transfer. Next week on Treasury Thursday, tackle a second bucket. - The parallel

Just as GLP-1 still requires healthy choices to work effectively, TAP automation still requires you to make smart spending decisions. But both remove the exhausting 'food noise'.

4. Mindful Drinking → Mindful Spending

- In nutrition

Drinks account for 18% of daily calories, and 54% of added sugar comes from beverages (often hidden in 'healthy' coffee drinks). Three cups of plain coffee (or tea) per day reduces mortality risk by 18-20%, but a 500-calorie Starbucks latte three times daily does the opposite. - In business finances

Small, unconsidered purchases are your 'hidden sugar'. The $9.99/month subscriptions, the 'quick' software purchase, the 'just this once' convenience buy ... they can add up quickly to 20-30% of business spending. - The fix

Before any business purchase, ask yourself these questions: Is this a need or a want? Does this align with my business goals? Have I explored alternatives? Can I afford this from my Operating account (not credit)?

On your next Treasury Thursday, cancel one unused or low-value subscription. - The science

Just as coffee is healthy but sugary coffee drinks aren't, business tools are necessary but impulse purchases aren't. Mindfulness is the key.

5. Eat 30 Different Plants → Use Multiple Bank Accounts by Purpose

The food plate shows vegetables, fruits, proteins, and grains—each feeding different body systems. Your 6 bank accounts (Income, Tax, Profit, Owner's Pay, Operating, GST) each serve different business functions.

- In nutrition

The '30 plant-based foods per week' target isn't about eating MORE. It's about diversity. Different plants feed different gut microbes, each with specialized jobs: some digest fiber, some produce vitamins, some protect your gut lining, some regulate mood. This diversity creates a resilient, healthy system. - In business finances

Just as different plants feed different microbes, different bank accounts serve different business functions: (1) the Money In account → Know immediately how much money you have on hand; (2) the GST/HST account → Net GST/HST fund held in trust (no CRA surprises); (3) Profit and Growth account → Business health fund (yes, profit comes FIRST - Buffer for tariff shocks and revenue dips); (4) Owner's Pay account → Your personal systematic 'pay cheque' (keeps personal expenses out of business); (5) the Income Tax account → Sets aside your 'withholding' taxes you have to pay; (6) the Operating Expenses account → Day-to-day business costs where spending is managed intentionally. - The fix

Open bucket (envelope) accounts with specific purposes. Each dollar coming into the business is 'assigned' ONE job—no decision fatigue.

Why does this reduces anxiety? (1) You can SEE your tax money is set aside. (2) You KNOW you're taking profit (not just hoping) F I R S T. (3) You're got a built in cushion when revenue drops. (4) While you're developing your 'Buy Canadian' strategy and exploring UK/EU/Asian markets, your autopilot cash management system ensures you're managing what you have wisely. - The science

Just as a diverse gut microbiome helps you weather illness and stress, multiple money buckets (envelopes) help your business weather economic uncertainty.

6. Stop Worrying About Protein (Focus on Fiber) → Stop Obsessing Over Debt (Focus on Cash Flow and Debt Repayment Plan)

- In nutrition

The average American needs ~50g of protein daily but consumes ~100g. Meanwhile, 95% don't get enough fiber. The average North American eats only the fiber recommended for a 4-year-old. The food industry pushes protein (profitable) while ignoring the real crisis: fiber deficiency. - In business finances

Everyone obsesses over debt (the 'protein'), but many solopreneurs ignore cash flow patterns and profit margins (the 'fiber'). You can have zero debt but still fail from poor cash flow management. - The fix

Create a debt repayment plan (we covered this in Section 2). But don't let debt worry paralyze you from tracking your actual cash flow. The real crisis isn't the debt itself; it's not knowing where your money goes.

If you're already following a debt repayment plan, stop obsessing over the balance. Focus your energy on allocating TAP so you can manage expenses from an offensive position all while learning and understanding your cash rhythm.

On Treasury Thursday, include a 3-minute scan of last week’s transactions. Circle any surprises. - The parallel

Debt = Protein → Important, but most people have 'enough' (or a manageable plan).

Cash Flow = Fiber → The actual deficiency that's killing businesses. You can have a net loss on your income statement but still keep the doors open if you have good cash flow. Cash is KING. - The science

Studies show businesses fail from cash flow problems, not from having debt. Similarly, health problems come from fiber deficiency, not protein deficiency.

7. Snack Smarter → Review Small Transactions Weekly

- In nutrition

95% of people snack, and snacks account for 25% of daily calories. The problem isn't snacking itself ... it's WHAT you snack on and WHEN. Healthy snacks (nuts, fruits) reduce cardiovascular disease risk by 30% in just 6 weeks. But 30% of people snack after 9pm, and 20% snack from boredom, not hunger. - In business finances

Small business expenses are your 'snacks ... frequent, often mindless, possibly adding up to 20-30% of total spending. The $9.99 subscriptions, coffee meetings, app purchases, supplies ... I could go on. - The fix

Use the Traffic Light Exercise (from Section 1) on your small transactions:

🟢 Green = Necessary and aligned with business goals

🟡 Yellow = Questionable—could I have spent less? Are there other options? (Think outside the box or reframe the need.]

🔴 Red = Personal expenses or forgotten subscriptions

Review small transactions weekly during your Money Monday bookkeeping window, not impulsively throughout the week.

Don't make financial decisions after 9pm when you're tired and stressed. Studies show 30% of regrettable purchases happen during evening 'snacking' sessions. - The science

Just as late-night snacking is associated with poor health outcomes (even with healthy snacks), late-night business purchases are usually regrettable.

Key Takeaway - What Food and Finances Have in Common

Both require:

✅ Consistency over perfection → Small, regular actions beat extreme measures.

✅ Mindfulness → Awareness of what, when, and why you consume.

✅ Systems reduce decision fatigue → Automation and establishing boundaries.

✅ Diversity with purpose → Multiple accounts (or plant-based foods) serving specific functions.

✅ Focus on the real problem → Cash flow (fiber), not just debt (protein).

And here's the bonus ...

When you eat well, your brain has the energy to make better financial decisions. When your finances are organized, you sleep better and stress less which helps you make better food choices.

It's all connected.

"You can sink your head in the sand and hope it all works out, or you can look at your problems and start to fix them, one day at a time."

Alec Quaid, Certified Financial Planner

4. When to Get Help (Canada)

Signs it's time to call in a professional

Sometimes the emotional barriers are too high to tackle alone. Or the financial situation is too complex. Or you simply need expert guidance.

That's not weakness. That's wisdom. Here's when to reach out and who can help.

When Debt Feels Unmanageable

If you're experiencing any of these, it's time to talk to a non-profit credit counsellor:

- Missing minimum payments regularly.

- Using one credit card to pay another.

- Creditor calls causing serious anxiety.

- Can't see a way out of the debt cycle.

All of these organizations offer reputable Canadian debt counselling services. With the exception of FCAC, these non-profit credit counselling services have free initial consultations:

- Financial Consumer Agency of Canada (FCAC - canada.ca/en/financial-consumer-agency) provides unbiased information about managing debt. Their credit cards and debt section has calculators and other resources. They also have a page dedicated to Canada's response to U.S. tariffs on Canadian goods.

- Credit Counselling Society (CCS - nomoredebts.org) offers free credit counselling, debt management programs, financial literacy workshops.

- Credit Canada (creditcanada.com) offers free credit counselling, debt consolidation programs, bankruptcy alternatives.

- Money Mentors (Money Mentors) offers free financial counselling, debt management, financial literacy mainly in Alberta and Saskatchewan. They have an holistic approach including budgeting and financial planning.

What these organizations can help you do:

- Understand all your options (debt consolidation, consumer proposal, bankruptcy alternatives).

- Negotiate with creditors on your behalf.

- Create a realistic, sustainable repayment plan.

- Protect your mental health while dealing with debt.

🦆 Important: Avoid for-profit 'debt settlement' companies that charge high upfront fees and make unrealistic promises. Stick with accredited non-profit counsellors.

When You Need Help With Your Books or Business Finances

Even if debt isn't your issue, you might need professional help to get your books current or create a financial plan:

- Certified Professional Bookkeeper (CPB) - When your books are behind or you need systems set up properly

- Chartered Professional Accountant (CPA) - For tax planning, CRA issues, or strategic business decisions

- Certified Financial Planner (CFP) - For retirement planning and integrating business with personal finances

- Tax Lawyer - If you need to file a voluntary disclosure application.

Start with your most pressing need. The right professional can break the overwhelm into manageable steps.

For detailed information on when to hire each professional, what they do, costs, and red/green flags to watch for, see Appendix: Choosing the Right Financial Professional.

You Don't Have to Figure This Out Alone

If you're losing sleep over your business finances, reach out:

• A bookkeeper can help you get current

• An accountant can help you plan and strategize

• A financial planner can help you see the bigger picture

• A credit counsellor can offer solutions for overwhelming debt

The right professional can break the overwhelm into manageable steps. Sometimes just knowing you have expert support is enough to break the avoidance cycle.

If you're losing sleep, talk to someone. A bookkeeper can help you get current. An accountant can help you plan. A financial planner can help you see the bigger picture. A debt counsellor can offer you solutions for your current circumstances ... and may even not require bankruptcy.

Key Takeaways

- Your money stress is emotional, not mathematical. The knot in your stomach when you think about your books? That's avoidance talking, and it's completely normal.

- The emotional barriers have names ... and solutions. Whether it's shame, overwhelm, or fear of what you'll find, there are specific techniques (like the RAIN method) that help you work through them.

- You need a system, not superhuman discipline. Separate accounts, automatic transfers, and a 15-minute daily routine should keep you compliant without willpower. Personally, I prefer Money Mondays and Treasury Thursdays to a daily routine.

The good news? Financial stress thrives in the dark and what you are imagining is always worse than the reality.

Yes, your books might be behind. Yes, you might owe money. But once you KNOW, you can DO something about it. The systems are here. The help is available. Start small, build one habit, and take the next right step.

Your future self (and your sleep) will thank you.

Appendix: Choosing the Right Financial Professional

Even if debt isn't your issue, you might need professional help to get your books current or create a financial plan. Here's when it makes sense to get other professional help:

Certified Professional Bookkeeper (CPB - https://cpbcan.ca/career-centre/find-a-bookkeeper.html)

When to hire:

• Your books are months (or years) behind

• You don't have time to maintain bookkeeping yourself

• You need someone to set up your systems properly

• Tax season is approaching and you're not ready

What they do:

• Catch up backlogged bookkeeping

• Set up accounting software correctly

• Establish systems you can maintain

• Process transactions accurately for CRA compliance

Cost: Varies. My preference is work with a bookkeeper who does not charge by the hour but prices the project and includes extras like sharing their insights into what they see and what you could perhaps do differently. I especially like bookkeepers who give a minimum of 3 pricing packages so you can pick what services you want. Backwork may require an hourly rate for a variety of reasons - sometimes it's a hornet's nest once you get started!

Chartered Professional Accountant (CPA)

When to hire:

• Tax planning and strategy questions

• Deciding on business structure (sole proprietor vs. corporation)

• CRA audit or payment arrangement issues

• Year-end financial statement preparation

• Complex financial decisions

What they do:

• Prepare and file tax returns

• Provide strategic tax advice

• Represent you with CRA if needed

• Analyze financial statements and advise on business decisions

Cost: Varies widely; many offer small business packages

Note: Some CPA firms are currently advertising bankruptcy filing services if your situation has reached that point in this economic tariff environment. I would note you want to hire a CPA licensed for public practice ... not a CPA employed in the private sector and does consulting on the side.

Certified Financial Planner (CFP - https://www.fpcanada.ca/planner-directory)

When to hire:

• You want a whole plan that integrates business and personal finances

• Retirement planning as a solopreneur

• Investment strategy questions

• Insurance needs assessment

• Exit strategy from your business

What they do:

• Create comprehensive financial plans

• Help you see the big picture beyond day-to-day operations

• Plan for retirement when you don't have a company pension

• Balance business reinvestment with personal financial security

Important: Look for CFPs who specifically understand solopreneur finances, not just corporate employees with benefits packages.

Tax Lawyer - see 'Is Voluntary Disclosure The Right Move'.

How to Choose the Right Professional

Start with your most pressing need:

• Books are a mess → Bookkeeper

• Tax questions or CRA issues → Accountant

• Overwhelming debt → Credit counsellor

• Want to plan for the future → Financial planner

• Emotional overwhelm about money → Consider all of the above but getting your ducks in order one at a time

Red flags to watch for:

• Guarantees specific financial results

• Pressure to buy products before understanding your situation

• Won't explain things in plain language

• Makes you feel stupid for asking questions

• High-pressure sales tactics

Green flags to look for:

• Asks about your goals and concerns first

• Explains fees clearly upfront

• Willing to collaborate with your other professionals (bookkeeper + accountant working together)

• Makes you feel capable, not dependent

• Answers questions patiently

• Has experience with solopreneurs specifically

* Profit First is a registered trademark in the U.S. and other countries.

Disclaimer: I am not a certified Profit First Professional or associated with Mike Michalowicz. I just like the system and introduced some of my client's to it. Get Mike's book to learn more about the system.

Back to top