- A Roadmap To CRA Compliance & Financial Stability

- Navigating Change

- TFSA Benefits for Solopreneurs

TFSA Benefits For Small Business Owners

A Simple, Stress-Reducing Personal Finance Habit

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting ... and keep it simple. Consistency beats perfection.

Published October 6, 2025 | Edited November 8, 2025

WHAT'S IN THIS ARTICLE

Introduction | Section 1 - Foundation | Section 2 - Strategy | Section 3 - Boundaries | Section 4 - Action | FAQ

Building personal savings helps you weather economic uncertainty without panic decisions.

Building personal savings helps you weather economic uncertainty without panic decisions.Why Your TFSA Might Be Your Most Important Business Tool

You land a slow month and a surprise repair bill. With no personal cushion, every business decision feels urgent ... you're in survival mode, not strategy mode. A Tax-Free Savings Account (TFSA) fixes that quietly, automatically, tax-free.

This isn't a retirement lecture. It's a simple personal habit that lowers stress, supports better business decisions, and builds options. Because when your household finances are stable, your business thinking gets clearer.

🦆 One critical rule

Your TFSA is 100% personal. Fund it from your Owner's Pay (what I call your 'pay cheque' in this simple cash management system), never directly from your business account. Separating business and personal money isn't just a CRA rule ... it's how you protect your household from business ups and downs.

Once your books are audit-ready and your business cash flow is organized, the next habit is protecting your personal finances. That's where a TFSA shines.

🦆 What you'll get here

A quick TFSA refresher, a simple setup, and an easy autopilot plan so you can build resilience without overthinking it. Consistency beats perfection ... let's get your ducks in a row.

📚 Foundation Reading (Optional but Helpful)

This article assumes you've separated business and personal finances and understand basic tax reporting. If you want to strengthen those foundations first:

1. Simple Cash Management System - Learn the 'Owner's Pay' concept and how to pay yourself consistently (this is where your TFSA contributions come from).

2. Understanding Your Investment Tax Slips - Good news: TFSA growth isn't reported on your tax return, but this explains WHY and how other investment income works.

3. Underground Economy - Why keeping business and personal separate isn't just smart ... it's essential for CRA compliance.

Already comfortable with these? Great ... let's talk TFSAs.

TFSA Benefits For Small Business Owners

Section 1: Quick TFSA Recap for Busy Owners

(What You Need to Know, Nothing You Don't)

Inflation affects how much we save and how much we spend.

Inflation affects how much we save and how much we spend.WHAT'S COVERED

TFSA Refresher | 3 Rules That Can Trip You Up | TSFA vs RRSP

A Tax-Free Savings Account (TFSA) is a registered account where investment growth and withdrawals are completely tax-free. Contributions are made with after-tax dollars (that means no deduction), but everything that happens inside the account (interest, dividends, capital gains) grows tax-free. And when you withdraw, there is no tax, no reporting, no impact on your other benefits.

Here's The Solopreneur-Specific Refresher

2025 Contribution Limits

- Annual limit: $7,000

- Cumulative room: $102,000 if you were born in 1991 or earlier and have never contributed

- Unused room carries forward indefinitely

- Withdrawals restore room the following January 1

Check your exact room in your CRA My Account before making large contributions. Just remember, CRA's information for the previous year is not usually updated until April. Over contributions trigger a 1% per month penalty.

The Three Rules That Trip Up Business Owners

1. Your TFSA is 100% personal. It is never a business tool.

- Don't deposit business income into it.

- Don't pay business expenses from it.

- Don't day-trade or "carry on a business" inside it.

If the CRA decides you're running a business in your TFSA (frequent trading, using specialized knowledge to flip securities), all gains become fully taxable as business income ... and you lose the tax-free status retroactively.

Keep it simple, keep it personal, keep it long-term.

2. Transferring investments in-kind? Watch for denied losses.

Moving a stock or ETF from a non-registered account into your TFSA triggers a deemed disposition:

- Gains are taxable (you'll report them that year).

- Losses are denied (you can't claim them).

🦆 Rule of thumb: If an investment is underwater, sell it first in your non-registered account (so you can claim the loss), then contribute the cash to your TFSA.

3. If you move TFSA money into your business, document it.

Life happens ... you might need to inject TFSA cash into your business. That's fine, but treat it properly following these steps.

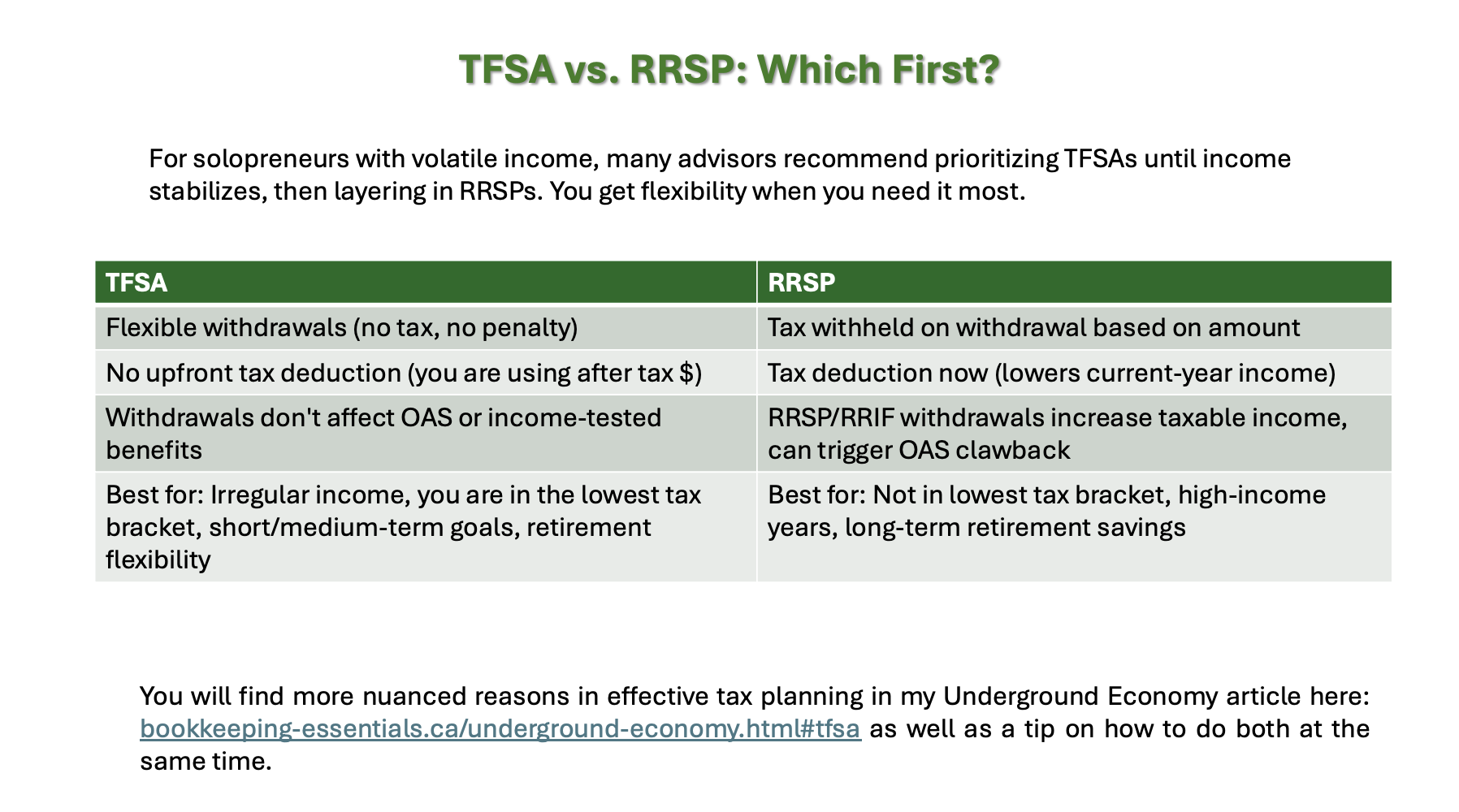

TFSA vs. RRSP: Which First?

Comparing TFSA vs RRSP features

Comparing TFSA vs RRSP featuresThat's the technical foundation. Now let's talk strategy about why this matters for your business decisions.

TFSA Benefits For Small Business Owners

Section 2: Strategy On Why Business Owners Should Care (The 'So What?')

Why traditional savings advice doesn't work for solopreneurs

Why traditional savings advice doesn't work for solopreneursWHAT'S COVERED

Why Traditional Advice Doesn't Work | Depoliticized Resilience | Irregular Income Buffer | Opportunity Fund | No Employer Pension | Income Smoothing | Spousal Planning | Exit-Ready

Why Traditional Savings Advice Doesn't Work for Business Owners

You might be thinking, "I've got a business to run. Why does a personal savings account matter?"

So hear me out before you think this is a stupid idea ...okay? Most financial advice assumes you get a steady paycheck every two weeks. This is not you, right?

As a business owner, your reality looks more like this:

- March was fantastic, April was terrible, May was okay. 📈📉📊

- You need $3,000 for new equipment but don't want to touch your business operating account. 💻💳

- Tax time hits, you have a huge tax bill ... and you realize you should have been setting money aside all year. 😱💸

- Your spouse asks about retirement planning and you laugh (or cry). 😅😭

Traditional savings accounts don't work for this reality. You need something flexible, accessible, and tax-efficient for your personal financial foundation. You need a TFSA.

Not just for 'someday retirement'. For the business decisions you're making this quarter. Your business decisions are only as good as your personal financial stability. Here's why:

Depoliticized Resilience

The global trade landscape is in the process of fundamentally shifting. You are living through an exceptional transition. As Canada-U.S. Trade Minister Dominic LeBlanc told the Senate Committee on Foreign Affairs and International Trade in October 2025: "The relationship with the United States has fundamentally changed and it will not magically go back to what it may have been a year ago or 25 years ago."¹

The era of predictable free trade is over; mercantilism is ascendant. Under the new U.S. approach, Prime Minister Carney has said that countries must now "buy access to the world's largest economy" through tariffs, investments, and policy changes.²

🦆 What this means for Canadian solopreneurs

The rules you built your business on are no longer stable ... pricing assumptions, supplier costs, cross-border access. And the forces driving instability aren't going away: tariffs shift, interest rates swing, tax rules change, currency fluctuates.

These disruptions won't end when any single leader leaves office. This is the new normal, whether we like it or not.

When external factors disrupt your business, a personal tax-free buffer lets you ride out the turbulence without making panic decisions. You're not scrambling to cut prices, chase bad-fit clients / customers, or make desperate pivots. Regardless of what's happening in Washington, Ottawa, or global markets, you're thinking strategically because your household finances are stable.

Your TFSA isn't a political hedge. It's a volatility hedge. It gives you the personal financial stability to make rational business decisions when the world around you is irrational.

Here's an example of what I mean. A bookkeeper whose clients are in manufacturing sees two clients close in one quarter due to tariff-related cost pressures. Her TFSA covers her mortgage for three months while she pivots to service-based clients.

¹ Canada-U.S. Trade Minister Dominic LeBlanc, Senate Committee on Foreign Affairs and International Trade testimony, October 2, 2025, as reported in National Post.

² Prime Minister Mark Carney, statements on Canada-U.S. trade, August 22, 2025.

Irregular Income Buffer

Solopreneurs often don't have steady pay cheques ... unless you are using my cash management system! A slow quarter, a delayed receivable, an unexpected lien ... any of these can create personal cash crunches. With a TFSA cushion, you can withdraw tax-free to cover your mortgage or groceries without:

- Triggering taxable income.

- Paying penalties.

- Making desperate business decisions (like deep-discounting to land a quick sale).

Real-world scenario:

Maya runs a bookkeeping practice. In Q1 2025, two clients delayed payment for 60 days. Instead of missing her mortgage payment or panic-pricing her next project, she withdrew $3,000 from her TFSA (tax-free, no penalties, no stress).

Before planning the payback, Maya checked her CRA My Account to confirm her TFSA room. Because she still had unused room in 2025, she recontributed the $3,000 in Q3 when cash flow recovered. If she hadn’t had room, her plan would have been to park the $3,000 in a high‑interest savings nicknamed 'Jan 1 TFSA Repayment'. Then she would pre‑schedule a transfer for the first week of January 2026 because that's when the 2025 $3,000 withdrawal re-opened as contribution room. Maya decided that for 2026, she would automate her contribution of $583.33/month (or less if that's what she could afford) to make it easy on herself to contribute to her TFSA.

Either way, she treated the TFSA as a buffer, not a line of credit, and pre-committed to replenishing it.

⚠️ WARNING: This only works if you have the discipline to repay yourself. If you're constantly dipping into your TFSA without replenishing it, you're just robbing your future self. This isn't a solution for chronic cash flow problems - it's a bridge for temporary rough patches.

Opportunity Fund

Beyond emergencies, a TFSA also positions you to act when personal opportunities arise ... not just react when problems hit.

Life doesn't wait for perfect timing:

- A professional certification that will increase your earning power goes on early-bird pricing.

- A conference that could transform your network has a registration deadline.

- A course that teaches a skill you've been wanting to master is offered at a discount.

- A health investment (dental work, therapy, fitness program) that you've been postponing becomes urgent.

These are personal investments in yourself, not business expenses. You pay for them personally, they benefit you personally (even if they indirectly make you better at your business).

With a TFSA Opportunity Fund, you can act fast without:

- Disrupting your household budget

- Taking on consumer debt

- Delaying the investment until "someday" (which often means never)

Withdraw from your TFSA (after your 24-hour cooling-off period, of course!), invest in yourself, and pre-commit to repaying your TFSA when cash flow allows.

Here are answers to three common questions ...

🦆 1. What About Business Opportunities?

Keep business and personal separate. P e r i o d.

If your business needs equipment, software, or inventory, that's a business cash flow decision ... not a TFSA decision. Before you even think about injecting personal money:

- Run your Profit First analysis. Have you 'wrung the towel'? Cut unnecessary expenses? Confirmed your Targeted Allocation Percentages (TAP) can't support this?

- Does it pass the banker test? If you were asking a bank for a loan, could you justify the ROI?

- Is your business cash flow stable? If you're considering personal funds to cover business expenses, that's a symptom of a deeper problem. Fix your business fundamentals first. See my sister site's (bookkeeping-essentials.com) article on how to put your cash on autopilot.

Only after you've passed all three tests should you consider a personal-to-business transfer. And if you do:

- Withdraw from your TFSA (personal transaction)

- Inject it as a documented Owner's Contribution (sole prop) or Shareholder Loan (corporation)

- Implement this Audit-Ready Habit for the TFSA paperwork.

But honestly? If your business can't afford something within its operating budget, injecting personal money is usually masking a problem, not solving it.

Your TFSA is for personal opportunities and personal resilience ... not for subsidizing business decisions your cash flow can't support. If your business regularly needs personal cash injections, that's a symptom of a deeper problem. Fix your business cash flow first ... or talk to your bank about an operating line of credit.

🦆 2. Wait ... How Do I Know If It's Personal or Business?

The line between 'professional development' and 'personal development' gets blurry when you're a solopreneur. The same principles from the 'Business Opportunities' section apply here ... but let's get specific about courses and certifications. Here's how to decide ... use the two-part test:

Part 1: The CRA Test (Is it a legitimate business expense?)

- Is this directly related to my current business activities? (Not a future business or career change.)

- Would a reasonable person in my industry consider this necessary or beneficial for my current role?

- If I were employed, would my employer pay for this to keep me competent in my current job?

If you answered 'no' to any of these → It's personal. Pay from your TFSA, don't claim it as a business expense.

Part 2: The Cash Flow Test (Can my business afford it?)

If it passed the CRA test, ask:

- Does my business's operating expense allocation support this right now? (Have you 'wrung the towel'? Is this within your TAP?)

- Is this urgent, or can it wait until next quarter's budget?

If your business can't afford it within its current OpEx % → S T O P. Don't inject personal funds. This is a business cash flow problem, not a TFSA problem. Fix your business cash flow first.

Your business should be able to fund its own professional development, software, equipment, and inventory from operating expenses. If it can't, that's a symptom of:

- Overspending in other areas. (Evaluation your expenses - 'wring the towel'!)

- Underpricing your services / products. (Are you charging enough to cover your true costs?)

- Poor cash flow rhythm. (Are you plating your expenses properly?)

See my sister site's (bookkeeping-essentials.com) article on how to self-diagnose your business health.

Examples:

✅ Business expenses are paid through the business's operating expense budget.

- Bookkeeper enrolls in CPB certification through their education partner program. It's a college program that directly improves your credentials and competency for your current bookkeeping business. It leads to an industry-recognized designation.

- Web developer takes a course on new framework their clients are requesting. It directly responds to market demand for current services.

❌ Personal expenses are paid from your TFSA. They are not a claimable business expense.

- Any course for a career change or future business. It's not related to current income or generating profit for your current business.

- General 'life skills' courses (time management, sales training, mindfulness) - beneficial, but not business-specific.

When in doubt, treat it as personal. The CRA doesn't like aggressive expense claims, and your business shouldn't rely on personal subsidies to function.

🦆 3. What If It's a Legitimate Business Expense But My Business Truly Can't Afford It Right Now?

First, ask yourself honestly - Is this truly urgent, or am I justifying it emotionally?

If it's genuinely urgent (e.g., certification renewal required to keep your license, client-demanded skill to keep a major contract), AND you've 'wrung the towel', AND you've confirmed your business will generate ROI from this investment, then ... reluctantly ... you can consider a personal-to-business transfer:

- Withdraw from your TFSA (personal transaction).

- Inject it as a documented Owner's Contribution (sole prop) or Shareholder Loan (corporation). See how at Audit-Ready Habit for the paperwork.

- Pre-commit to repaying your TFSA (literally write up an IOU contract to ensure it is repayable) ... AND adjusting your business budget so this doesn't happen again.

But be honest with yourself. If your business can't afford a $500 course within its operating budget, injecting personal money is usually masking a problem, not solving it.

Your TFSA is for personal opportunities and personal resilience. It is not for subsidizing business decisions your cash flow can't support.

Remember, businesses can be like spoiled children always having temper tantrums until they get what they want. It is up to you (the parent) to know what is best for your 'child' to meets their needs and not spoil them to your detriment.

No Employer Pension? You Need Flexibility

Solopreneurs don't get employer pensions or group RRSPs. You are building retirement savings solo ... which means you need tools that work WITH the unpredictability of self-employment, not against it. TFSAs offer:

- Flexible access before age 65 (unlike RRSPs, which trigger withholding tax on early withdrawals).

- No mandatory withdrawals (RRSPs convert to RRIFs at 71 with forced annual withdrawals).

- Tax-free growth that doesn't increase taxable income in retirement (which can affect some benefits).

Income Smoothing in Retirement

TFSA withdrawals:

- Don't increase your taxable income.

- Don't trigger OAS clawback (Old Age Security is reduced if your income exceeds ~$91,000 for the 2025 tax year).

- Don't affect income-tested benefits.

This makes TFSAs a powerful tool for managing retirement income alongside CPP, OAS, and RRIF withdrawals.

Spousal Planning: Double the Household Resilience

You and your spouse/common-law partner each get your own TFSA room. That's $14,000/year combined in 2025, or $204,000 cumulative if neither of you were 18 years old or older in 2009 and have never contributed.

- One partner can gift money to the other for TFSA contributions (no attribution rules as you are using after tax dollars and TFSA growth is not considered taxable income).

- Two TFSAs = two tax-free buckets for household emergencies, opportunities, and retirement.

🦆 Practical Tip

If one spouse has irregular income (you) and the other has steady employment, consider having the steady earner max out their TFSA first for household stability, then layer in yours as business cash flow allows ... but be serious and intentional about this.

Having said that, I'm going to nag. If you implement my cash management system, you should have a steady pay cheque even when business income is irregular. And remember, every quarter you review your TAP including your pay remuneration. You can make your pay seasonal so it follows your business's cash rhythm. Just remember the seasonal pay must meet your non-discretionary needs ... that's not negotiable if you want to escape entrepreneurial poverty.

Exit-Ready: Building Personal Liquidity

Planning to scale down, sell, or transition your business in 5–10 years? A healthy TFSA gives you:

- Personal runway during the transition by giving you the ability to cover your personal expenses during due diligence or transition periods when business draws are unpredictable.

- Flexibility to wait for the right buyer (not the desperate-sale buyer) and negotiate from strength, not need.

- Tax-free income to supplement reduced business draws.

TFSA Benefits For Small Business Owners

FAQ: Common Questions from Solopreneurs

As I was researching for this article, I came across an article published by the Canadian Western Bank. It outlined seven TFSA benefits for business owners. I've adapted their list so here's how I think their list translates for solopreneurs:

Compliance & Safety (What NOT to Do)

Can I pay business expenses directly from my TFSA?

Compliance & Safety (What NOT to Do)

Can I pay business expenses directly from my TFSA?

N E V E R.

If the CRA sees business transactions in your TFSA, they'll tax all gains as business income ... and you lose the tax-free status retroactively. If you need to move TFSA money into your business, withdraw it first (personal transaction), then inject it as a documented Owner's Contribution or Shareholder Loan. See Audit-Ready Habit for how to do the paperwork.

Compliance & Safety (What NOT to Do)

Can I day-trade in my TFSA?

Compliance & Safety (What NOT to Do)

Can I day-trade in my TFSA?

Absolutely not! Frequent trading can be taxed as business income. The CRA has been auditing large TFSAs specifically for this. Keep your TFSA simple: buy-and-hold ETFs, GICs, or high-interest savings ... mutual funds. You can even invest in individual stocks if you use a buy-and-hold strategy. Save the active trading for a non-registered account (where losses are at least deductible) ... see caveat below.

As this is important, I want to say this again in different words ...

In Canada, if your personal active trading is considered a business, the profits are taxed as 100% business income. If it is classified as an investment activity, it is taxed as a capital gain, with only 50% of the profit included in your taxable income. This distinction is based on your intent and the nature of your trading activity, not just the frequency of your trades.

Compliance & Safety (What NOT to Do)

Is my TFSA protected from creditors if my business fails?

Compliance & Safety (What NOT to Do)

Is my TFSA protected from creditors if my business fails?

Not under the federal Bankruptcy and Insolvency Act. Some provinces offer limited protection for insurance-based products, but don't count on it. If creditor protection is critical, consult a lawyer. That said, keeping your TFSA well-funded reduces the risk of business failure in the first place as it's your personal stability buffer.

Practical Basics (How to Start)

How much should I contribute to my TFSA each month?

Practical Basics (How to Start)

How much should I contribute to my TFSA each month?

Start small and automate:

- Volatile phase (startup, irregular income): 2-5% of Owner's Pay

- Stable phase: 5-10% of Owner's Pay

- Strong cash year: Top up in December after confirming room in CRA My Account

🦆 Caveat: always keep track of your contribution limits to avoid penalties.

See Section 4: When and How Much to Contribute for the full framework.

Practical Basics (How to Start)

Should I max out my TFSA before my RRSP?

Practical Basics (How to Start)

Should I max out my TFSA before my RRSP?

It depends on your income volatility. TFSAs offer flexibility (withdraw anytime, no tax) while RRSPs offer upfront tax savings (but withholds income tax upon withdrawal). Many solopreneurs prioritize TFSAs until income stabilizes, then layer in RRSPs. See TFSA vs. RRSP comparison in Section 1.

That said, one strategy to do both is to contribute to your RRSP (if you are not in the lowest tax bracket) and use your resulting tax refund to contribute to your TFSA. Two birds ... one stone.

Strategic Uses (When & Why to Withdraw)

What if I need to take a health leave or burnout recovery? Can I use my TFSA?

Strategic Uses (When & Why to Withdraw)

What if I need to take a health leave or burnout recovery? Can I use my TFSA?

Yes. Solopreneurs don't get sick days. A TFSA covers your bills when you need surgery, mental health recovery, or family leave ... without triggering taxable income or penalties. This is why flexible access matters more than maximizing RRSP contributions early in your business. We discussed earlier how this would work at No Employer Pension.

Strategic Uses (When & Why to Withdraw)

Should I use my TFSA to save for income tax instalments? Can I use my TFSA as an emergency fund for my business?

Strategic Uses (When & Why to Withdraw)

Should I use my TFSA to save for income tax instalments? Can I use my TFSA as an emergency fund for my business?

Yes to your first question, if you have irregular income. Park funds in a TFSA savings account or GIC so they grow tax-free until instalment deadlines. This is what CWB (Canada Workers Benefit) calls a "tax-time reserve". You avoid CRA interest charges without tying up cash in a non-registered account.

Just remember: withdraw for taxes, then replenish when cash flow recovers. See my cash management system for how to automate this.

🦆 Important: treat this like any other TFSA withdrawal. It's a loan to yourself that you'll replenish when cash flow recovers. Set a reminder to top up your TFSA after tax season ends.

That said, if you have corporate tax instalments due remember to create your audit-trail and deposit the funds to your business account as a 'Due to Shareholder' loan before paying your corporate instalment to CRA. Document it properly. Learn how at Audit-Ready Habit.

No to your second question, your TFSA is 100% personal, never a business account. But here's what you CAN do: use it as a Personal Emergency Fund that prevents desperate business decisions.

When clients delay payment or revenue dips, you withdraw tax-free to cover your personal expenses like mortgage or groceries ... so you're not panic-pricing or chasing bad-fit clients.

🦆 Moral of the story: Your TFSA protects your household, which protects your business decision-making. See the discussion we had earlier about Irregular Income Buffer for details.

Strategic Uses (When & Why to Withdraw)

What if I need to withdraw from my TFSA multiple times?

Strategic Uses (When & Why to Withdraw)

What if I need to withdraw from my TFSA multiple times?

Every withdrawal is a loan to yourself. Track it, pre-commit to repayment, limit it to once a year unless genuine emergency.

Use your TFSA as a buffer, not a revolving door. Here's the personal guardrails I setup before I retired:

- Set a personal rule - withdrawals are for true household emergencies or high-ROI opportunities only (not routine bills).

- Withdrawal limit - no more than once per year unless it’s a genuine emergency.

- Pre-commit to repayment - if you withdraw, schedule an automatic top-up starting next January 1 (when room resets), or temporarily increase monthly contributions until you’re back to target.

- Add friction - keep your TFSA at a different institution, require 2FA, and use a 24-hour 'cooling-off' rule before withdrawing.

- Track it - keep a one-line note in your TFSA log with date, reason, and your payback plan.

🦆 Tip on lending money to yourself

A loan to yourself is still debt. When calculating your debt-to-income ratio or assessing your financial health, count TFSA withdrawals you haven't repaid as outstanding debt. Just because you're both lender and borrower doesn't mean it doesn't count. Your long-term financial stability matters as much as any banker's portfolio.

Here's why I think it's a good idea to think this way:

- Treating it as "real debt" creates accountability. Without that mental frame, you rationalize non-repayment ('it's my own money').

- An unreplaced TFSA withdrawal IS a reduction in net worth and future financial capacity ... functionally equivalent to debt.

- It emphasizes and reinforces discipline, audit-ready habits, and separating business from personal.

- Would a financial planner or banker agree? Most likely from a personal perspective not a lending perspective. Unreplaced withdrawals reduce your safety net and retirement savings ... that's a financial liability, even if informal.

- It's disciplined thinking that protects solopreneurs like you from self-sabotage.

Strategic Uses (When & Why to Withdraw)

Can I withdraw from my TFSA to pay for professional development or certifications?

Strategic Uses (When & Why to Withdraw)

Can I withdraw from my TFSA to pay for professional development or certifications?

It depends. Is it a business expense or a personal investment?

Use the two-part test (from the Opportunity Fund section):

Part 1: The CRA Test (Is it a legitimate business expense?)

1. Is this directly related to my current business activities? (Not a future business or career change.)

2. Would a reasonable person in my industry consider this necessary or beneficial for my current role?

3. If I were employed, would my employer pay for this to keep me competent in my current job?

✅ If yes to all three → It's a business expense. Your business should pay for it from operating expenses.

❌ If no to any → It's personal. Pay it from your TFSA.

Part 2: The Cash Flow Test (Can my business afford it?)

- Does your business's operating expense allocation support this right now? (Have you 'wrung the towel'? Is this within your TAP?)

- Is this urgent, or can it wait until next quarter's budget?

If your business can't afford it → S T O P. Don't inject personal funds. This is a business cash flow problem, not a TFSA problem. Fix your business fundamentals first. See my sister site bookkeeping-essentials.com's article on how to self-diagnose your business health.

Go back to the Opportunity Fund section for more details.

Strategic Uses (When & Why to Withdraw)

Is a TFSA useful if I'm planning to sell my business in 5-10 years?

Strategic Uses (When & Why to Withdraw)

Is a TFSA useful if I'm planning to sell my business in 5-10 years?

Very. A healthy TFSA gives you exit-ready liquidity ... a personal runway during the transition, flexibility to wait for the right buyer (not the desperate-sale buyer), and tax-free income to cover expenses during due diligence.

Source: Adapted from Canadian Western Bank's "7 Ways TFSAs Are Good for Business Owners" and tailored for Canadian solopreneurs.

TFSA Benefits For Small Business Owners

Section 3: Practical: How to Implement Without Mixing Business and Personal

Shifting to how a solopreneur can implement a TFSA savings program

Shifting to how a solopreneur can implement a TFSA savings programWhat Goes Inside Your TFSA? (Not Investment Advice ... Just the Boundaries)

Once your TFSA is open and funded, you'll need to decide what to hold inside it. That's a personal finance decision, not a business one ... and it's outside the scope of this article.

But here's what you DO need to know as a business owner. Match your TFSA contents to your timeline:

- Short-term safety (0–24 months): If you're using your TFSA as an emergency buffer or opportunity fund, keep it liquid and stable (high-interest savings or GICs). You can't afford volatility with money you might need next quarter.

- Long-term growth (5+ years): If you're building retirement savings or a future sabbatical fund, you can consider growth-focused investments (stocks, ETFs, balanced funds). But that's a conversation for a financial advisor or a personal finance resource ... not your bookkeeper.

🦆 Your job as a business owner

Decide WHY you're using the TFSA (safety buffer vs. long-term wealth). Then talk to a professional or educate yourself separately about WHAT to hold inside it.

What to avoid (business owner-specific):

- Frequent trading or day-trading. The CRA can tax all gains as business income if they decide you're "carrying on a business" inside your TFSA. Keep it simple, keep it long-term.

- Holding investments you actively manage as part of your business expertise. If you're a financial advisor or trader by profession, the CRA may scrutinize your TFSA more closely. When in doubt, get professional advice.

- Using your TFSA as a business cash account. Never pay business expenses from it, never deposit business income into it. (We covered this in Section 1, but it bears repeating.)

Where to learn more about TFSA investing:

I'm not going to tell you what to buy ... that's not my lane. But here are reputable, non-commercial resources:

- Canada.ca: Tax-Free Savings Account - official CRA rules and limits [https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/tax-free-savings-account.html]

- Financial Consumer Agency of Canada (FCAC) - unbiased financial literacy tools [https://www.canada.ca/en/financial-consumer-agency.html]

- GetSmarterAboutMoney.ca - Ontario Securities Commission - investor education, no sales pitch [https://www.getsmarteraboutmoney.ca/]

Or talk to a fee-only financial planner (one who doesn't earn commissions on what they sell you).

Bottom line:

Your TFSA is a container. What you put inside it depends on your personal goals, risk tolerance, and timeline. I'm just trying to help you use that container correctly as a business owner. Keep it separate, fund it cleanly, and avoid CRA trouble.

The investment strategy? That's between you, your risk tolerance, and a qualified advisor.

TFSA Benefits For Small Business Owners

Section 4: Putting It Into Practice

Take one baby step after another until saving for your TFSA becomes as routine as brushing your teeth

Take one baby step after another until saving for your TFSA becomes as routine as brushing your teethWHAT'S COVERED

Personal Discipline Rule | The Put It On Autopilot Habit | Audit-Ready TFSA Withdrawals | Compliance Checklist | Next Steps | Tie It All Together

💡 Personal Discipline Rule: Every TFSA Withdrawal Is A Loan To Yourself

Treat every TFSA withdrawal (whether for an emergency or an opportunity) as a personal loan to yourself that you will repay.

Wondering how to make repayment automatic? ... here's the discipline part:

- Check your TFSA room before withdrawing (CRA My Account).

- If you have room this year, recontribute as soon as personal or business cash flow allows.

- If you don't have room, park the repayment amount in a separate savings account labeled "TFSA Repayment - Jan [next year]" and pre-schedule the transfer.

- Track every withdrawal and repayment in your TFSA log (date, amount, reason, payback date).

For you skeptics, here's why this matters ...

There will always be reasons not to repay it. A slow month. An unexpected expense. "I'll do it next quarter." If you don't treat it as a non-negotiable personal loan, you'll never build the retirement cushion or financial stability you're aiming for.

Your TFSA isn't a business slush fund. It's your personal financial resilience fund. Protect it.

The One Habit That Makes This Work

You understand what a TFSA is, why it matters for your business decisions, and how to keep it separate from your business. Now let's make it automatic.

Automate a monthly transfer from your personal account to your TFSA on the same day you pay yourself.

Make it part of payday, not a separate decision. You'll never 'find' the money to save. You have to move it first, then live on what's left.

- How much?

Start small. Even $100 / month (or less) builds the habit. As your business stabilizes and you refine your Owner's Pay using a simple cash management system, you can increase it.

Rules of thumb (adjust to your reality):

- Startup/irregular phase: 2–5% of Owner's Pay

- Stable phase: 5–10% of Owner's Pay

- Strong cash year: Top up with a lump sum in December (after confirming your contribution room in CRA My Account)

🦆 Consistency beats perfection. A small automatic contribution every month will outperform sporadic lump sums you 'intend' to make but never do.

Audit-Ready Habit: If You Move TFSA Money Into the Business

Life happens. Sometimes you need to inject personal funds into your business. That's fine. But the moment money crosses from personal to business, documentation becomes non-negotiable. Here's how to do it correctly:

Step 1: Withdraw from Your TFSA

This is a personal withdrawal (tax-free, no reporting required).

- Transfer the amount to your personal chequing account.

- Record it in your TFSA log: date, amount, reason.

Step 2: Document the Business Transaction

Now you're injecting your personal money into the business. The CRA needs a clear paper trail.

🦆 If You're a Sole Proprietor: Treat it as an Owner's Contribution (a capital injection).

What to document:

- Record it in your books: Debit Cash, Credit Owner's Contribution

- Create a dated memo (one paragraph):

Date, amount, source ('Personal funds from TFSA'), purpose, your signature

Sample wording:

On [date], I contributed $[amount] from my TFSA to [Business Name] to cover [specific purpose]. This is a capital contribution. Signed: [Your Name], [Date].

🦆 If You're Incorporated: Treat it as a Shareholder Loan (the corporation owes you).

What to document:

- Record it in your books: Debit Cash, Credit Due To Shareholder

- Create a simple promissory note (one page):

Date, amount loaned, repayment terms, interest rate: optional for small loans (under $10,000) [consider charging at least CRA prescribed rate for larger or long-term loans], your signature

Sample wording (interest-free):

On [date], [Your Name] loaned $[amount] to [Corporation Name]. This loan is interest-free and repayable on demand. Signed: [Your Name], [Date].

Why This Matters?

If the CRA audits your business and sees unexplained deposits, they'll assume it's unreported business income ... and you'll owe tax, interest, and penalties.

P a p e r w o r k m a t t e r s. A one-page note takes 5 minutes. An audit dispute takes months and costs thousands.

Track It (Both Sides)

- Personal: Log the withdrawal in your TFSA tracker (date, amount, reason, repayment plan).

- Business: Keep the promissory note or memo with your tax records.

Use those draws (your personal income) to replenish your TFSA when you have contribution room.

- Sole proprietors: You take draws as the business generates profit. Use those draws (your personal income) to replenish your TFSA when you have contribution room.

- Corporations: Record the repayment in your books (Debit Shareholder Loan Payable, Credit Cash). If you charged interest, report it on your personal tax return. Once the corporation repays you, use those funds to replenish your TFSA.

Need Help?

If your loan is large, long-term, or you're unsure about interest rates and tax implications, talk to your accountant. They'll help you structure it properly and so you avoid surprises at tax time.

More >> Simple Audit Proofing Method

More >> Why You Want An Audit Trail

Quick Compliance Checklist

✅ Do:

- Do fund your TFSA from Owner's Pay (personal income), never directly from your business account.

- Do automate contributions so they happen without you thinking about it.

- Do check your contribution room in CRA My Account before making large contributions. (Heads up. From January to April, CRA may not have updated the prior-year data yet.)

- Do track total contributions across all TFSAs if you have accounts at multiple institutions.

- Do consider using institution-to-institution transfers if moving your TFSA between banks but beware there may be a transfer fee. (Don't withdraw and recontribute in the same year unless you have the room. Otherwise, withdraw in December and recontribute in January.)

❌ Don't:

- Don't pay business expenses from your TFSA.

- Don't deposit business income directly into your TFSA.

- Don't day-trade or frequently trade inside your TFSA. (The CRA can tax all gains as business income if they decide you're "carrying on a business".)

- Don't over-contribute. (There is a 1% penalty per month on excess amounts.)

- Don't forget to document personal-to-business transfers so you are audit-ready if the taxman pays you a visit.

Your Next Steps

☐ Confirm your contribution room in your online CRA My Account. [https://www.canada.ca/en/revenue-agency/services/e-services/cra-login-services.html]

☐ Open a TFSA. (Start with a high-interest savings account if you're unsure. You can always add a brokerage TFSA later for long-term growth. What's important here is to just start by starting ... refine later.)

☐ If you haven't already, setup yourself up a regular 'pay cheque' from your business twice a month. Then ...

☐ Set up automatic monthly transfers from your personal chequing or savings account. (Make it for the same day you pay yourself from the business.)

☐ Create a simple TFS contribution tracker so you don't over contribute in any given year. (It can be a spreadsheet or notebook with the date, institution, contribution amount, withdrawal amount, running total.)

☐ Review quarterly. (Why? To check your progress. There's no need to tinker. You are just confirming the automation is working and nothing untoward has occurred.)

Think of a TFSA as your tax-free personal safety net

Tie It All Together

Think of your TFSA as the personal sidecar to your business cash flow system. Your business funds your Owner's Pay. Your Owner's Pay funds your TFSA. Your TFSA funds your household resilience.

When your personal finances are stable, your business decisions get clearer. You're not in survival mode. You're in strategy mode.

🦆 One account. One automatic transfer. One review each quarter.

That's how you stay audit-ready on the business side and sleep-better-ready on the personal side.

Get your d u c k s i n a r o w ... one simple, repeatable habit at a time.