- A Roadmap To CRA Compliance and Financial Stability

- Payroll Manual

- Payroll Tax Filing Deadlines

Payroll Tax Filing Deadlines

For Canadian Small Business

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting ... and keep it simple. Consistency beats perfection.

Published January 1, 2024 | Edited May 20, 2024 | Revised July 20, 2024

WHAT'S IN THIS ARTICLE

Employee Statement of Earnings | PD7A Deadline | T4 deadline | T4 Prep Tip | Electronic T4

NEXT IN SERIES >> Payroll Tax Guide

Which Worker Relationship Status Do You Want?

A. Employer-Employee | Contract of Service

B. Independent Contractor | Contract For Services

Your ducks are almost lined up. Pretty impressive. You are aiming for consistency not perfection!

Your ducks are almost lined up. Pretty impressive. You are aiming for consistency not perfection!Highlights Of This Post

- Employee Statement of Earnings & PDOC

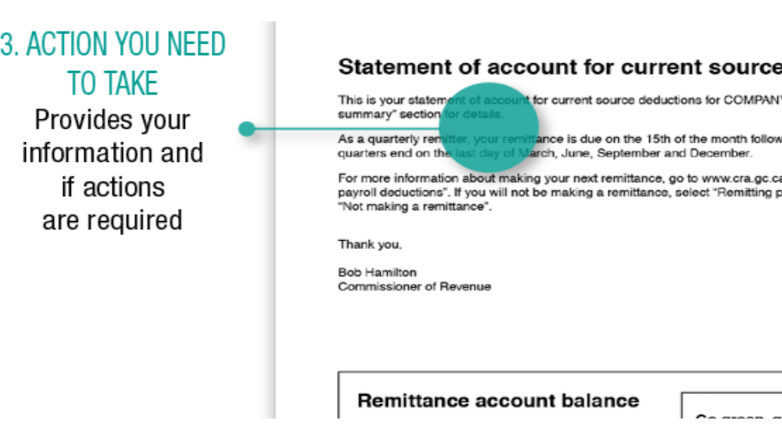

- Source Deductions Remittance Deadline Form PD7A

Remittance deadline is determined your remitter type; CRA calculates your average monthly withholding amount (AMWA). They add up all source deductions sent over the past two years divided by the numbers of payment periods over one year.

- T4 Slip Deadline - Paper or Electronic

T4 slips must be issued to your employees by the last day of February each year.

- T4 Electronic Copies Requirement

Employers can provide an electronic copy of the T4 if the employer has received the employee's consent in writing or electronic format.

- T4 Preparation Tip

When an employee is PAID (not earned) determines the payroll remittance due date.

Help getting all your ducks in a row

Get all your ducks in a row so you can file on time!

Get all your ducks in a row so you can file on time!What are you looking for? GST deadlines, payroll deadlines, business income tax, independent contractor deadlines ... WHAT! There are deadlines for independent contractors?

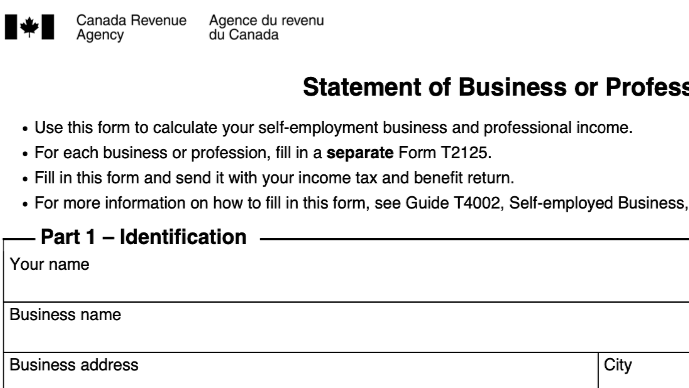

Employee Statement of Earnings

CRA wants small business owners to know that PDOC, the online calculator, is NOT meant to be used as a statement of earnings for your employees.

It is recommended you check your employment standards to determine what information is legally required.

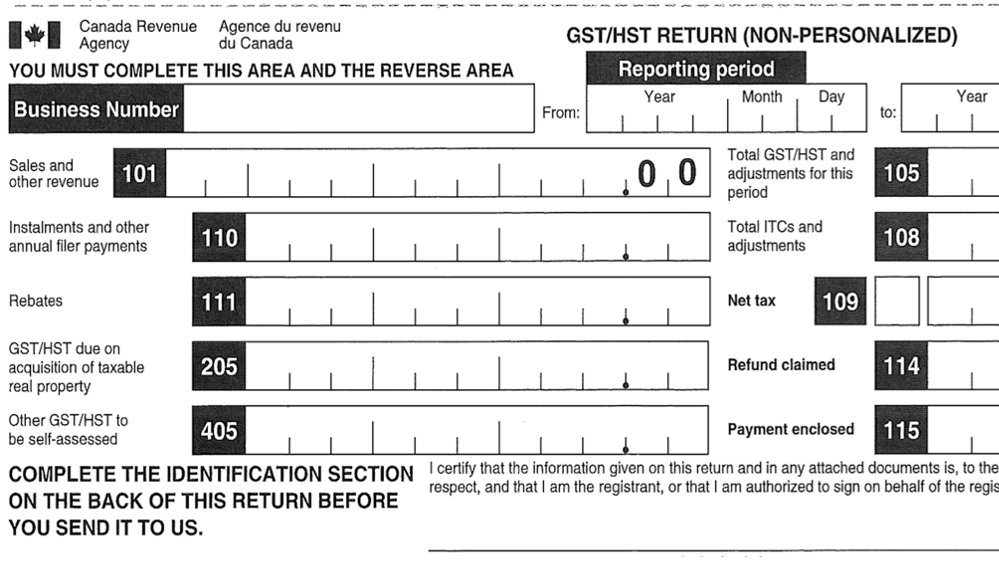

Payroll Tax Filing Deadlines - Form PD7A

CRA determines your remitter type by calculating your average monthly withholding amount (AMWA). They add up all source deductions sent over the past two years divided by the numbers of payment periods over one year.

If the due date falls on a Saturday, Sunday or holiday, it moves to the next business day.

| Assigned Reporting Period | Form PD7A Filing DEADLINE | Payment DEADLINE | AMWA |

|---|---|---|---|

| Quarterly - new small employers | 15th of April, July, October, January | Same as filing deadline | Not based on AMWA* |

| Quarterly - after 1 year | 15th of April, July, October, January | Same as filing deadline | L.T. $3,000* |

| Monthly | 15th day of following month | Same as filing deadline | L.T. $25,000 ($15,000 prior to 2015) |

| Semi-Monthly | 25th day of same month and 10th day of following month |

Same as filing deadline | $25,000 to $100,000 ($15,000 to $50,000 prior to 2015) |

| Weekly | Due 3rd work day after the period** | Same as filing deadline | G.T. $100,000 ($50,000 prior to 2015) |

Payroll Tax Filing Footnotes

*Must have perfect payroll tax compliance history over a twelve month period to qualify. If not, you must remit monthly. If you qualify, CRA will notify you.

**Remittances must be done through a Canadian financial institution one full day prior to the due date to avoid penalty charges.

Payroll taxes are also referred to as source deductions. Source deductions are reported on a quarterly, monthly, semi-monthly or weekly basis on form PD7A. Your reporting period is assigned by CRA based on your remitter type (discussed below). Revenue Canada mails the form ahead of your due date enabling you to meet your tax filing deadlines.

You have two options for filing online:

- Using My Payment

- Through your financial institution. It may require payment of an initial administration fee to get setup.

T4 Preparation Tip

When an employee is PAID (not earned) determines the payroll remittance due date.

Don't confuse this with GAAP guidelines for the matching principle where you record wages when they are earned (worked) not paid.

For small businesses, monthly filers are the most common reporting period with quarterly filers being the other common period. Currently NEW EMPLOYERS start as monthly remitters.

In 2016, as per the Federal Budget Economic Action Plan, CRA introduced quarterly remittances for new employers "with monthly withholdings of less than $1000 AND maintain a perfect compliance record in respite of their Canadian tax obligations".

If you are going to be tempted to spend the withholdings instead of treating them as funds held in trust, I recommend you do not move to quarterly filing even if it is offered to you. Remember you are trying to get all your ducks in row. Spending funds that are not yours to spend will take you down a whole other path and likely down the rabbit hole mentioned earlier. Remember you are trying to create new habits that will give you a successful outcome.

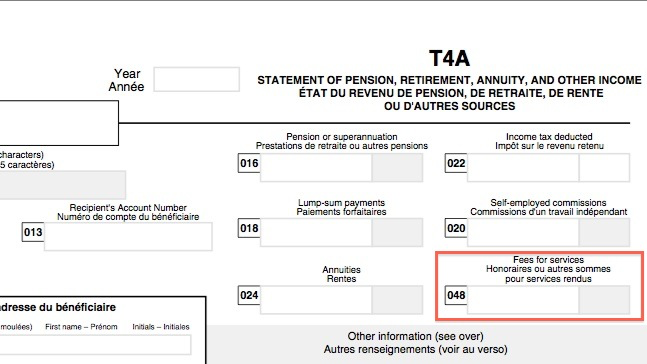

What is the Deadline for T4 Slips To Be Issued?

Can I Provide Electronic Copies Instead of Paper Copies?

T4 slips must be issued to your employees by the last day of February each year.

Employers need to have released T4 slips to employees on or before the due date. Failure to do so results in hefty fines.

If you are wondering whether you can give the employee an electronic copy of the T4 instead of mailing or handing out the paper slip ... CRA says yes "if you have received the employee's consent in writing or electronic format".

See the Canada Revenue RC4120 Employers Guide - Filing the T4 slip and Summary.

What is the easiest way to meet your tax filing deadline for T4 Summary and slips?