- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Canadian Income Tax Compliance

- Meals and Entertainment Expense Deduction

Meals and Entertainment Expense Deduction

Form T2125 Line 8523

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

Edited May 4, 2024 | Updated January 12, 2024 | Originally Published on Bookkeeping-Essentials.com in 2010

WHAT'S IN THIS ARTICLE

What is deductible? | 50% Category | GST & Meals Limits | Meals & Tips | 100% Category | Working Through Lunch Meals

NEXT IN SERIES >> CRA's Position On Internet Service and Cell Phones

A company party for all employees is 100% deductible.

A company party for all employees is 100% deductible.How much can you write off for meals and entertainment in Canada?

Meals and entertainment are routinely audited by CRA to ensure the claims qualify for a self employment tax deduction and that the limitations for deductibility were adhered to. It's important you know the rules.

What Meals and Entertainment Expenses Are Deductible?

Meal and entertainment expenses fall into three categories. Which category depends upon the purpose of the meal or event. They must also be reasonable not lavish and for the purpose of earning business income.

AUDIT READY

It's important to understand that not every business expense is tax deductible.

CRA publication IT518R Food, Beverages and Entertainment (Archived) states, "to qualify as a deductible expense, a taxpayer must be prepared to demonstrate that the amount was incurred for the purpose of earning income. Records should be maintained of the names and business addresses of the customers or other persons being entertained, together with the relevant places, dates, times and amounts supported by such vouchers as are reasonably obtainable."

50% Deductible Category

Meals and entertainment are generally limited to 50% of the amount paid if you can show the restaurant meal or entertainment was for business purposes.

The amounts must be reasonable not lavish; and incurred for the purpose of earning business income. This includes the cost of meals while traveling as well as meals or restaurant certificates during a conference.

Meals and entertainment expenses when you are traveling alone to earn business income are deducible. (Meals when you are not travelling and working alone are never deductible.)

Sidebar: There are special rules pertaining to claiming conference expenses.

Income Tax Interpretation Bulletin IT-518R #17 defines a meal as "food or beverages for human consumption including any tips and taxes". Under this definition, coffee supplies, bottled water, and food for clients should be claimed here as it is consumable, not under supplies.

Traveling is defined around incurring expenses to earn business income. Allowable expenses include public transportation fares, hotel accommodations, and meals. The 50% limit applies to all travel expenses provided you document the purpose and costs.

When are meals in a restaurant a business deduction?

When are meals in a restaurant a business deduction?Here are some examples of common 50% deductible expenses that must be substantiated:

- hosting a business meal with a customer or client

- business networking over meals

- meals while traveling for business

- dinner for employees working late for 2 or more hours AND the overtime is not frequent (less than 3 times a week)

- food for staff meetings

There are special rules for a long-haul truck driver and bike couriers which won't be discussed here.

AUDIT READY

Don't leave yourself open to reassessment by claiming 100% of the total cost of your meal and entertainment expenses.

Don't leave yourself open to reassessment by claiming any percentage of meals and entertainment that were not incurred to earn income.

A CRA tax auditor requires you to substantiate the amounts you spent on meals and entertainment were incurred for the purpose of earning income. They will want supporting documentation and evidence to prove this.

"Records should be maintained of the names and business addresses of the customers or other persons being entertained, together with the relevant places, dates, times and amounts supported by such vouchers as are reasonably obtainable. Expenses that are personal in nature (other than expenses incurred by the taxpayer while away from home in the course of carrying on business) are not deductible by virtue of paragraph 18(1)(h)."

WHAT NOT TO CLAIM

How does CRA define "reasonable" in relation to meals and entertainment expenses?

As a guideline, turn to the parameters set out under the simplified method of accounting for meals. Since 2020, CRA considers a reasonable meal expense to be $23 a meal to a maximum of $69 a day including sales tax. (The rate between 2009 and 2019 was $17 per meal to a maximum of $51 a day.)

If your tax expense for meals or entertainment exceeds these limits without an explainable reason under the circumstances, limit your tax deduction to these guidelines. The amount over the guidelines can still be booked as a business expense ... it's just not a tax deductible business expense.

HOW MEALS AND ENTERTAINMENT LIMITS AFFECT GST HST RETURNS

The 50% limit applies to the GST HST input tax credit as well. You can handle this two ways:

- Expense 50% of sales tax each time you book a receipt. If you choose this bookkeeping method, be sure to let your accountant or tax preparer know. This can be done by setting up a Meals or MandE tax code in your books that would do the following:

DR Meals or Entertainment Expense 100%*excluding sales tax as it is a legitimate business expense

DR Sales Tax Expensed To Owner's Draw 50% (not tax deductible)

DR Sales Tax Payable 50% (ITCs to claim)

CR Bank or Credit Card 100%

*Sidebar: You always record your meal and entertainment expenses at 100% in your books. The tax adjustment comes when the tax return is prepared. The tax software calculates the 50% non-deductible part of the claim. - Make an adjusting entry at every quarter or at year-end to expense 50% of the ITCs booked throughout the year to Owners Draw as it is not tax deductible; or it could be added back in your tax return.

AUDIT READY - INPUT TAX CREDIT ADJUSTMENT

SS236(1) states you must recapture 50% of the ITCs claimed. This is in line with SS67.1(1) which states meals are generally limited to 50%.

CRA's website explains that you have two ways to make this adjustment - (a) during each reporting period or (b) annually. If you are not adjusting each reporting period, remember to make the meals and entertainment Annual GST ITC Adjustment on your GST/HST return.

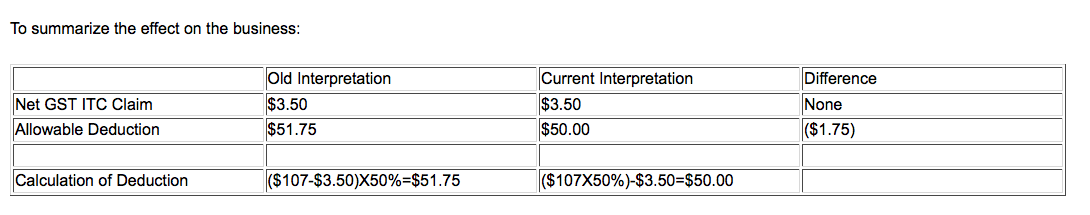

Keith Anderson, CPA-CA had a good explanation of the GST/HST issues relating to meals and expenses on his defunct website. His summary table of the effect on business follows.

References: GST/HST Memoranda Series 8-2 - General Restrictions and Limitations; CRA Calculate input tax credits – Methods to calculate the ITCs

Tips on Meals and GST

AUDIT READY

Tips paid voluntarily are not subject to GST/HST ... so ITCs should NOT be claimed on these amounts.

Tips added as a service charge to a bill require GST/HST be charged and ITCs may be taken on these amounts.

Reference: CRA> Taxes >GST/HST for businesses >GST/HST in special cases >Tips and gratuities

When are meals and entertainment 100% Deductible?

The meals and entertainment 50% limit does NOT apply in the following situations:

There is a limit of 6 staff parties a year.

There is a limit of 6 staff parties a year.- You are in the hospitality industry and the expenses were to provide food, beverages, or entertainment to paying customers.

- It is related to fundraising for a charity.

- You billed your client for the expenses.

- It is included in an employee’s income.

- The employee cannot be expected to return home daily (such as work camps).

- It is a special work location (at least 30 kilometers from a city with 40,000 plus in population).

- It is a company party for ALL employees (6 per year limit).

- You attended a conference, convention or seminar (2 per year).

See CRA's publication IT-518R Food, Beverages, and Entertainment Expenses for more detailed information about exceptions to the 50% meal limitations.

I'm going to repeat this as it is important. This area if always audited so be very familiar with your meals and entertainment expense deduction rules.

Can I deduct meals eaten while working?

Meals eaten where no business meeting was conducted are never deductible.

Meals eaten where no business meeting was conducted are never deductible.This meals and entertainment expense item should not be on your tax deduction checklist as it is frequently audited for compliance.

Meals eaten during an ordinary business day where no business meeting was conducted are not deductible.

Yes, you read that correctly. Just because you are self-employed does NOT mean you get to deduct all your meals. Ask yourself this question when in doubt, "When I was an employee, would my employer have paid for this?" If the answer is no, then you probably can't deduct it either. The idea is that you would still have to eat if you were not self-employed.

That means the trip to town for supplies where you also grabbed lunch "while you were working" ... is NOT a business expense. The trip to town can be logged in your auto log though.

One bookkeeper tells her clients that want to deduct these meals that they should just call the CRA and tell them to come audit them! :0)

AUDIT READY - WORKING FROM HOME

Personal Expenses Are Never Deductible

The line can get blurred between business and personal when you work from your home.

Food purchased for your business that you or your family consume for personal use must be removed from your business expenses by coding the dollar value to your Owner's Draw account. Make a good memo as to why you made the transaction. This habit will go a long way to having smooth tax audits if or when they occur.

Sidebar: This restriction also applies to personal use of property like your business computer or office supplies. Keep your business expenses separate from your personal expenses by having a separate bank account and credit card for your business affairs.