- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Navigating Change

- Understanding Your Investment Tax Slips

Understanding Your Investment Tax Slips

What your tax slips reveal about your financial future ... and why it matters

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

Published February 25, 2024 | Updated January 14, 2026 | Edited January 24, 2026

WHAT'S IN THIS ARTICLE

Salary vs Dividends | Tax Slips | Dividend Types | Dividend Gross-Up | RRSP vs TFSA vs IPP | Tax Treatment of Various Types of Income | How to Declare and Pay a Dividend | FAQ | Retirement Planning

NEXT IN SERIES >> RRSP Tips and Traps for Small Business Owners

Understanding your investment tax slips received from diversifying and planning for retirement

Understanding your investment tax slips received from diversifying and planning for retirementAs an owner-manager of a CCPC (Canadian Controlled Private Corporation), did you pay yourself a dividend last year? Does it get reported on a T5 slip or a T3 slip - both slips have dividend boxes? Quick answer - a T5 slip.

Keep reading to find out the difference between eligible and other than eligible dividends and which one you should be using to pay yourself.

Sidebar: One of the mistakes an unincorporated self-employed person can make is not saving for retirement. So this article is worth a read for you too!

Highlights Of This Post

Understanding your investment tax slips

- Incorporated business owners can choose between business salary or dividends

- Understanding your investment tax slips - T3, T5, T5008

- Eligible vs other than eligible dividends vs foreign dividends

- How to calculate the dividend gross-up and tax credit

- Business owners need to plan a retirement exit strategy early - RRSP, TFSA, IPP, investment portfolio

- A retirement planning option to consider now

FAQ about investment income and retirement pensions

- Steps to declare and pay a Canadian dividend

- Please explain what happens if a CCPC has income over $500,000. Does this affect the type of dividend a small business owner can pay themself?

- What is GRIP and how do you get a GRIP balance in your CCPC?

- What is the Dividend Tax Credit and what is its purpose?

- Foreign dividends receive different tax treatment than Canadian dividends. How are foreign dividends taxed in Canada?

- Please explain how capital gains (and losses) receive favourable tax treatment in Canada. What is the new capital gains inclusion rate effective June 25, 2024?

- What is the Lifetime Capital Gains Exemption (LCGE) and the Canadian Entrepreneur's Incentive (CEI)?

- Can you please explain how IPPs work?

- Would a small business owner be able to attract better personnel if the company had a retirement plan in place for employees?

Understanding Your Investment Tax Slips

Salary or Dividends: Why You Got a T4 or T5 From Your Own Company

Incorporated business owners can choose between receiving business salary or dividends. Your choice determines which tax slip you get. Understanding your investment tax slips (T5s) are different from your earned income tax slips (T4s) is important.

As an owner of a CCPC, you get to choose how to pay yourself - through dividends or salary. It's possible to take a combination of both salary and dividends. An ideal mix would depend on the small business owner's income needs, tax bracket, the corporation’s income, and future plans for growth.

Deciding the best mix of salary versus dividends is a significant financial decision for small business owners. It's wise to let your accountant determine the best mix for you. Both options carry distinct advantages and disadvantages, and the choice largely depends on the specific circumstances and goals of the business owner.

Sole Proprietors

Sole proprietors, freelancers are not employees therefore they cannot be on their own payroll; nor are they shareholders so they do not qualify to receive company dividends.

Learn how to pay yourself if you are a sole proprietor business owner.

Self-employment income counts as earned income for RRSP contribution room and CPP premiums. There is still value in understanding your investment tax slips if a sole proprietor has personal investments that create taxable investment income.

1. Salary (T4 slip): Paying yourself a salary from your small business means that you would be considered an employee of your company. The benefits of taking a salary include:

- The corporation receives a tax deduction for the salaries paid to employees.

- The ability to manage your personal finances independently of your business.

- Creates RRSP (Registered Retirement Savings Plan) contribution room, as contribution room is based on earned income. Therefore, contributing to an RRSP could provide a significant tax deduction.

- Provides a larger CPP payout when you retire.

- Beneficial support if you plan to apply for a personal loan or a mortgage, as lenders usually ask for proof of regular income.

Paying a salary involves administrative work because you need to withhold and remit taxes to the Canada Revenue Agency (CRA), as well as make Employment Insurance (EI) and Canada Pension Plan (CPP) contributions. If you already have employees on your payroll, the administrative burden should not be a factor.

Caution - Talk to Your Accountant

Please use the information in this section more for talking points with your accountant ... so you have a better feel for what kind of information you are seeking. Your accountant will customize advice specifically for your situation. Think of it like this ... Having a map BEFORE you enter the forest is so much better than getting lost in the forest!

2. Dividends (T5 slip): Paying yourself with dividends means distributing company profits to you as a shareholder. Dividends may be taxed at a lower rate than salary, especially if the business owner's personal income level is low.

In one way, dividends have less of an administrative burden as they don't require withholding taxes and there's no need to make EI and CPP contributions. However, it does require paperwork for a Director's Resolution to declare the dividend; so it's a bit of a wash from my point of view.

Note: The onus is on you personally, rather than your company, to plan to have enough personal funds to pay the income tax on your dividends when you file your tax return or when you make quarterly tax installments. So again in my opinion, the administrative burden from paying a dividend has just shifted and is just in a different format.

As dividends do not create RRSP contribution room, they might be less preferable if the business owner has high personal tax rates. You'll also have a reduced CPP payment when you retire and may lose some personal tax deductions that are based on earned income if you don't take a salary.

AUDIT READY

- One point to note is that a corporation must have retained earnings or a surplus to legally pay dividends. If a corporation pays dividends without sufficient retained earnings it can face legal consequences.

- A dividend must also be declared formally with the paperwork filed in your minute book prior to payment as the paperwork cannot be backdated.

- A potential pitfall to avoid is the "kiddie tax." If dividends are paid to minor children, they may be taxed at the top marginal tax rate.

Whatever your situation, it is prudent as a small business owner to seek professional advice from a tax accountant or tax advisor who can understand your specific circumstances and provide personalized advice. They can also run different scenarios to determine the tax implications and help decide the best remuneration strategy for you and for your business. Please don't just listen to your buddies' advice while you are golfing or at the bar. Run everything past your accountant before you implement a remuneration plan.

Understanding Your Investment Tax Slips

What Are T3, T5, and T5008 Slips?

(And Why You Got Them)

You will receive a T5 slip in February of the following year for dividends paid in the prior year. Understanding your investment tax slips do not have income tax withheld on the investment income reported; you'll need to put money aside to the pay income taxes on the company dividend paid.

You will receive a T5 slip in February of the following year for dividends paid in the prior year. Understanding your investment tax slips do not have income tax withheld on the investment income reported; you'll need to put money aside to the pay income taxes on the company dividend paid.Your company had a profitable year and you were paid a dividend. How does this get reported to CRA and how do you pay your personal taxes owing on the dividend received?

BEST PRACTICE HABIT

Income Tax Due On Dividends Received

In case you didn't notice, incomes taxes were not withheld when you were paid your dividend. This means you have to put money aside to pay the applicable income taxes when you file your T1 return.

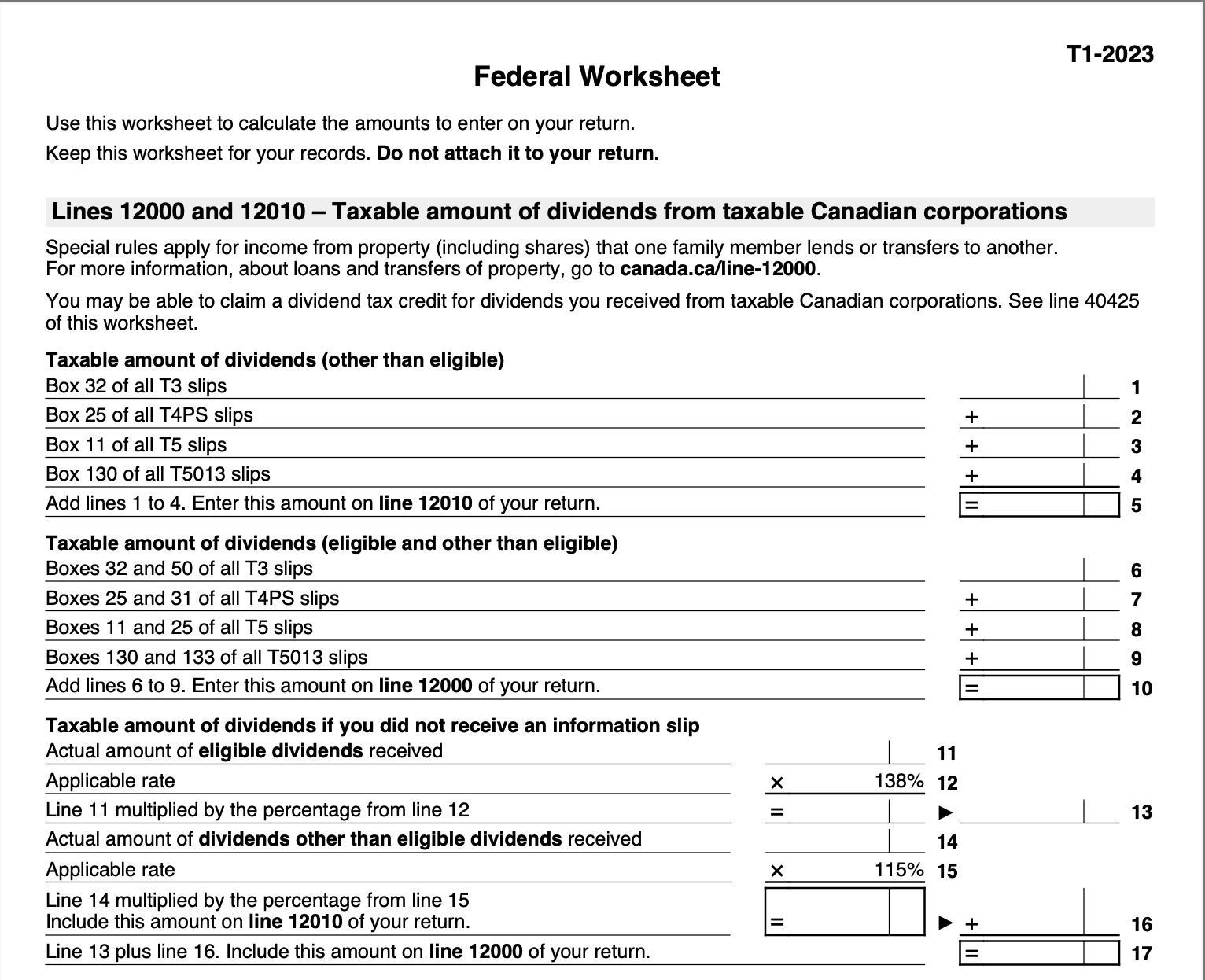

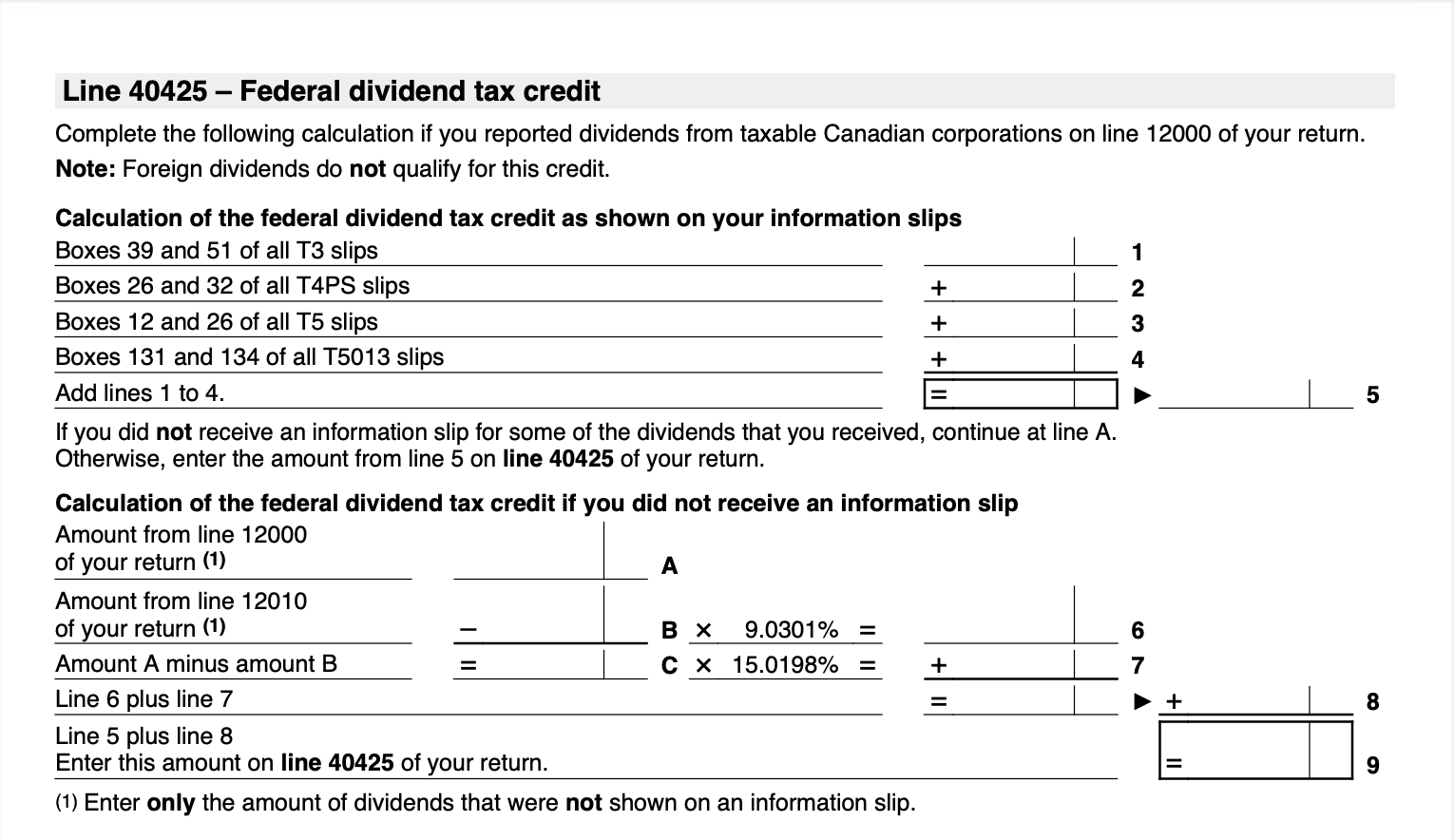

CRA Form Federal Worksheet summarizes all taxable amounts of dividends from taxable Canadian corporations that is then carried forward to lines 12000 or 12010 of your T1 return. It includes the calculation of the gross up of the dividend paid.

Your Investment Tax Slips

In Canada, different types of investment income are reported using different tax slips. These tax slips are issued for investments held outside registered (RRSP, RRIF, or TFSA) accounts. Here's a brief explanation of three of the more common investment income slips -- T3, T5, and T5008 slips:

1. T3 Statement of Trust Income Allocations and Designations: Must be issued before the end of March of the following calendar year.This slip reports income from Canadian trusts. It could be mutual funds, exchange-traded funds (ETF) or income trusts. The T3 slip will indicate other types of income not just dividends, such as capital gains and other income, which might receive a more favourable tax treatment. Expect to receive a T3 slip if you have invested in any mutual funds or ETFs outside of your business.

2. T5 Statement of Investment Income: Must be issued by the last day of February of the following calendar year. This slip is used to report investment income from interest, dividends from corporations, and foreign income. If you own shares of a corporation that pays dividends, you would receive a T5. The T5 slip has different boxes to indicate eligible dividends, other than eligible dividends, or foreign dividends, all of which have different tax rates.

3. T5008 Statement of Securities Transactions: Must be issued by the last day of February of the following calendar year. This slip is used to report the proceeds and acquisitions of securities transactions. It's essentially a report of your buying or selling of stocks, bonds, and other securities you have invested in outside your business and outside your registered investment accounts. While it is not specifically an income tax slip, the amounts it details factor into calculations of your capital gains or losses. This slip helps you prepare Schedule 3 of your personal tax return.

Note, in kind transfers may not show up on this statement but you must still report them as deemed dispositions on Schedule 3 as well as any other deemed dispositions not on the statement. Taxtips.ca says not to "use the proceeds amounts from the T5008 because they are not net of commission (for Cdn or US dispositions) or US SEC fees (for US dispositions). Your trading summary should have the correct proceeds."

In summary, the difference between a T3 and T5 slips is the source of the income. T3 (from Canadian trusts) and T5 (from corporations) slips report different types of trust and corporate investment income, while a T5008 reports securities transactions. They are all integral parts of your tax filing if you hold investments outside your business. It's always a good idea to consult with a tax professional to fully understand your obligations.

Everyone Has To Save For Retirement

Even the Self-Employed and Small Business Owners

Start Early To Cushion Future Setbacks

Understanding Your Investment Income Slips

Eligible vs. Non-Eligible Dividends: What the Boxes on Your T5 Mean

When you look at a T3 slip or a T5 slip, you will notice that boxes 23 and 49 on a T3 slip and boxes 10 and 24 on a T5 slip deal with Canadian dividends. Box 15 may include foreign dividends.

Let's look at the differences between the three types of dividends.

- An eligible dividend - T3 Box 49 or T5 Box 24 - normally comes from large Canadian corporations who pay corporate income tax at the general corporate rate. Therefore, the credit on eligible dividends is larger due to the fact that eligible dividends are paid out of profits taxed at the higher corporate income tax rate. As a result, investors receive a more significant tax break on eligible dividends to prevent double taxation.

CCPCs who have earned more than $500,000 in active business income generates a General Rate Income Pool (GRIP) notional account under the Canadian tax system for private corporations. It represents the total aggregate amount of income retained by a corporation that has been taxed at the general corporate tax rate, as opposed to the small business deduction rate. Learn more about GRIP. - An other than eligible (or non-eligible) dividend - T3 Box 23 or T5 Box 10 - is a dividend that is not an 'eligible dividend'. These dividends are typically paid out by small corporations that are eligible for the small business deduction and thus pay taxes at a lower corporate income tax rate. This means the credit or tax break that investors receive on non-eligible dividends is comparatively smaller.

- Foreign dividends - T5 Box 15 - received by a Canadian resident, whether an individual or a corporation, are generally subject to Canadian income tax. The tax treatment though can vary depending on the circumstances but in general they do not qualify for the dividend tax credit. Find out more about how foreign dividends are taxed.

A fourth type of dividend is a capital dividend. It is received on a tax-free basis so you will not get a tax slip for this type of dividend. Capital dividends require a special election be filed with CRA. It is recommended you verify your Capital Dividend Account with CRA prior to issuing any capital dividends.

More >> What is a capital dividend and how do you pay a capital dividend?

How To Calculate Dividend Gross-up and Tax Credit

Are you trying to understand your investment tax slip and wonder how is the dividend gross up and dividend tax credit calculated.

Here are your 2024 (2023) dividend gross ups for T3 boxes 32 & 50; T5 boxes 11 & 25:

- Eligible dividends are grossed up 38%;

- Other than eligible dividends are grossed up 15%.

Here are your 2024 (2023) dividend tax credit rates for T3 boxes 39 & 51; T5 boxes 12 & 26:

- Eligible dividends are grossed up 15.0198%;

- Other than eligible dividends are grossed up 9.0301%.

Example of an eligible dividend gross-up and tax credit:

- Taxable eligible dividend paid: $10,000 reported on T3 or T5 tax slip

- Gross-up: $10,000 x 1.38 = $13,800 flows through to T1 line 12000

- Dividend tax credit: $13,800 x .150198 [15.0198 / 100] = $2,072.73 flows through to T1 line 40425

Example of an other than eligible dividend gross-up and tax credit:

- Taxable non-eligible dividend paid: $10,000 reported on T3 or T5 tax slip

- Gross-up: $10,000 x 1.15 = $11,500 flows through to T1 lines 12000 & 12010

- Dividend tax credit: $11,500 x .090301 [9.0301 / 100] = $1,038.45 flows through to T1 line 40425

In the above examples:

- The gross-up adds tax the corporation has already paid on the dividend income in effect reporting the pretax income. Eligible dividends paid the general corporate tax rate of 15% federal [+ provincial rate]. Other than eligible dividends paid the small business tax rate of 9% federal [+ provincial rate].

- The dividend tax credit is a credit to offset the gross-up to prevent double-taxation of dividends. Learn more about the purpose of the dividend tax credit.

Tip - Federal Worksheet Form 5000-D1

CRA Form 5000-D1 - T1 Federal Worksheet helps you calculate Lines 12000 and 12010 as well as Line 40425. You can see a snapshot of the form below. It can be found on CRA's website.

Calculate lines 12000 and 12010 – Taxable amount of dividends from taxable Canadian corporations

Calculate lines 12000 and 12010 – Taxable amount of dividends from taxable Canadian corporations Calculate line 40425 Federal Dividend Tax Credit Calculation

Calculate line 40425 Federal Dividend Tax Credit CalculationNot Saving For Retirement Means You May Be Paying More In Taxes Than You Need To

Understanding Your Investment Tax Slips

Business Owners Need To Plan a Retirement Exit Strategy

Small business owners in Canada have several tools and strategies at their disposal for saving for retirement outside of their businesses. It's smart to diversify and not rely solely on the sale of your business to fund your retirement.

Small business owners in Canada have several tools and strategies at their disposal for saving for retirement outside of their businesses. It's smart to diversify and not rely solely on the sale of your business to fund your retirement.Small business owners in Canada have several tools and strategies at their disposal for saving for retirement outside of their businesses. It's smart to diversify and not rely solely on the sale of your business to fund your retirement. Here are a few options for your consideration:

1. Registered Retirement Savings Plan (RRSP): An RRSP is a retirement savings and investing tool for employees and the self-employed in Canada. Like other citizens, small business owners can make contributions to their RRSP to create a future income.

The best investments to hold in a RRSP are those that produce income which would otherwise be heavily taxed, like interest income from bonds or GICs but don't let tax treatment wag the tail. Plan for long term investment goals first, then examine any tax advantages. You receive a tax deduction when you contribute to an RRSP, and all investment growth is tax-sheltered, but withdrawals are fully taxable.

TAX TIP

Stick with conservative investments. Your RRSP is not the place to hold speculative investments. Plan these types of investment outside your RRSP where you can claim any capital losses. Losses inside your RRSP damage the tax-shelter value of your investments.

The federal BIA (Bankruptcy and Insolvency Act) provides creditor protection for assets held in RRSPs (and RRIFs) in all provinces and territories of Canada in the event of bankruptcy. If you do not declare personal bankruptcy, they are not protected. However, BC, Alberta, Saskatchewan, Manitoba, PEI, and Newfoundland have provincial legislation to provide creditor protection outside of bankruptcy. Keep in mind the CRA, children and ex-spouses have specials rights to jump the queue.

Unlike an IPP (see #3 below), RRSP funds are not locked in until retirement providing some flexibility if a situation arose where you needed to access the funds before retirement.

2. Tax-Free Savings Account (TFSA): A TFSA is another beautiful tool for Canadians to save tax-free throughout their lifetime. Their simplicity makes them easy to use. Contribution room is not based on earned income but it does have annual contribution limits, so it's a good option for someone whose income varies, like a small business owner.

TFSAs are excellent receptacles for investments that have a high potential for growth, like equities, because any increase in value (capital gains) or dividends are tax-free, as are withdrawals. However, having a TFSA that protects your short-term savings or GICs from tax is good too. You can usually get a better deal on interest rates at alternate online banks than Canada's big banks. Remember you can have more than one TFSA account; just keep CDIC (Canada Deposit Incorporation Corporation) deposit insurance limits in mind.

TAX TIP

Contributions can be in kind (qualified) investments from your unregistered accounts. This attracts a deemed disposition at the time of the contribution. Capital gains will be taxable, capital losses cannot be claimed. If you have a loss, don't transfer your unregistered investment to any registered account.

Under the BIA, protection is not provided to TFSAs (or registered education saving plans (RESPs)) .

3. Individual Pension Plans (IPP): Designed for high-income business owners and incorporated professionals looking to increase their retirement savings. They are more complex than RRSPs, but can provide greater contribution limits.

An IPP is a defined benefit pension plan tailored to provide retirement benefits for a single member, typically the business owner or a key employee. An IPP is established by the company on behalf of the individual. One of the significant benefits of an IPP is that it can guarantee minimum returns, and if the investments underperform, the company can contribute additional amounts to ensure those minimum returns are met.

Contributions to an IPP are tax deductible to the corporation.

TAX TIP

IPPs are most suited to: (1) individuals over 40 with a T4 income of $100,000 plus; (2) incorporated professionals; (3) family business interested in intergenerational wealth transfer; (4) exit strategy for cash-rich businesses. Sole proprietors and partnerships cannot set up an IPP.

Unlike RRSPs, IPP assets enjoy creditor protection through provincial legislation. Amounts contributed to an IPP cannot be seized by creditors as long as they are within the IPP. However, the benefits payable can be seized.

4. Diversifying Portfolio: Small business owners should also consider broadly diversifying their investment portfolio. This can include a balanced mix of equities, bonds, cash, and perhaps even real estate. Diversification can help reduce risk and improve returns.

Here's how creating a diversified portfolio separate from your business in Canada can possibly reduce risk, improve returns as well as provide a more secure retirement income stream.

- Reducing risk: Diversification is a key risk management strategy used in investing. By spreading your investments across various financial instruments, sectors, and sometimes geographies, you can reduce the potential for financial loss. If your sole investment is your business, any downturn or business failure could severely impact your financial future. By diversifying, you reduce the risk associated with putting all your eggs in one basket.

- Improving returns: A diversified portfolio allows you to take advantage of different types of investments and their respective returns. Different financial assets have various degrees of risk and return potential. Some assets may perform well when others do not, providing a balanced portfolio return over time. This approach can potentially provide a better overall return compared to investing solely in your business.

- Providing a more secure retirement income: Having a diversified portfolio allows you to accumulate wealth outside your business, which can be essential for retirement. This is particularly crucial if your business's value declines or if you're unable to sell it when you need to retire. The returns and capital gains from your diversified investments can provide a more secure and potentially increased source of retirement income.

- Added flexibility: Finally, having a diversified portfolio separate from your business gives you more freedom and flexibility to make decisions. For example, if you need to liquidate some investments for an unexpected cost or opportunity, you may be able to do so without affecting your business operations.

5. Estate Planning: While not strictly speaking a retirement plan, estate planning can ensure that the business owner’s wealth is passed on to their heirs with minimal taxation.

A small business owner needs to build an exit strategy for their business. This can involve selling to a willing buyer, transferring ownership within the family, or simply winding down the business. Such a strategy should be planned well in advance and can form part of the owner's retirement and estate planning.

Even though there is inherent risk in owning a business, small business owners should not necessarily favour ultra-conservative investments outside of their business. A diversified, balanced investment portfolio that matches your risk tolerance and retirement goals is often a better approach. However, it's always sensible to consult with a professional financial planner or investment advisor for personalized advice.

Not All Income Is Taxed the Same: What This Means for Your Tax Bill

Not all taxable income is taxed at the same rate. The order of investment income for the most preferential tax treatment for investments held outside of registered plans would generally be:

- Capital gains: Only 50% is taxable.

- Dividend income: Thanks to the dividend tax credit, taxes are reduced, but they are still higher than on capital gains.

- Business or Rental income: Fully taxable, but expenses incurred with the operation of the business or rental property can be deducted.

- Interest income: This is fully taxable at your marginal rate.

Example of net after tax cash flow on $1000 investment income assuming a 26% tax rate:

- Interest income or net business income or net rental income = $1000 x (1-.26) = $740

- Non-eligible dividend income = $1000 x 1.15 gross up = $1150 x .090301 = $103.85 tax credit; $1150 - $103.85 x (1-.26) =$774 rounded

- Capital gains = $1000 x 50% = $500 x (1-.26) = $370 + $500 not taxed = $870

- Eligible dividend income = $1000 x 1.38 gross up = $1380 x .150198 = $207.27 tax credit; $1380 - $207.27 x (1-.26) =$868 rounded

Understanding Your Investment Tax Slips

FAQ About Investment Income and Personal Retirement Pensions

Just a reminder that all the information presented here is meant to be talking points with your accountant ... so you have a better feel for what kind of information you are seeking. Your accountant will customize advice specifically for your situation. Think of it like this ... Having a map BEFORE you enter the forest is so much better than getting lost in the forest!

Board of Directors declares a dividend, then passes a resolution which is dated and signed by all directors; the signed resolution is filed in the minute book.

Board of Directors declares a dividend, then passes a resolution which is dated and signed by all directors; the signed resolution is filed in the minute book.Steps to Declare and Pay a Canadian Dividend

Steps to Declare and Pay a Canadian Dividend

A dividend is a payment distributing profits to shareholders of a corporation that has been declared by the company's Board of Directors. This occurs when a resolution is passed and signed by all directors; the original copy of the resolution must be filed in the company's minute book. The dividend must apply to all shareholders in a class equally.

It is highly advisable to have a lawyer draft your dividend payable resolution and not rely upon templates found on the internet. You don't want to fool around with anything to do with corporate governance.

Three dates are important when declaring a dividend:

- the date the directors resolution approved the dividend - this is important to prove the declaration was not back dated; dividends cannot be declared in the past

- the date the dividend is being declared payable to shareholders - it must be the same date as the declaration or a future date

- the date upon which the shareholders of record is determined - only shareholders as of this date are eligible to receive the declared dividend

Statute governing the declaration of dividends

Each province's corporation act governs the rules around declaration of dividends. For example, section 43 of Alberta's Business Corporations Act states:

43 A corporation shall not declare or pay a dividend if there are reasonable grounds for believing that (a) the corporation is, or would after the payment be, unable to pay its liabilities as they become due, or (b) the realizable value of the corporation’s assets would thereby be less than the aggregate of its liabilities and stated capital of all classes.

Please explain what happens if a CCPC has income over $500,000. Does this affect the type of dividend a small business owner can pay themself?

Please explain what happens if a CCPC has income over $500,000. Does this affect the type of dividend a small business owner can pay themself?

A Canadian Controlled Private Corporation (CCPC) is a private corporation that is primarily owned and controlled by Canadian residents. The tax system in Canada allows a CCPC to access a small business deduction on its first $500,000 of active business income, letting it pay taxes at a significantly lower rate. This effectively decreases the tax burden of small businesses.

However, if a CCPC's income exceeds $500,000, the business income over that threshold will be taxed at the general corporate tax rate, which is higher than the small business rate. This does not directly affect the type of dividend a small business owner can pay to themselves, but it impacts the tax treatment of those dividends.

When a CCPC earns income taxed at the lower small business rate, the dividends paid out of this income are considered to be "other than eligible dividends" and have a corresponding lower dividend tax credit for the individual shareholder. However, any income earned above the $500,000 threshold that is taxed at the general corporate rate results in "eligible dividends". This means that the dividends have a higher dividend tax credit, which can result in a lower tax bill for the individual shareholder.

Therefore, as a small business owner, if your CCPC's income exceeds $500,000, you could choose to pay yourself eligible dividends out of the income taxed at the general rate, potentially reducing your personal tax liability. You should consult with a tax professional to identify the most tax-efficient way of paying yourself dividends in this situation.

What is GRIP and how do you get a GRIP balance in your CCPC?

What is GRIP and how do you get a GRIP balance in your CCPC?

General Rate Income Pool (GRIP) is a notional account or concept under the Canadian tax system for private corporations. It represents the total aggregate amount of income retained by a corporation that has been taxed at the general corporate tax rate, as opposed to the small business deduction rate.

The GRIP balance comes into play when determining the type of dividends a corporation can pay to its shareholders - eligible or non-eligible dividends. If a corporation has a positive GRIP balance, it can pay out eligible dividends, which come with a higher gross-up and tax credit rate, potentially leading to a lower personal tax liability for the shareholder.

A Canadian Controlled Private Corporation (CCPC) generates a GRIP balance through earning income above the small business limit (currently $500,000), which is then taxed at the general corporate tax rate. Other ways a CCPC may increase its GRIP balance include receiving eligible dividends from other entities or selling eligible capital property at a profit.

The GRIP balance is reduced when the corporation pays out eligible dividends to its shareholders. This means the CCPC must have a positive GRIP balance to continue paying out eligible dividends.

Calculating the GRIP balance can be complex due to the many variables and rules involved, so it is always a good idea to consult with a tax professional who is knowledgeable in this area.

What is the Dividend Tax Credit and what is its purpose?

What is the Dividend Tax Credit and what is its purpose?

In Canada, eligible and non-eligible dividends are taxed differently due to the features of the Canadian tax system known as the Dividend Tax Credit. The purpose of the Dividend Tax Credit is to compensate for the fact that corporations have already paid tax on the profits from which these dividends are paid.

In simple terms, the tax rate on eligible dividends is lower than on non-eligible dividends because eligible dividends are paid from income that has been taxed at a higher corporate rate. This is a part of Canada's system of integrating corporate and individual taxes to prevent double-taxation of dividends. Each province has different tax rates and credits, so the actual impact can vary depending on the taxpayer's province of residence.

Foreign dividends receive different tax treatment than Canadian dividends. How are foreign dividends taxed in Canada?

Foreign dividends receive different tax treatment than Canadian dividends. How are foreign dividends taxed in Canada?

Foreign dividends received by a Canadian resident, whether an individual or a corporation, are generally subject to Canadian income tax. The tax treatment though can vary depending on the circumstances.

For individual taxpayers, foreign dividends are typically included in income and taxed at their marginal tax rate. However, they do not qualify for the dividend tax credit that applies to eligible and other than eligible dividends from Canadian corporations. Foreign tax credits may be available to offset any foreign taxes paid on these dividends to avoid double taxation.

If a Canadian corporation receives dividends from a foreign corporation in which it has a significant interest (generally 10% or more), those dividends are typically not subject to Canadian income tax, but this varies depending on the terms of any applicable tax treaty and other complex tax rules.

Again, Canadian tax law, especially when it comes to international matters, can be quite complex and subject to changes. It is recommended to consult with a tax professional to get current and personalized advice.

Please explain how capital gains (and losses) receive favourable tax treatment in Canada.

Please explain how capital gains (and losses) receive favourable tax treatment in Canada.

Capital gains refers to the increase in value of an investment or real estate that gives it a higher worth than the purchase price. In Canada, only 50% (see Note 1) of the value of any capital gains are taxable. This is considerably less than the tax applied to interest income or earned income, making it a preferable form of income for many. If you have any capital losses, they can be used to offset capital gains in the current year, any of the three preceding years, or any future year.

Note 1*: The following legislation died when Parliament was prorogued on January 6, 2025. It is now deferred to January 2026. Effective June 25, 2024, the capital gains inclusion rate will increase from 50% to 67% for (1) capital gains over $250,000 per year for individual, and (2) all capital gains for corporations and most trusts. This change does not affect the principal residence exemption.

These are things you cannot do to lessen your capital gain tax burden:

- Current rules do not permit elections to realize a gain or loss on property without an actual transfer.

- Capital gains cannot be averaged over multiple years to stay under the threshold.

- Individuals cannot share their $250,000 annual threshold with corporations they own.

- The 67% exclusion rate applies across all sectors and all assets. There is no preferential treatment.

- There are no special rules based on how long an asset has been held.

* CPA Canada News October 15, 2024 article Taxpayers in limbo: Compliance in uncertain times says "The legislation to enact these proposed changes has not yet been introduced in the House of Commons, and with the minority government stuck debating parliamentary privilege and facing multiple non-confidence motions, it is hard to determine when, or even if, these tax proposals will reach royal assent.".

Source: Department of Finance News - Fair and Predictable Capital Gains Taxation June 10, 2024

What is the Lifetime Capital Gains Exemption (LCGE) and the Canadian Entrepreneur's Incentive (CEI)?

What is the Lifetime Capital Gains Exemption (LCGE) and the Canadian Entrepreneur's Incentive (CEI)?

Lifetime Capital Gains Exemption (LCGE)

Doane Grant Thornton reported on November 5, 2025 (one day after the Federal Budget 2025 was released) that the Budget "reiterates the proposed increase to the LCGE to $1.25 million (from $1,016,836) on the sale of qualifying small business shares and farming and fishing property. If enacted, the proposed LCGE exemption increase would be effective June 25, 2024."

Background

As of June 25, 2024* and until December 31, 2025, the lifetime capital gains exemption (LCGE) can shelter up to $1.25 million of gain realized on qualified small business corporation shares. Indexation, which began in 2015, will resume in 2026. Before June 25th, it was $1,016,836 for 2024. Only gains that exceed a cumulative net investment loss (CNIL) are eligible for the exemption.

The LCGE is calculated on CRA Form T657 and reported on your personal tax return in Part 1 of Schedule 3.

The rules for LCGE are very complex and require advanced tax planning to ensure you qualify. It would be prudent to obtain professional advice on this matter due the complexity of the rules.

* CPA Canada News October 15, 2024 article Taxpayers in limbo: Compliance in uncertain times says "The legislation to enact these proposed changes has not yet been introduced in the House of Commons, and with the minority government stuck debating parliamentary privilege and facing multiple non-confidence motions, it is hard to determine when, or even if, these tax proposals will reach royal assent.". As Parliament was prorogued on January 6, 2025, this legislation dies.

More >> Historical LCGE maximums

The Canadian Entrepreneur's Incentive (CEI)

The Canadian Entrepreneur's Incentive (CEI) was to become available January 1, 2025. It would have provided a capital gains inclusion rate equal to one-half of the usual rate on up to $200,000 of capital gains qualifying shares per individual over their lifetime. It would have increased in $400,000 increments each year until it reaches $2 million in 2029. This incentive was to be available over and above the LCGE. [Note: This legislation was not enacted and appeared to be canceled in the Federal Budget 2025.*]

* Doane Grant Thornton November 5, 2025 The Canadian Entrepreneurs’ Incentive appears to be cancelled

Can you please explain how IPPs work?

Can you please explain how IPPs work?

An Individual Pension Plan (IPP) is a defined benefit pension plan tailored to provide retirement benefits for a single member, typically the business owner or a key employee. An IPP is established by the company on behalf of the individual.

Here's how IPPs generally work:

1. Establishment: The company sets up an IPP with a pension plan provider on behalf of the individual. All of the required documents and legalities are taken care of during the setup. This plan is registered with the Canada Revenue Agency and provincial pension regulators.

2. Contributions: The company makes tax-deductible contributions to the IPP each year on behalf of the individual which are consequently invested. The amount of annual contributions is calculated based on several factors, including the individual's age, employment earnings, and years of service to the company.

3. Retirement Benefits: The resulting pension at retirement is based on a formula that takes into account the individual's years of service and their career average earnings.

4. Minimum Returns: One of the significant benefits of an IPP is that it can guarantee minimum returns, and if the investments underperform, the company can contribute additional amounts to ensure those minimum returns are met.

5. Annuity Purchase: At retirement, the IPP assets can be used to purchase an annuity, be transferred to a Registered Retirement Income Fund, or a combination of both.

6. Creditor Protection: IPP assets are often protected against claims from creditors, offering a significant advantage for business owners.

Setting up an IPP comes with a high extent of administrative responsibility and costs, and the paperwork can be relatively complex compared to other retirement savings options like RRSP. It's also important to keep in mind that the funds in an IPP are locked-in until retirement, meaning they can't be accessed easily if needed. However, with its higher contribution limits and potential for guaranteed income upon retirement, an IPP can be an attractive option for business owners and high-income employees looking to maximize their pension savings.

It's recommended to seek professional advice from a pension consultant and tax advisor, who can provide personalized advice considering your specific circumstances and goals before proceeding with an IPP. This is a great example where having a map BEFORE you enter the forest is so much better than getting lost in the forest!

What are some credit protection strategies for business owners?

What are some credit protection strategies for business owners?

Some ideas to discuss with your lawyer or accountant:

- incorporating your business means you cannot be sued personally, however there are some exceptions (I.E., you guaranteed the corporation's debts making you liable; you can be sued personally and your company's assets seized)

- using multiple corporations to protect assets from the creditors of your operating business

- setting up an IPP or Retirement Compensation Agreement (RCA)

- purchasing professional liability insurance

Would a small business owner be able to attract better personnel if the company had a retirement plan in place for employees?

Would a small business owner be able to attract better personnel if the company had a retirement plan in place for employees?

Absolutely! Offering a retirement plan can make a company more attractive to potential employees, regardless of its size. It's a benefit that shows the company values its employees' long-term well-being and security. It can also help in retaining employees, as it adds an extra layer of financial protection and incentive for them to stay.

In competitive job markets, potential employees look at the complete compensation package, including salary, healthcare, and retirement benefits. If a small business owner can afford to offer a retirement plan such as an IPP, it could give them an edge in attracting and retaining high-quality personnel.

However, establishing and maintaining a retirement plan does involve certain costs and management responsibilities. It's essential for a small business owner to carefully assess their financial capability and get professional advice to make sure it's a feasible and beneficial move for their business.

A Retirement Planning Option To Consider Now

I love reading Tim Cestnick's columns in the Globe and Mail. His January 31, 2024 column Business owners need to weigh RRSPs and their corporations as retirement options is food for thought. He presents the logic and numbers to leave business owners with three tips:

- Instead of deferring tax by leaving excess funds in the corporation to invest for retirement, consider this option - It's usually in your best interests to pay yourself enough salary to cover your costs of living, then top it off with additional salary to contribute as much as possible to your RRSP. You'll still defer tax until you make an RRSP withdrawal when you retire.

- It doesn't make sense to pay yourself a salary just to create the maximum RRSP room possible if you don't need the salary to meet your living costs. Why? Because you would need to invest the excess funds in an unsheltered account which is taxed annually. It's better to leave the funds in your corporation.

- Tim says there are other considerations when deciding your remuneration package vs. leaving funds invested in the corporation.

As I've said many times, it is prudent to seek professional advice from a tax accountant or tax advisor before you withdraw funds from your corporation. Not only will s/he help you understand your investment tax slips, any potential problems can be addressed.

References: Financial Post The power of individual pension plans compared to RRSPs; RBC Dominion Securities Inc. IPPs: Frequently Asked Questions; Wealth Insurance Inc. IPP vs RRSP: Why Business Owners Should Consider an Individual Pension Plan (IPP); RBC Wealth Management Creditor protection of RRSPs and RRIFs

Back to top