- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Tax Audits in Canada

- Is Voluntary Disclosure the Right Move

Is Voluntary Disclosure The Right Move?

How To Address Unfiled Taxes In Canada

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

Revised September 27, 2025 | Previously Revised May 27, 2024 | Originally Published in Bookkeeping-Essentials in April 2010

WHAT'S IN THIS ARTICLE

Introduction | 2025 Update | What is VDP? | When is voluntary disclosure the right move? | 2025 changes | How to apply | Ineligibility | Third party civil penalties | Non-compliance penalties assessments | Is voluntary disclosure the right move? | Tax accountant vs tax lawyer | FAQ | Key takeaways | 2018 Changes

NEXT IN SERIES >> Responding to a Tax Audit Notice

In Canada, our tax system is a self assessing system and relies on voluntary compliance. In dealing with the Canada Revenue Agency (CRA), small business owners often find themselves frustrated with the complexities of Canadian tax regulations.

If you are deficient in any of your tax filings, one tool at your disposal is the CRA’s Voluntary Disclosures Program (VDP).

This tool can be a pivotal option for rectifying past tax records without facing harsh penalties. Below, I explore when and how to use the program, along with recent changes coming into effect October 1, 2025 that might affect your decision.

🎯 IMPORTANT UPDATE - Good News Coming!

Starting October 1, 2025, the CRA is making the Voluntary Disclosure Program much easier to use and more forgiving. Think of it as the CRA saying 'we want to make it simpler for you to get back on track.'

If you're reading this before October 2025 and thinking about voluntary disclosure, you might want to chat with a tax professional about timing - the new rules are generally much better for small business owners like you.

Here's what's changing in plain English. The CRA is dropping a lot of the complicated rules that made people afraid to use the program, and they're offering better relief from interest and penalties. It's like they're extending a friendlier hand to help you get your ducks in a row.

This article covers both the current rules (if you need to act before October) and what's coming (so you can make informed decisions about timing).

When is voluntary disclosure the right move?

When is voluntary disclosure the right move?What is the CRA’s Voluntary Disclosures Program?

The CRA’s Voluntary Disclosures Program is designed to promote compliance with Canada's tax laws. It's purpose is to encourage individuals to self-correct incomplete or inaccurate information, and past omissions; while granting relief on a case by case basis to those who satisfy all the conditions through waiving interest, penalties, publicity, and prosecution.

But is voluntary disclosure the right move for your situation?

When is Voluntary Disclosure the Right Move?

Voluntary disclosure may be the right move for you under the following scenarios:

- Unreported Income:

Have you failed to report all your income in past years? If so, using the VDP could reduce your risk of penalties and legal repercussions. Did you know that technology helps CRA determine who it audits. The CRA has developed their own database to select returns to be audited. They will compare your tax return against known filers who have a verified history of non-compliance and against filers who have a proven history of compliance. If your return falls within the appropriate parameters, it will be flagged for an audit. - Filing Errors:

Incorrect or incomplete filings from previous years are suitable for disclosures under the VDP. For example, tax returns filed weren't accurate tax returns because of unreported income (discussed above), understated sales, or overstated expenses. Many small business owners make these errors because they do not keep adequate books and records. This can be expensive in the long term. It is for this reason that this group of taxpayer is most likely to get audited by the CRA. - Late Filings:

If you’ve missed deadlines for income tax, GST/HST, or other tax obligations, VDP can help correct these oversights. To ensure you always have the funds available for all types of taxes owing, consider implementing this simple cash management system. If not being great at paperwork is the roadblock to filing on time, hire a certified professional bookkeeper to do your bookkeeping. The route to success is surrounding yourself with people who have a different skill set than you do and complements your skill set. - Omissions in Payroll Deductions:

Small business owners who have not properly reported or remitted payroll deductions can use the VDP. For example, ignoring taxable benefits or conferred shareholder benefits.

These are some of the situations that may make voluntary disclosure the right move for you and your business.

2025 Changes to the VDP Rules

In September 2025, the federal government announced changes to the Voluntary Disclosure Program. Policy changes to the voluntary disclosure program guidelines will come into effect October 1, 2025. The first policy change applied to income tax and source deductions. The changes were outlined in Information Circular IC00-1R7. The second policy change applied to GST/HST disclosures. The changes were laid out in GST/HST Memorandum 16-5-1.

Here is a brief overview of the changes in the two policies that may affect your decision of whether voluntary disclosure is the right move for you:

What’s Changing?

For applications the CRA receives on or after October 1, 2025, the VDP becomes simpler and more forgiving, especially on interest relief.

Which Rules Apply To You?

If your application is received before October 1, 2025, the 2018 rules still apply. On or after October 1, 2025, the new rules apply.

What Does This Mean In Real Life?

If you come forward on your own before CRA contacts you about a specific issue, you’ll usually get more relief. If CRA has already contacted you about a specific problem, you can still get relief ... just a smaller amount.

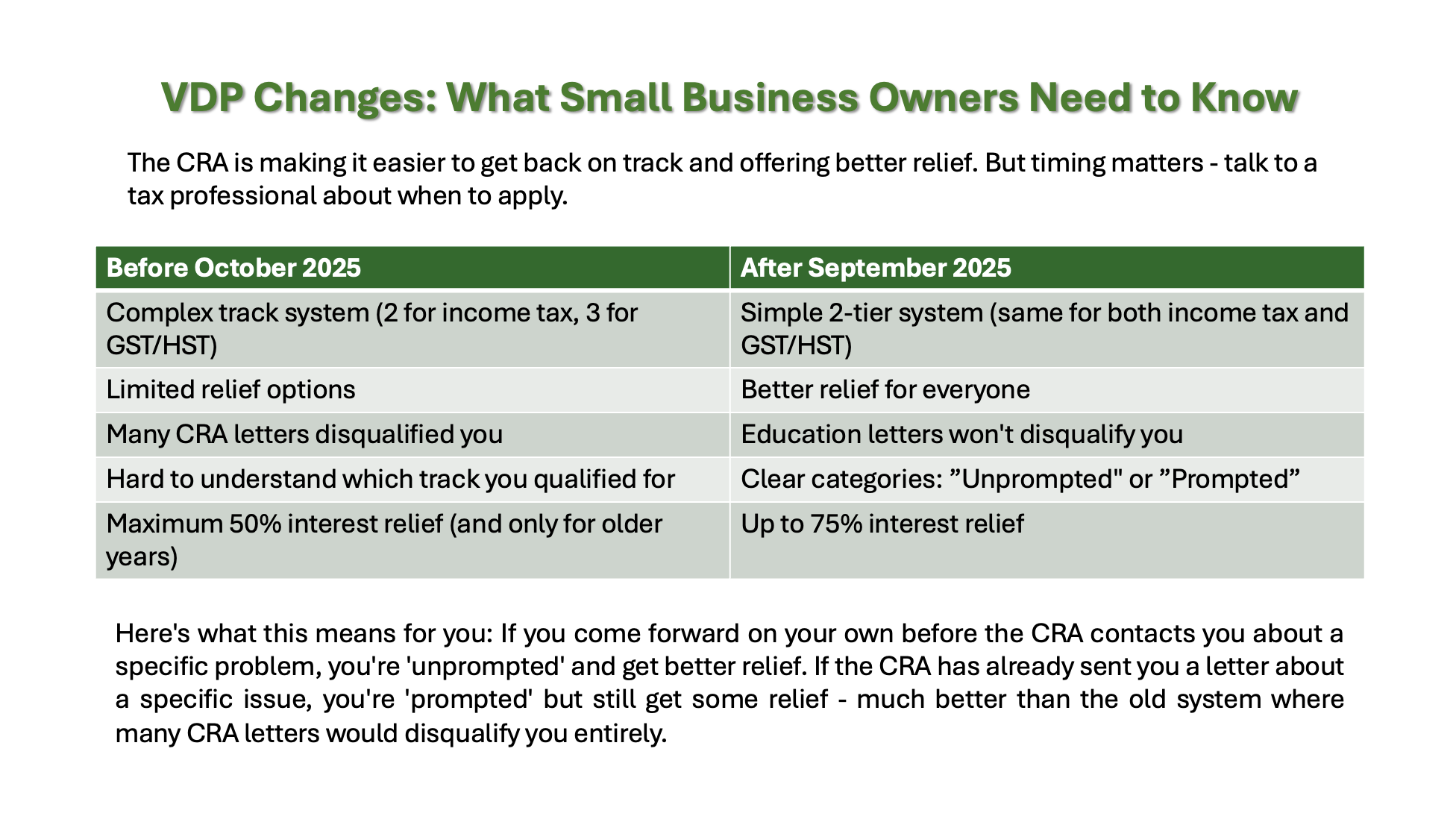

The CRA is making it easier to get back on track and offering better relief. But timing matters - talk to a tax professional about when to apply.

The CRA is making it easier to get back on track and offering better relief. But timing matters - talk to a tax professional about when to apply.

Income Tax and GST/HST Policy Changes – What's new from Oct 1, 2025

(Reference: IC00‑1R7 and GST/HST Memorandum 16‑5‑1)

1. Simpler Two-Tier Relief System (replaces General/Limited programs)

The CRA is moving to two clear lanes. If you put your hand up before the CRA points to a specific problem on your file, you’re in the “General” lane. That means 100% of the penalties tied to what you disclose are waived, and 75% of the related interest is forgiven. If the CRA has already nudged you about that exact issue, you’re in the “Partial” lane. You can still get up to 100% penalty relief, but interest relief drops to 25%. Either way, if your disclosure is accepted, the CRA won’t refer the disclosed issue for criminal prosecution.

2. Easier to Qualify as 'Voluntary'

In the past, lots of CRA mail could knock you out of the program. For example, education letters won't disqualify you anymore. Only actual audits or investigations in progress make you ineligible. If CRA has contacted you about a specific issue and given you a deadline to fix it, you can still apply. You'll just get prompted relief (which means a smaller interest break)instead of being shut out entirely.

3. Clearer Documentation Requirements

For income tax, focus on the years that actually need fixing.

- If the issue is Canadian‑sourced income or assets, include the most recent six years that have errors.

- If it involves foreign income or assets, include the most recent ten years with errors. Clean years within those windows don’t need to be included. The CRA can still ask for more if they need a fuller picture.

- If your issue is GST/HST, the window is usually four years.

4. Application Mechanics

You’ll file using Form RC199. The CRA says a simplified version will be available starting October 1, 2025. Anonymous 'no‑name' filings still aren’t allowed, but you (or your representative) can have an informal, no‑names pre‑disclosure chat with the CRA to understand how your situation might be handled. And if someone helped you (your bookkeeper, accountant, or a promoter) you’ll need to list them on the form.

5. Important Limits and When There’s No Relief

The VDP is meant to help when tax and/or penalties are actually owing. It won’t grant relief if your disclosure would only lead to a refund, if there’s nothing owing, or if you’re trying to remove penalties or interest that have already been assessed. Also, it isn’t a workaround for intentional or egregious non‑compliance. The program is designed for getting honest mistakes and omissions back on track.

6. Broader Coverage and Special Relief

The program now covers more tax types, including Underused Housing Tax and select Luxury Items Tax. GST/HST 'wash transactions' can get 100% interest and penalty relief. Second applications are now allowed for different issues.

How to Apply to the VDP

If you decide that voluntary disclosure is the right move for you, there is an unforgiving procedure to follow to make a voluntary disclosure. It is advisable to follow it and not cut corners.

- Gather Information: Compile relevant financial documents and tax records for the years you want to correct.

- Consult a Professional: Discuss your situation with a tax professional who understands the VDP. They can provide guidance tailored to your situation. The tax professional (usually a lawyer or an accountant) will help determine if voluntary disclosure is the right move for you and lay out other options if applicable.

- Complete RC199: Make sure you provide all the relevant information and sign the application.

- Submit Your Application: You or your advisor can submit an application online, by mail, or through My Account, My Business Account or Represent a Client on the CRA website.

Come October, the request must use CRA Form RC199. Before October, the request could be submitted by writing a letter as well. The voluntary disclosure date is when the CRA has received the request OR the date the taxpayer (or their representative) signs the client agreement form.

You must meet five conditions to qualify for the program. If you do not meet the criteria, then voluntary disclosure is not the right move for you. The five conditions listed on CRA's website are:

- it must be voluntary;

- it must be complete;

- must involve an income tax penalty or interest;

- the information is at least one or more years overdue; and

- include payment of the estimated tax owing.

You must submit all information and documentation with the application which includes the type of returns involved, type of information returns, type of omission, primary business activity along with an explanation of how you feel you have met the five validity conditions that must be met. Under extraordinary circumstances, the CRA may extend your deadline for up to 90 days.

When applying, you no longer have the no-name disclosure option therefore the 90 day option on whether to proceed and complete the application is also eliminated. You can however hold preliminary discussions on an anonymous basis. See CRA's publications IC00-1R6 (for applications before Oct 1, 2025) or IC00-1R7 (for applications on/after Oct 1, 2025).

You can find more details on the process on the CRA website under CRA compliance and enforcement> Voluntary Disclosures Program (VDP) > How to apply.

Voluntary Disclosure Ineligibility

If CRA has already made a demand request, you are no longer eligible for the program. Under the 2025 rules, fewer CRA communications will disqualify you compared to the 2018-2025 period. However, audits or investigations by CRA or other authorities (such as law enforcement agencies, securities commissions, or other federally or provincially regulated authorities) can also make you ineligible if they relate to the same issue you want to disclose.

So the first and most important rule in doing business in Canada ... each year pay CRA by the filing deadline ... estimating the tax payable if necessary.

My favorite tax site has a great income tax calculator you could use to this do estimate.

Protect Yourself Against Third Party Civil Penalties

If you are a bookkeeper and suspect that criminal proceedings may be possible if the voluntary disclosure program was not used:

- It is usually recommended that you refer your client to a tax lawyer (one who specializes in this field) before proceeding,

- A lawyer has solicitor-client privileges that an accountant or bookkeeper does not have. Court orders can force an accountant or bookkeeper to client share information.

The lawyer can then engage the services of an accountant or bookkeeper of the client's choice to act as their agent. You should then not be subject to the possibility of third-party civil penalties.

Sidebar: Since 2000, penalties can be imposed by the CRA on third-parties who make false statements or knowingly omit in information from their tax returns. Learn more.

The first submission is of utmost importance, especially in the event the request is denied. This underscores the need for meticulousness and accuracy in your work.

Check out the call out box about the topic of client privilege of a lawyer vs. an accountant. It is worth reading if you are a bookkeeper dealing with tax matters!

The article explains that privilege is different from confidential communications with professional advisors. It explains how you can protect privilege over communications with professional advisors other than your lawyer.

Remember, certain communications (oral and written) with your clients should be "off limits" because it is out of the scope of your relationship and could bring harm to your client if you are forced to share the information with CRA. Refuse to listen to a client if this happens and immediately refer them to a tax lawyer.

More >> See the August 1, 2022 article titled Protecting a taxpayer’s privileges by The Tax Advisor. It is an American publication but Canadian laws are very similar so most of the advice likely holds ... although there could be some differences in Canada.

What Are Possible Non-Compliance Penalties Assessments?

Penalties apply for failure to comply with the Income Tax Act (ITA). Technically, it is a criminal offense not to file a tax return for any reason ... but CRA rarely prosecute solely for not filing ... but it could happen.

My references say penalties include:

1. Gross negligence civil penalties (knowingly under reporting tax income) assessed¹ are the greater of:

- $100; and

- 50% of tax that was avoided

- A corresponding provincial penalty may also be applied

- Corporations cannot be charged both a false statement penalty under subsection 163(2) and a failure to report income penalty under subsection 163(1) on the same amount

2. Repeated failure to file income²:

- 10% of income not reported

- 50% of the difference between (a) the understated tax or overstated credits for the amount that you failed to report, and (b) the tax withheld from the amount that you failed to report.

- A corresponding provincial penalty may be applied

3. Failure to file criminal charges (failed to file when required OR tax evasion)³ are assessed are:

- Must still pay the full amount of taxes owing, plus interest and any civil penalties assessed by the CRA

- A penalty of up to 200% of the tax evaded plus possibly 5 years jail time

- Being convicted of tax fraud carries a sentence of up to 14 years in prison

4. Failure to file civil penalties OR failure to report income civil penalties⁴ are assessed as follows:

- The penalty is 5% of the unpaid tax at the date on which the return was due to be filed AND 1% of the unpaid tax for each complete month the return was late ... for up to 12 months ... that's a minimum of 17% per year (before compounded daily interest).

- Repeated failures to file after a demand for return was served doubles the penalties.

These charges add up so it is worth asking the question, "Is voluntary disclosure the right move for you?".

Sources:

1. CRA website - Businesses > 2025-07-28 Avoiding penalties

2. CRA website - Personal tax > 2025-01-21 False reporting or repeated failure to report income

3. CRA Website - Scams and fraud> 2025-03-21 Tax evasion, understanding the consequences

4. CRA Website - CRA publications> 2019-03-27 IC01-1 Third-Party Civil Penalties;

Is Voluntary Disclosure The Right Move For You?

Some the consequences of unreported income that you should be aware of are:

- Interest and penalty assessments.

- Possible charges of tax evasion and/or imprisonment along with public posting of charges on CRA website.

- Loss of personal property as CRA forces sale of home and other personal assets. CRA liens are paid out first (i.e. before your mortgage).

Here's what you can do to help you decide if voluntary disclosure is the right move for you:

- Have you reviewed your past tax filings for potential errors or omissions?

It might be time to consider your options under the VDP. Whether you move forward with this tool or not, regularly review your business's financial records for accuracy and completeness going forward. - Are you unsure about the implications of your tax mistakes?

Consulting with a professional can provide clarity and help you navigate the VDP process effectively. See below for how to decide whether to use a tax accountant or tax lawyer when seeking advice regarding a VDP application. - Could your business benefit from correcting past tax filings without steep penalties?

Explore the changes to the VDP to understand how they might impact your application and the potential impacts on your business.

By actively engaging in these considerations and seeking the right advice, small business owners can navigate the complexities of the CRA’s Voluntary Disclosures Program to ensure tax compliance and minimize risk.

What's The Difference Between Getting Advice From a Tax Lawyer Vs a Tax Accountant?

When a small business owner in Canada is considering making an application to the CRA's Voluntary Disclosure Program (VDP), I believe it is vitally important to seek expert advice to ensure that the process is handled correctly and efficiently. Deciding whether to consult a tax lawyer or a tax accountant depends on the specific needs and circumstances of your business. Here are some considerations:

1. Privilege and Confidentiality:

- Tax Lawyer: Communications between a client and a tax lawyer are protected by solicitor-client privilege. This means that, except in rare circumstances, any information shared with the lawyer cannot be disclosed without the client’s consent. This legal privilege can be important in cases where sensitive information is involved and the client needs assurance that details of their financial or legal issues will remain confidential.

- Tax Accountant: Generally, accountants do not have the same privilege with their clients. While accountants follow strict confidentiality standards, the information shared with them can be compelled by court orders or other legal mandates in a legal proceeding.

2. Legal Representation and Litigation Support:

- Tax Lawyer: If the voluntary disclosure escalates to legal actions or if there are potential criminal implications, a tax lawyer is qualified to provide legal representation in court. Lawyers can handle disputes, appeals, and litigations that may arise during or after the VDP application process. Tax lawyers can also provide legal advice and ensure that your legal rights are protected throughout the process.

- Tax Accountant: If the case primarily involves correcting errors in filed returns or disclosing unreported income that does not involve legal complexities, a tax accountant might be sufficient. If accountants help ensure all financial aspects are correctly reported and comply with tax laws through your lawyer, then client privilege is maintained. While tax accountants are experts at handling the financial and tax preparation aspects, they are limited when representing clients in court and should probably not do so. Their role is better suited to financial advising and tax compliance.

3. Negotiating with CRA:

- Tax Lawyer: Beyond addressing potential legal issues, tax lawyers can negotiate with the CRA on your behalf and provide a legal interpretation of the tax implications. Lawyers are trained in negotiation and understand the legal boundaries within which they can operate. If there's a need to negotiate terms or penalties with the CRA, a tax lawyer would typically be more equipped to handle these discussions effectively, navigating both the legal and tax complexities. Preparation and review of any legal documents that might be necessary during the disclosure process or subsequent proceedings are better handled by a tax lawyer, given their expertise in legal matters.

- Tax Accountant: Accountants are trained to prepare tax forms and tax returns; lawyers are not. They can work with your tax lawyer to prepare tax documents, calculate taxes owed or refundable, and help comply with tax regulations. Accountants can give non-legal tax opinions but only lawyers can give legally binding tax opinions.

4. Legal Representation:

- Tax Lawyer: Should the situation escalate or if there is a high risk of litigation or penalties, having a tax lawyer ensures that you have legal representation who is familiar with your case right from the start. If you end up in Tax Court or in Criminal Court, a tax lawyer has been trained in litigation matters whereas a tax accountant has not. A tax lawyer can provide a more comprehensive risk assessment concerning legal exposure, advice on the implications of disclosing certain information, and help in managing those risks legally.

- Tax Accountant: Accountants can give non-legal tax opinions but only lawyers can give legally binding tax opinions.

5. Cost:

- Consulting a tax lawyer generally tends to be more expensive compared to hiring an accountant. However, the investment might be worthwhile if legal issues are at play or if the stakes are particularly high in terms of potential penalties.

6. Preventive Advice:

- Tax Lawyer: Offers comprehensive protection by advising on the legal implications and future preventive measures.

- Tax Accountant: Focuses more on financial advice, ensuring that future filings are correct while helping set up systems to avoid similar issues.

In summary, if the issue involves simple errors or financial adjustments, a tax accountant might be suitable. However, for complex issues, potential legal concerns, or where there may be significant penalties, a tax lawyer would be the better option to protect the business's interests fully. Often, consulting both professionals for their respective expertise can be the most comprehensive approach.

Given these factors, while both tax lawyers and accountants have critical roles to play, I believe the legal privileges and broader legal protections afforded by a tax lawyer can be particularly advantageous in navigating the complexities of the CRA's Voluntary Disclosure Program, especially in scenarios where there is a potential for significant penalties or legal issues.

If you want to learn more check out Moody's April 15, 2021 article Privilege where Legal Advice Rendered by a Law Firm of Collaborating Lawyers and Accountants or the Ottawa Business Journal January 30, 2024 Know your rights: The difference between confidential and privileged information.

FAQ About The Voluntary Disclosure Program

Let's clarify some questions around the 2025 VDP changes.

Do I need professional help? Who should I talk to?

Do I need professional help? Who should I talk to?

This is a very good question. This might seem like it should have a short answer, but the nuances matter more than you'd think. Here's why:

Quick answer ...

If there’s any chance your situation involves intentional conduct or could turn serious, speak to a tax lawyer first. Conversations with lawyers are protected by solicitor‑client privilege.

For straightforward corrections, a tax accountant may be enough. Often, the best setup is the lawyer engages the accountant or bookkeeper to do the number‑crunching, which helps keep privilege intact while you get the work done right.

Check out the callout box (before the FAQ start) to understand the difference between a tax lawyer and a tax accountant.

Let's look deeper at why you need to consult a professional before filing your VD application.

On the surface, the new rules do look simpler. But a few 'small' choices can change your outcome a lot, especially the interest break you get and whether you stay eligible.

- Getting the lane right matters financially.

The difference between “unprompted” and “prompted” can mean 75% vs 25% interest relief. A pro can read CRA’s letters and emails the way CRA will, so you don’t accidentally move yourself into the lower‑relief lane by how or when you contact them. - Choosing the right years (and only the right years).

Under the 2025 rules, how many years you include depends on the type of income/assets:

• Canadian‑sourced issues: most recent 6 years that have errors

• Foreign‑sourced issues: most recent 10 years that have errors

• GST/HST: most recent 4 years that have errors

Include too many years and you expose more than you need to. Include too few and CRA can say the disclosure isn’t 'complete'. A pro helps you thread that needle. - 'Complete' means complete.

If you leave out a related issue (say, you disclose shareholder loans but forget the taxable benefits; or you fix income tax but skip the GST registration you should have had), CRA can deny relief or open an audit. A pro will map your whole situation (income tax, GST/HST, payroll, UHT- Underused Housing Tax) so the package hangs together. - Wash transactions are powerful but technical (GST/HST).

If your situation qualifies as a “wash,” interest and penalties on that portion can go to zero. But you’ll need to prove the other party’s entitlement to ITCs and line up the documents. A pro knows the evidence CRA accepts and can save you a lot of back‑and‑forth. - Paperwork, timing, and wording count.

Form RC199 is required, you must name anyone who helped you, and CRA expects a clear explanation of what went wrong and how you fixed your books. The way you describe facts can affect whether CRA views it as unprompted vs prompted, and whether they see the errors as careless vs intentional. Pros speak 'CRA' and keep you on message. - Cash‑flow planning and payment arrangements.

You need to pay the tax (and the remaining interest). If you need a payment plan, CRA wants verifiable proof you can meet it. A pro helps you model the numbers, avoid promising too much, and keeps interest from snowballing while you wait. - Protecting yourself if there’s any risk.

If there’s even a small chance your situation could be seen as intentional, talk to a tax lawyer first. Conversations with lawyers are protected by solicitor‑client privilege; they can then engage your accountant/bookkeeper to do the number‑crunching under that umbrella. That’s peace of mind you can’t get with DIY.

When would DIY possibly be fine?

One or two straightforward Canadian‑sourced errors (for example, missed slips), no CRA contact about the issue, no GST/HST or payroll angle, and you can comfortably pay what’s owing. Even then, a quick “sanity‑check” call with a pro can keep you from missing something simple that has big consequences.

Bottom line

You’re smart and capable. The VDP is simpler now, but it still has moving parts, and small missteps can cost real money or eligibility. A short consult can help you pick the right lane, include the right years, keep your story consistent, and get your ducks in a row with less stress. IMHO, this is no time to penny pinch!

Sources referenced: CRA Information Circular IC00‑1R7 and GST/HST Memorandum 16‑5‑1; CRA IC00‑1R6 and GST/HST Memorandum 16‑5; PwC Tax Insights (Issue 2025‑36); McMillan LLP Tax Bulletin (Sept 11, 2025); Knowledge Bureau summary (Sept 2025). This is general information, not legal or tax advice.

The CRA is moving into two clear lanes. I'm confused. Isn’t the “new 2025” VDP still just two lanes like it was in 2018? What am I missing?

The CRA is moving into two clear lanes. I'm confused. Isn’t the “new 2025” VDP still just two lanes like it was in 2018? What am I missing?

It looks that way, but it will work differently.

In 2018, two programs existed (General and Limited), but lots of CRA contact could knock you out completely, and the Limited program gave little or no interest relief.

From October 1, 2025 onward, the two tiers are simple and predictable: Unprompted if you come forward before CRA flags a specific issue, and Prompted if CRA already pointed to that issue. Both tiers still offer real relief. The “you’re out” trapdoor is now much narrower. It will now be mainly when an audit or investigation has already started on the same issue.

Should I apply now or wait until October 1, 2025?

Should I apply now or wait until October 1, 2025?

It depends on your situation. If the CRA receives your VDP application before October 1, 2025 = 2018 rules apply. If the CRA receives your VDP application on or after October 1, 2025 = new 2025 rules.

The post‑October rules are friendlier (especially on interest and eligibility), but interest keeps accruing while you wait. If you’ve only had a general education letter, you may still qualify as unprompted after October 1.

If CRA already sent you a letter naming a specific issue, you can still apply ... just expect prompted relief. If you sense an audit is imminent, sooner is usually better. This is a good moment to talk to a qualified CPA tax expert in public practice about timing for your situation.

What does “unprompted” vs “prompted” really mean. When am I ineligible?

What does “unprompted” vs “prompted” really mean. When am I ineligible?

Unprompted means you raised your hand before CRA identified a specific error on your file. Prompted means CRA already contacted you about that exact issue (for example, a letter naming the error and giving a deadline).

Good news!

General education letters don’t disqualify you anymore. You’re usually ineligible only if an audit or investigation has already started on the same issue for you or a related person.

Note: that audit/investigation could be by CRA or another authority (for example, securities commission or law enforcement).

- You received a general education letter from CRA. Are you out?

No. Education letters no longer disqualify you. You can still be considered unprompted if CRA hasn’t flagged a specific issue.

- CRA sent me a letter about a specific error with a deadline. Can I still use the VDP?

Yes, usually as a prompted application. You’ll likely get up to 100% penalty relief and 25% interest relief if your disclosure is accepted.

- When am I actually ineligible?

Mainly when an audit or investigation has already started on the same issue (for you or a related person). Also, there’s generally no relief if your disclosure would only create a refund or there’s nothing owing, or if you’re trying to remove penalties/interest already assessed.

What relief can I realistically expect if I’m accepted?

What relief can I realistically expect if I’m accepted?

If your application is accepted, penalties tied to what you disclose are normally waived in both tiers. Interest is reduced by 75% if you’re unprompted and by 25% if you’re prompted. CRA also won’t refer the disclosed issues for criminal prosecution.

For GST/HST wash situations, where tax wasn’t collected but the customer could fully claim it back, or certain related‑party ITC mismatches ... interest and penalties on that wash portion can often be reduced to zero under CRA’s wash policy.

What do I actually file? And which years should I include?

What do I actually file? And which years should I include?

You’ll use Form RC199 (which is now required). CRA says a simpler version of the form will be available October 1, 2025.

Anonymous “no‑name” applications are still not allowed, but you (or your representative) can have a pre‑disclosure chat with CRA without naming yourself. If someone helped you (your bookkeeper, accountant, or a promoter) you must name them on the form.

How many years to include in your application is now clearly defined.

- For income tax, include the most recent six years that need correcting if the issue is Canadian-sourced; ten years if it’s foreign-sourced.

- For GST/HST, include the most recent four years that need fixing. You don’t need to include clean years within those windows. CRA can ask for more if needed.

Processing time

CRA aims for about 180 days, but it can take longer in practice. Knowledge Bureau used an example of a May 2023 application not resolved until October 2024 ... 369 business work days. Build some patience and cash-flow planning into your timeline.

Key Takeaways

Is voluntary disclosure the right move for you?

- The VDP can be a valuable tool to correct past tax errors while minimizing penalties.

- The 2025 VDP changes represent a significant improvement, making the program more accessible with better relief options.

- Professional advice remains crucial and prudent when considering a VDP application due to timing considerations, the application complexities and potential consequences of tax disclosures.

- Applicants need to ensure their applications are fully compliant and all disclosures are accurate and complete to avoid penalties or denial and maximize potential benefits under the VDP.

2025 Sources (acknowledged):

- CRA: Information Circular IC00‑1R7, Voluntary Disclosures Program (published September 10, 2025; applies to applications received on/after October 1, 2025).

- CRA: GST/HST Memorandum 16‑5‑1, Voluntary Disclosures Program (Applications received on or after October 1, 2025).

- PwC Canada, Tax Insights Issue 2025‑36 (September 16, 2025) – GST/HST and other non‑income tax VDP changes, including treatment of wash transactions and clarity on “prompted/unprompted.”

- McMillan LLP, “Major Changes to Voluntary Disclosures Program Coming Into Effect October 1, 2025” (September 11, 2025) – Overview of relaxed voluntariness, expanded scope, and practical considerations.

- Knowledge Bureau (Evelyn Jacks), summary of IC00‑1R7 highlights and processing time realities (September 2025).

2018 Sources: CRA IC00-1R6; June 21, 2017 Issue 26 EY Tax Alert-Canada; pwc Tax Insights issue 2017-28; June 21, 2017 Issue 27 EY Tax Alert-Canada; December 21, 2017 EY Tax News Update - Canada Revenue Agency revises GST/HST Voluntary Disclosures Program

Tracing History (For Reference Only)

2018 Changes to the VDP Rules

In March 2018, two administrative policy changes to the voluntary disclosure program guidelines came into effect. The first policy change applied to income tax and source deductions. The changes were outlined in Information Circular IC00-1R6. The second policy change applied to GST/HST disclosures. The changes were laid out GST/HST Memorandum 16-5.

Here is a brief overview of the changes in the two policies that may affect your decision of whether voluntary disclosure is the right move for you:

Income Tax and Source Deductions Policy & Changes

1. Tightened Criteria (Effective 2018):

The criteria for acceptance into the VDP is now more stringent. Full relief from penalties is harder to qualify for, and partial relief is now more common. Take a look at some of the changes:

- File using Form RC199 or an equivalent letter

- Rules around when/if a second application can be filed.

- Must disclose the name of the advisor when making the application.

- Must pay estimated taxes at the time the application is made.

- The option of not providing a name when filing the application is eliminated.

- CRA can cancel the application if the applicant filed incomplete information due to misrepresentation, neglect, willful default or fraud.

- Reduced relief considered in limited program for corporations with gross revenue over $250 million in two of the last five years, offshore accounts, sophisticated taxpayers, and more.

- Restricts who can make an application under the program; exclusions/no relief for:

(a) no taxes owing or refunds expects;

(b) transfer pricing matters;

(c) proceeds of crime disclosures;

(d) person in receivership or bankrupt; and

(e) applications that require agreement with a competent authority under a tax treaty provision (for example S-corporation agreements).

2. Two Track System:

The VDP now differentiates between applications that involve intentional conduct and those that do not, affecting the relief granted. It moves away from the "one size fits all' program. As a result, there will be two tracks:

- General Program for inadvertent and minor non-compliance with no change in current penalty relief policy and a 50% interest relief may be granted for most recent years; and

- Limited Program where relief is curtailed for major cases of unreported income, including sophisticated taxpayers. They will not be assessed gross negligence penalty and not subject to criminal prosecution; all other penalties assessed will not be forgiven as well as no interest relief. They also waive their objection rights pertaining to taxes assessed. You must meet specific conditions to be accepted. If the CRA has already received potential involvement in non-compliance, your application will be rejected.

3. Limited Periods for Correction:

The program specifies limits on the number of tax years for which correction is possible, generally up to 10 years.

It's important to note that a Canadian small business owner can still be audited by the CRA even after being accepted into the Voluntary Disclosures Program. Acceptance into the VDP generally provides relief from penalty or prosecution regarding the information disclosed.

However, if the CRA finds inaccuracies or incomplete information within the VDP application itself, or if new information comes to light that requires verification, the CRA still reserves the right to audit the taxpayer. Moreover, the disclosed information might be reviewed for accuracy and completeness, and an audit might be conducted if discrepancies or further issues are detected. See Tax Interpretations 2022 Grewal decision for an example of when this might occur. In this example, the taxpayer disclosed loans under the VDP but not the associated taxable benefits which led to an audit.

Baker Tilly points out in their July 26, 2022 article titled Voluntary Disclosures Program not to be taken lightly that "taxpayers should review their VDP submission carefully to ensure the years in question align with the 10-year statutory period for waiver of interest and penalties. Otherwise, the VDP may not provide the protection sought by the taxpayer."

GST/HST Policy & Changes

Similar to the income tax policy changes, here are key changes to the VDP:

1. Restriction on Eligibility:

- Disclosures must not be primarily related to amounts already known to the CRA or amounts that involve the avoidance of penalties and interest.

- Applications that involve transfer pricing adjustments or those related to large corporations are not eligible for the VDP.

2. Three Tracks for Disclosure:

- General Program:

This track covers most disclosures that involve errors or omissions where there was no intentional attempt to avoid taxes. It includes four years before the application filing date with possible 50% interest relief and 100% penalty relief. - Limited Program:

Designed for more serious breaches where there might have been intentional avoidance or evasion. This track provides less relief compared to the General Program.

Unlike track 1 and 3, it includes all relevant years before the application filing date. There is no interest or penalty relief. However gross negligence penalties will not be assessed even if warranted.

Examples of where this might apply would be collecting but not remitting GST/HST, participating in the underground economy, gross negligence, multiple years of non-compliance. - Wash Transactions Program:

Specifically designed for situations where a registrant failed to collect or remit GST/HST, but the customer was entitled to claim a full input tax credit (ITC) or where ITCS are wrongly claimed between closely related parties.

This track helps reduce penalties and interest associated with such errors but often involves a notable failure in tax collection and remittance responsibilities. It includes four years before the application filing date. It may result in full interest and penalty relief. See GST/HST Memorandum 16.3.1, Reduction of Penalty and Interest in Wash Transaction Situations.

3. Pre-Disclosure Discussion:

- Taxpayers can now engage in anonymous pre-disclosure discussions with the CRA to understand the potential relief available under the VDP. However, full disclosure and identity disclosure must follow for any formal relief to be granted.

4. Payment of Estimated Tax:

- To qualify under the VDP, applicants must include payment of the estimated tax owing or propose a payment arrangement supported by verifiable evidence of payment ability.