- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Navigating Change

- 30-Day Admin Reset

Canadian Small Business CRA Compliance Routine

30-Day Admin Reset for Solopreneurs

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

Published September 19, 2025 | Revised September 20, 2025 | Edited October 23, 2025

WHAT'S IN THIS ARTICLE

Intro | Your Secret Weapon | 5-Piece System That Works | Your 30-Day Reset | What Happens After the Reset | Choose Your Tech Comfort Level | Where AI Can Help | Backup & File Storage | Why This Reset Matters More Than Ever | CRA Compliance Notes | Start by Starting | Image Index

FIRST IN SERIES >> An Primer for Impact of Tariffs Canadian Solopreneurs

Getting your ducks in a row: A clean workspace and simple daily administration routines are the foundation of stress-free CRA compliance for Canadian solopreneurs.

Getting your ducks in a row: A clean workspace and simple daily administration routines are the foundation of stress-free CRA compliance for Canadian solopreneurs.Whether you're staring at a shoebox full of receipts from three years of "I'll deal with this later" or you're a new solopreneur trying to start with good habits, September's the perfect time to get your administrative house in order.

Whether you call yourself a solopreneur, small business owner, self-employed, or a freelancer, running your own business demands time, energy, creativity ... and yes, paperwork. It seems like a chore, but here's the thing: every invoice filed, every receipt organized, every tax document recorded brings you closer to operational efficiency and financial stability. More importantly, when trade costs shift unexpectedly or supply chains get disrupted, having current books means you can adjust pricing and make decisions fast instead of flying blind.

You've chosen a path that takes real courage. You decided to be your own boss, creating opportunities not just for yourself, but potentially for others too. It's completely normal to dislike the administrative side ... most entrepreneurs do. But think of it as the foundation that lets you build something extraordinary.

Whether you're starting from scratch or trying to tame existing chaos, this 30-day reset will meet you where you are. We're not aiming for perfection here ... we're building simple routines that become as automatic as your morning coffee. By the end of these 30 days, you'll have a system that puts you well on your way to having audit ready, CRA-compliant books. Your stress will be reduced, and you should begin having the numbers you need to make smart business decisions.

Remember what Oprah said, "Do what you have to do until you can do what you want to do." Right now, that might be getting organized. But imagine the confidence you'll feel when you've built a sustainable business with solid administrative foundations.

Start by starting. Your future self will thank you.

Whether you think you can or you think you can't, you're right.

Henry Ford

Dealing With The New Normal of Tariffs Series

Not interested in this article? Where do you want to go next? Click on the picture to go any of these other articles in the tariff series.

Get Your Ducks In A Row: A 30-Day Admin Reset

New routines feel awkward on purpose. Your brain is wired to avoid discomfort, so admin tasks trigger resistance. That's not a sign you're doing it wrong ... it's a sign you're building a new muscle.

September's here, and if you're like most solopreneurs, you're looking at year-end thinking "I really should get organized this time." Good news: you've got four months to build a routine that'll make next year's taxes a breeze.

You don't need a new app to get organized ... you need an easy routine you'll actually do. This month, we'll build a simple, Canadian-made admin flow that keeps you CRA-compliant, cuts stress, and gives you the numbers you need to make quick decisions when costs shift unexpectedly. We'll keep it light, flexible, and 100% practical.

Here's the thing: when everything outside your business feels unpredictable ... tariffs changing supply costs, shipping rates jumping, input prices all over the map ... having your administrative house in order becomes your superpower. You can't afford to be three months behind on your books when you need to adjust pricing fast or figure out if that new tariff just ate your profit margin.

Start by starting. New routines feel awkward on purpose. Your brain is wired to avoid discomfort, so admin tasks trigger resistance. That's not a sign you're doing it wrong ... it's a sign you're building a new muscle. Each time you work through that 'I don't want to do this' feeling and do it anyway, you're strengthening the habit pathway.

Why Routines Are Your Secret Weapon

Here's what most solopreneurs get wrong about getting organized ... they think they need perfect systems. What you actually need are simple routines that become automatic.

Introducing Money Mondays and Treasury Thursdays

Every Monday, clear your Admin Inbox while your coffee's still hot and check your actual cash position. I call it Money Mondays.

If you are just learning to manage your cash, you might want to do cash management on Treasury Thursdays and leave Money Mondays solely for catching up your bookkeeping paperwork. Checking your cash position every Thursday becomes your weekly e x h a l e ... a moment to release stress and confirm you're on track. It lets me exhale as I know my cash is looking good. If it's not, I head off the issue before it becomes a problem. When your cash looks good, I breathe easier. When it doesn't, you spot the issue while there's still time to course-correct.

I chose Monday and Thursday because I like tackling admin before the week gets chaotic and reviewing cash mid-week to ensure I'm on track to meet my goals. But if Monday mornings are your busiest time, pick Tuesday or Wednesday instead. The name sticks even if your day doesn't. What matters is the same day, same time, every week.

I've started giving my routines memorable names (Money Mondays, Treasury Thursdays) because named routines are easier to stick with. Pick names and days that work for your business rhythm. The non-negotiable part is consistency, not the calendar day.

Your body and brain love predictability. When you do the same small actions at the same times, they stop feeling like decisions and start feeling like brushing your teeth. Going through receipts every Monday morning becomes as natural as your coffee ritual. Checking your cash balances every Thursday helps you exhale and release some stress.

This is especially powerful for administrative tasks because they're not urgent until they suddenly are. A routine removes the mental load of constantly deciding "when should I deal with this?" The answer is always the same: during your scheduled time.

The magic happens when these small, consistent actions compound. Five minutes of receipt sorting every day beats three hours of panic sorting once a month. Your stress drops because you're never behind. Your decision-making improves because you have current numbers. Your confidence grows because you know exactly where you stand.

We're going to build just five simple routines over the next 30 days. Each one takes 5-30 minutes and links to something you already do. In 30 days, these won't feel like 'bookkeeping tasks' ... they'll just be part of how you run your business.

The 5-Piece System That Works

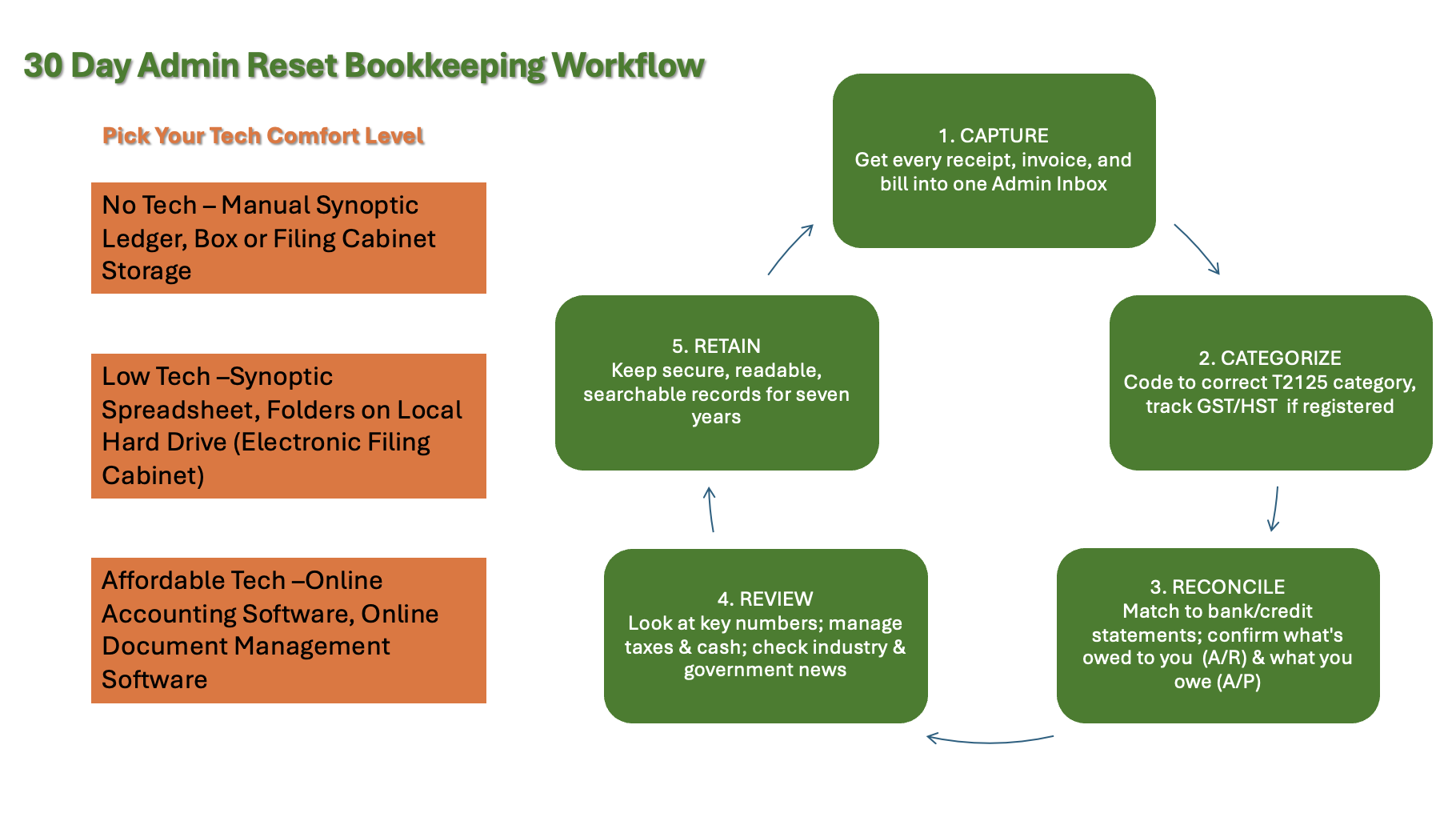

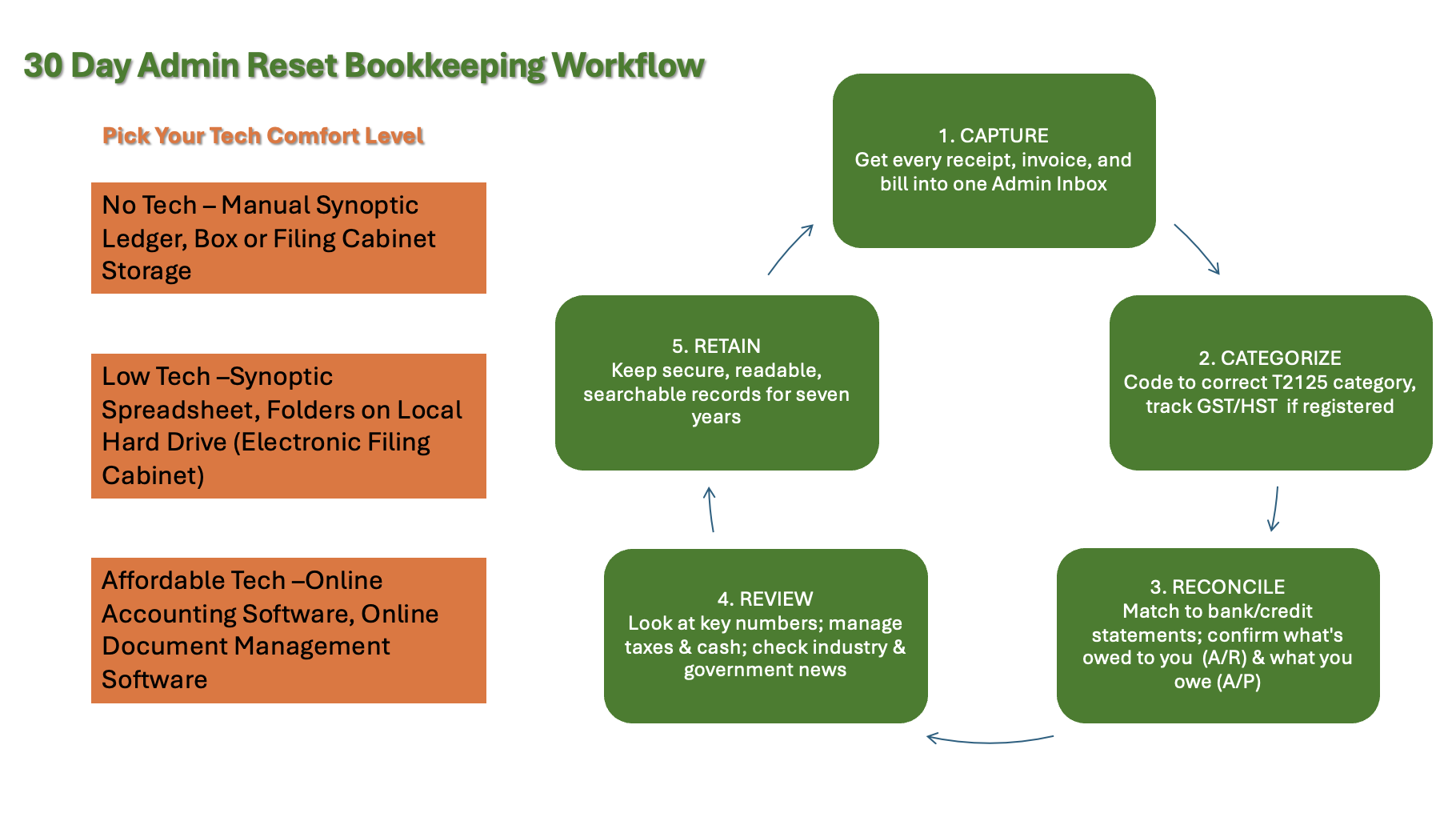

The 5-step process you will be creating.

The 5-step process you will be creating.Before we dive into the 30-day reset, let's get clear on what we're building. Every successful small business admin routine has five pieces:

- Capture - Get every receipt, invoice, and bill into one Admin Inbox.

- Categorize - Code it to the right T2125 (income and expense) category.

- Reconcile - Match to bank/credit statements; track GST/HST if registered, confirm what's owed to you (A/R) and who you owe (A/P.)

- Review - Look at key numbers; review your taxes and learn your cash rhythm, check industry and government news.

- Retain - Keep secure, searchable (must be accessible and readable) records for seven years. Paper receipts should not be 'fadeable', electronic records must be accessible (PDF format works best), pictures must be in focus.

That's it. Pick your tech comfort level (no tech, low tech, or love your apps) and we'll make it work. No complicated workflows. Just five simple actions that become as automatic as your morning coffee or tea.

Heads Up: The Comfort-to-Competence Curve

- Days 1–7: Highest friction. Rely on timers and tiny steps.

- Days 8–14: Neutral. The routine starts to feel familiar.

- Days 15–30: Momentum. You think less, do more.

You don’t need to love admin. You just need to show up for 10 minutes, repeatedly. Boring is profitable.

Your 30-Day Reset

Four Weeks To Get Your Ducks In A Row

We're going to build this routine one week at a time. I know, I know ... this desk has way too many plants! Unless you're a master gardener, I'm not sure how you would work here ... but we aim for you to have a clean, organized desk in 30 days!

We're going to build this routine one week at a time. I know, I know ... this desk has way too many plants! Unless you're a master gardener, I'm not sure how you would work here ... but we aim for you to have a clean, organized desk in 30 days!We're going to build this routine one week at a time. About 30 minutes a day, 2-3 hours total per week. In four weeks, you'll have a system that runs itself.

Jump To >> Week 1 - Capture | Week 2 - Categorize & File | Week 3 - Reconcile | Week 4 - Review & Plan

The Science of Small Habits

Research shows that small, consistent actions create lasting change better than big dramatic overhauls. Here's why this 30-day approach should work:

- Habit Stacking - You are going to link new admin tasks to things you already do reliably (morning coffee, closing your laptop, Monday mornings). This uses your existing routines as anchors for new ones.

- Reduced Decision Fatigue - When receipt processing happens 'every Monday at 9 AM' or checking your cash balance 'every Thursday at 9 AM', you stop wasting mental energy deciding when to do it. That energy goes toward managing (or growing) your business instead.

- Compound Effect - Five to fifteen minutes daily beats three hours monthly because consistency builds momentum. Small actions compound into audit-ready books and stress-free tax seasons.

- Automatic Stress Relief - Routines reduce the mental load of remembering what needs doing. When your admin runs on autopilot, you can focus on what you love about your business.

- Crisis Preparedness - When tariffs hit your supply chain or shipping costs spike, current books let you model the impact immediately. The routine gives you the data to make fast, informed decisions.

The goal isn't perfect bookkeeping on day one. It's building habits so strong that by in 12 months, you'll be the solopreneur who's got their ducks in a row while everyone else is scrambling.

Work Through the Discomfort: Why It Feels Hard (And What To Do)

- Discomfort is a growth signal. New routines create “limbic friction” (your brain’s comfort bias). Expect a little pushback.

- Use the 10-minute rule: set a timer, start, stop when it rings. Showing up matters more than finishing.

- Habit stack plus reward. Pair Money Monday with a treat you only have during admin time (special tea / playlist), then tick a box. Do the same with Treasury Thursday. Maybe change your treat (favourite coffee / instrumental play list). Small rewards train your brain to like the routine.

- Never miss twice. If you skip a day, make the next one a 2-minute version. Consistency beats perfection.

- Make it easier than not doing it. Keep your Admin Inbox visible, spreadsheet open by default, phone camera shortcut ready.

- Connect accountability and reward. Keep a simple streak tracker on your desk or your whiteboard.

I'll say it again. Start by starting. Start by showing up. Expect some discomfort while you learn a new habit and routine.

Week 1: Capture Everything

I don’t have to feel like it. I only have to start.

- The Goal - Create one place where all your business paperwork lands, and build the habit of actually using it.

Set up your intake system

- Physical: One tray on your desk labeled 'Admin Inbox'.

- Digital: One folder on your computer called 'Admin Inbox.

- Mobile: Pick one app for receipt photos (even your phone's camera app works). If you want something more robust, LedgerDocs is a Canadian document management system that lets you email, text, or upload receipts directly ... and it's surprisingly affordable. I've covered how their workflow works over at bookkeeping-essentials.com.

🦆Quack Fact Reality Check - These days, most businesses operate in a messy middle ground between 'all paper' and 'completely digital'. Depending on your paperwork flow, you'll likely need both a physical tray and a digital folder ... especially if you're working toward a more paperless, automated workflow. The reality is:

- Gas stations often still print receipts.

- Parking meters often give you paper tickets.

- Some vendors only take cash.

- Client meetings generate handwritten notes.

- Contractors hand you invoices on site.

Daily habit to build

After your last coffee or tea of the day, do a 5-minute 'receipt sweep'. Drop all paper receipts into the tray. Snap photos of any fuel receipts, parking meters, or cash purchases on your phone.

- 🦆Duck Tip - If you're using LedgerDocs, forward any email bills, receipts, or invoices directly to your LedgerDocs inbox ... this keeps everything flowing to one place for processing and helps you stay audit-ready.

- 🦆 Routine Reality Check

You're not just organizing receipts - you're building a capture habit. Every time you drop a receipt in that tray instead of leaving it in your pocket, you're strengthening the neural pathway that makes this automatic. Consistency beats perfection every time. If this feels awkward, you're doing it right. You're teaching your brain that receipts live in one place now. Five minutes today saves an hour later.

This week's tasks

- Set up your Admin Inbox system (physical tray + digital folder).

- Test your receipt photo process (take a few practice shots, make sure they're readable).

- Start a basic mileage log (app or paper in your glovebox).

- Choose your email forwarding method if using a system like LedgerDocs.

- Micro-challenge - Here's your discomfort drill for this week. Do one 'receipt sweep' while mildly annoyed. Note how you feel after.

Habit hook

After you close your laptop for the day, drop all your receipts into the tray, snap any photos you need, or forward relevant paperwork to LedgerDocs.

By Friday, you should have a week's worth of receipts in one place instead of scattered across your car, pockets, and desk. Well, maybe two places if you're living in that messy middle ground we talked about ... but hey, two is infinitely better than seventeen random locations. That's progress.

Want to go deeper on workflow setup?

If you are new to improving your workflow to automate as much as possible if it improves efficiency, I've written my thoughts on how to begin automating your accounting workflow process that pairs perfectly with this 30-day reset. Check it out at bookkeeping-essentials.com once you've got your basic capture system running.

Week 2: Categorize and File Like the CRA Expects

Two minutes is enough to keep the streak alive.

- The Goal - Create (or review your existing one) a simple chart of accounts that mirrors how you'll file your T2125, and start sorting your captured receipts. Then, build a simple filing system so processed items have a home. This will make your books audit ready.

Make your category list

Keep it short and T2125-friendly. Think: Office supplies, Vehicle expenses, Professional fees, Advertising, etc. Need help with T2125 categories? Pull out your last year's tax return to see what tax lines you used on Form T2125. See this detailed breakdown that explains every line of the Form T2125 to common small business expenses.

Set up your filing system now

Since you're categorizing receipts, you need somewhere to put them once they're processed. So choose one filing structure this week and stick to it. The aim is 'find it fast', not fancy.

I lay out a lot of options for your filing system at bookkeeping-essentials.com. Look through them and pick the one that best matches your organizational style.

Here are three basic filing structure options to consider to keep it simple for now:

- Physical - Monthly envelopes in a banker's box, labeled by month

- Digital - Year > Month folders a simple file‑naming rule so you can find things fast (YYYY-MM-DD_Supplier_Amount)

- Hybrid - Digital for most, monthly envelopes for cash receipts/parking as well as original paper receipts (even if you have scanned them, CRA requires you to keep the original).

Set up GST/HST tracking

How you track this depends on your tech level ...

- No/Low Tech - Simple spreadsheet with columns for GST/HST collected and Input Tax Credits (ITCs) ... the old fashioned but effective synoptic ledger.

- Affordable Tech - Online software like QuickBooks Online or Xero have built-in sales tax modules that track everything automatically ... you just need to turn the feature on and follow their setup instructions.

- Either way - Note your filing frequency (monthly, quarterly, or annually) and make sure you can easily see what you've collected vs. what you can claim.

Need the complete picture on GST/HST requirements? Check out my Canadian sales tax guide that covers registration thresholds, filing frequencies, and what qualifies for Input Tax Credits plus more.

Daily habit to build

Every Monday (let's call it 'Money Monday'), clear 7-10 items from your Admin Inbox. Sort them into categories and record any sales tax according to your registration status ... registered businesses track GST/HST collected and ITCs, while unregistered businesses record the GST/HST paid on expenses as part of its cost. Lastly, immediately file them in your chosen filing system.

- 🦆 Routine Reality Check

'Money Monday' isn't just a catchy name - it's habit stacking. By linking receipt processing to something as reliable as Monday morning, you remove the decision fatigue of 'when should I do this?' Your brain starts expecting this routine, making it easier to stick with. Categorizing won't feel smooth at first. Do the obvious ones, park the tricky items in a 'Decide Friday' folder. Momentum before mastery. Progress over perfection.

🦆Duck Tip - How to build audit ready books to reduce single‑point‑of‑failure risk

No/Low Tech (Paper-first)

Save each paper original receipt/bill in a 'Bookkeeping-in-a-box' format - envelopes or file folders organized in an orderly fashion. The only way I see that you can create a backup of your paper filing system is to scan it and keep a copy on your local hard drive. That’s two independent homes: your local drive + your cloud copy.

Low Tech (Digital-first)

Save each receipt/bill as a PDF to your Year > Month folders and let a cloud drive (OneDrive/Google Drive/Dropbox) auto‑sync. Keep paper originals that must exist (fuel/parking) in a monthly envelope. That’s two independent homes: your local drive + your cloud copy.

Affordable Tech (Pick one work flow)

One possible bundle is QBO + LedgerDocs: Capture and code source documents in LedgerDocs, then publish/push to QBO. QBO stores a copy on the transaction; LedgerDocs keeps the 'original'. That gives you two independent homes ... easy audit drill-down in QBO, independent backup in LedgerDocs.

- Xero + Hubdoc (recommended with Xero): Capture and code source documents in Hubdoc, then publish to Xero. Hubdoc retains the 'original'; Xero attaches a copy to the transaction. Again: two homes ... You need to confirm data residency and backup policies with Xero.

- Xero + LedgerDocs (alternative): If you prefer LedgerDocs with Xero, enable the LedgerDocs–Xero sync and use LedgerDocs as your single capture app. Don’t run Hubdoc and LedgerDocs at the same time ... pick one to avoid duplicates. But my preference would be to use Hubdoc with Xero.

🦆 Behind on Bookkeeping? The Catch-Up Strategy

Don't let backwork derail your routine. Focus on current transactions first:

- This week - Process only this week's receipts.

- Goal - Stay current going forward, tackle backlog separately in the coming months. (I.E. chip away at it.)

- For a complete catch-up system, see my article on A Simple Tax Compliance Method For The Self-Employed - it's specifically designed for when you're behind and need to get organized fast.

🦆Quack Fact - Backups you control

Attachments inside QBO/Xero are convenient for audit drill-down, but you don’t control those platforms. Keep at least one independent copy outside your bookkeeping software (LedgerDocs/Hubdoc or your own folder system). We’ll formalize this in Week 4 with the 3‑2‑2 backup rule.

This week's tasks

- Create your T2125-friendly chart of accounts (keep it short).

- If you are registered, set up GST/HST/PST tracking based on your tech level.

- Test your categorization system with a few practice receipts.

- Post/record this week's new business transactions (sales, expenses, receipts from your Admin Inbox) to your bookkeeping system of choice.

- Recommended: As you categorize, attach the receipt to the transaction (QBO/Xero) and ensure the same doc also lives in LedgerDocs/Hubdoc or your folders.

- Micro challenge - Here's your discomfort drill for this week. Categorize 10 items on a timer. Stop at the bell.

🦆Duck Tip for no-tech users

Print out your category list and tape it inside your Admin Inbox (or somewhere you can easily see it or reach for it). When you're sorting receipts, you won't have to remember if that software subscription goes under 'Office expenses' or 'Professional fees'.

Habit hook

Every Money Monday, clear your Admin Inbox while your coffee's still hot and check your actual cash position ... or implement the simple cash management system (see tip below).

🦆Duck Tip - Cash management.

Learn how to implement an easy cash management system for the self-employed based on Profit First principles. It pairs with Money Monday and helps you automatically set aside money for taxes, expenses, and profit.

Week 3: Reconcile, Collect Money Owed, and Start Saving for Taxes

Done weekly beats perfect eventually.

- The Goal - Make sure your records match your bank accounts, and get a handle on who owes you money. Lock in a simple method to save for your tax.

Reconcile your accounts

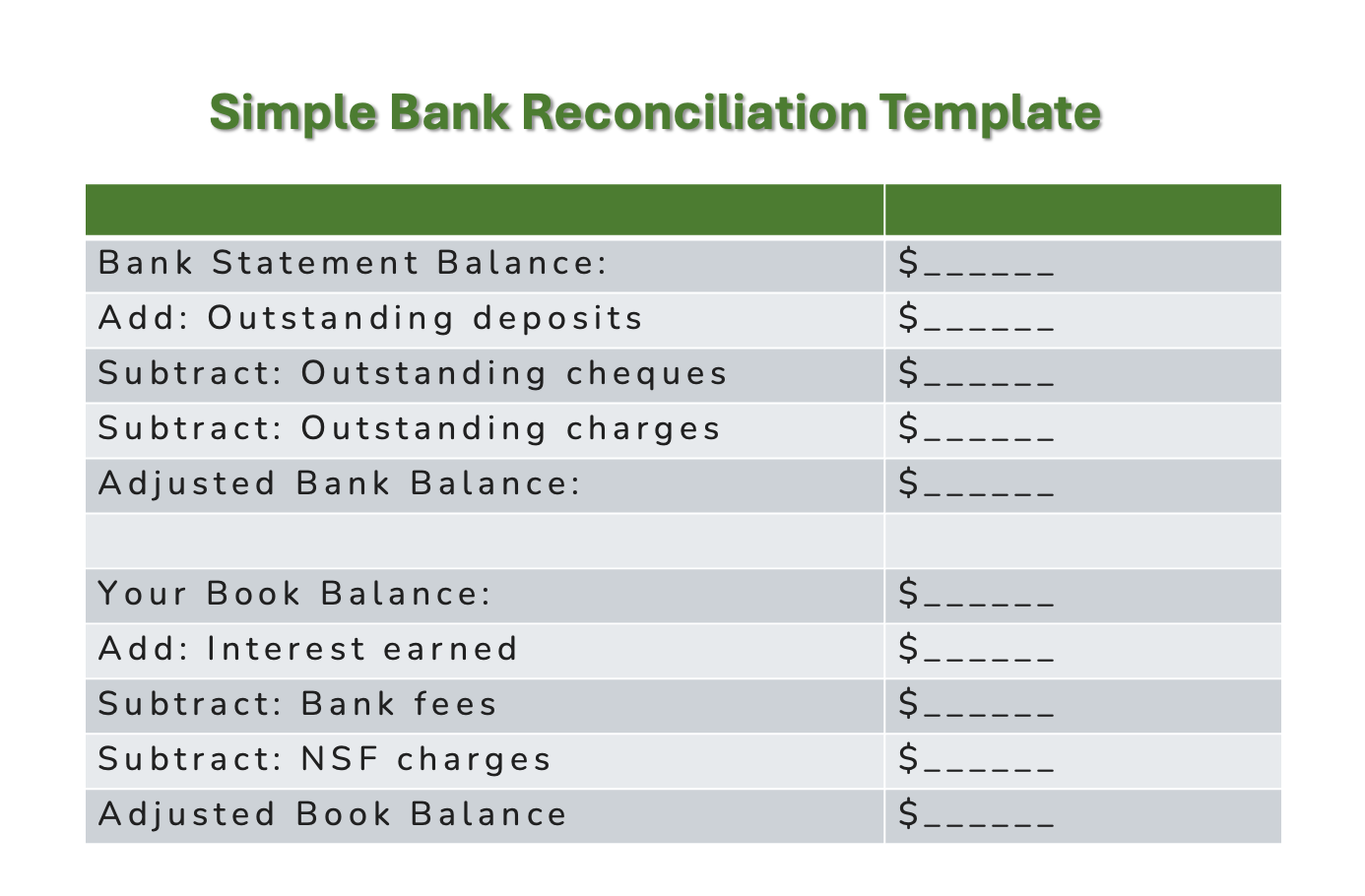

- No Tech - Get your paper bank statement, or your downloaded eStatement, and use this simple reconciliation format:

Simple bank reconciliation template: Save or print this worksheet to reconcile your accounts manually.

Simple bank reconciliation template: Save or print this worksheet to reconcile your accounts manually.Both your adjusted balances should match. If they don't match, you need to find the difference. It's usually a missed transaction, a math error, or a bank fee you didn't record.

- Low Tech - Download your bank statement as a PDF or CSV. Open it alongside your expense spreadsheet. Go through each bank transaction and check it off when you find the matching entry in your records. Make a list of anything that doesn't match.

Use the same reconciliation template provided above for the no-tech method to balance everything out. Remember to book any missing items or make note of timing differences to carryforward for next month's reconciliation.

- Affordable Tech - Use your accounting software's bank feeds and reconciliation screens. The software will suggest matches - your job is to review and approve them, then investigate and correct any unmatched items.

🦆Quack Fact Reality Check - Most Canadian banks charge extra for paper statements these days, so you're likely working with eStatements. The process is the same - you're just choosing whether to view them on your computer, print them, download the data, or connect them directly to your software.

If you are using eStatements, make sure you take the time to download your bank and credit card statements as you need them. They are a third party source document and CRA will want to look at them.

Review your receivables

List all unpaid invoices. Send one polite reminder for invoices overdue in the past seven days. Create a simple system to track what's outstanding. If you are using accounting software, this should be an easy process. Run the Aging Accounts Receivable report and use your software's features to email the reminders. I chat about how important it is to stay on top of your accounts receivable on bookkeeping-essentials.com.

Set up your tax savings (learn your cash rhythm)

- Decide what percentage of income to set aside for taxes (start with 15-20% excluding GST/HST if you're unsure). Adjust it as you learn your own cash rhythm.

- Set up an automatic weekly or bi-monthly transfer to a separate savings account. See the simple cash management system I chatted about in week 2 for more details about the why and how.

Daily habit to build

Once a week, spend 15-20 minutes reconciling the week. Pick a time when you're fresh and have a quiet block - whether that's Friday morning with your coffee, Thursday afternoon, or whenever works for your energy and schedule ... but it needs to be a penciled in regular scheduled activity. No procrastinating. Remember you are aiming for consistency not perfection.

- 🦆 Routine Reality Check

Weekly reconciliation feels tedious now, but here's what's happening ... you're training your brain to spot patterns and problems early. In three months, you'll catch bank errors immediately instead of discovering them at year-end. The routine is building your business intelligence muscle. Reconciliation anxiety is normal. You are checking that everything matches, which feels high-stakes. Remember, most discrepancies are simple such as a missed bank fee, a timing difference (deposit in transit or uncashed cheque), or a transaction you forgot to record. Work through the discomfort knowing you're building crucial financial awareness.

This week's tasks

- Set up automatic tax savings transfers.

- Reconcile your main business bank account first, then chip away at any other bank accounts you have.

- Reconcile your business credit card.

- Post/record any missing transactions you discovered during reconciliation.

- Send overdue invoice reminders.

- Micro challenge - Here's your discomfort drill for this week. Reconcile (clear) 5 transactions. Send 1 reminder. Done.

Habit hook

On whatever day works for you, reconcile your past seven days when you are fresh and focused.

Week 4: Review and Secure Your System

Future me gets paid for this 10 minutes.

- The Goal - Build your compliance calendar, set up basic backups, and establish your monthly review routine. Build the habits that keep you compliant and help you make smart business decisions.

Create your compliance calendar

Mark key CRA dates, GST/HST filing deadlines, and any installment payment dates. Put these in whatever calendar you actually check. Check out 'Daily Compliance' on the top menu bar to help you decide what your deadlines are. Don't forget to include your inventory count at year-end if it applies to your business.

Set up backup basics

- Choose your cloud drive and enable 2FA

- Ensure your filing system auto-syncs

- Schedule monthly eStatement downloads

- Organize your 7-year filing system (physical envelopes by month/year, digital folders with consistent naming, cloud storage services or a document management subscription)

- Backups and retention (3-2-2 rule)

In today’s cyber environment, treat backups as part of compliance. Follow 3-2-2 ...

Keep 3 copies of every source document on 2 different media/services with 2 offsite.

🦆 CRA Audit Ready: Your 7-Year Filing System Options

The CRA requires you to keep business records for 7 years. Here are three approaches that work:

No Tech (Paper-First System)

- Monthly envelopes in banker's boxes (or filing cabinet), labeled by year/month.

- Scan important receipts as backup to cloud storage (Sync.com, OneDrive).

- Keep all paper originals (fuel receipts, parking, cash purchases) even if you scanned them.

Low Tech (Digital-First System)

- Year > Month folder structure with consistent file naming (YYYY-MM-DD_Supplier_Amount).

- Store in cloud storage services (Sync.com, Dropbox, Drive, OneDrive, iCloud) for sync/availability and as a secondary copy. (Rely on your true backup service or external drive for the actual backup layer.)

- Keep paper originals only where CRA specifically requires them.

Affordable Tech (Hybrid System)

- Use Document Management Systems* (LedgerDocs/Hubdoc) for smart processing—these read receipts, categorize expenses, and integrate with accounting software.

- Cloud storage services* provide your independent backup and general file sync.

- Monthly envelopes for cash receipts and required paper originals.

*The Difference - Document Management Systems are smart filing cabinets that understand business documents. Cloud storage services are digital lockers for backup and sync. Use DMS for processing, cloud storage for backup. You may be wondering why the distinction matters. DMS like LedgerDocs can extract data from a receipt, categorize it, and push it to an accounting platform like QuickBooks. Dropbox just stores the receipt image as a file.

DMS is designed specifically for business documents with features like:

- OCR (reads text from receipts)

- Expense categorization

- Integration with accounting software

- Audit trails and compliance features

- Workflow automation

- Search by vendor, amount, date, etc.

- Examples - LedgerDocs, Xero's Hubdoc, or the more expensive Dext

Cloud storage services are more for general document storage and syncing with features like:

- File backup and sync

- Folder sharing

- Version control

- Basic search by filename

- Examples - Dropbox, OneDrive, Google Drive, iCloud, Sync.com

For bookkeeping, a DMS is more powerful, but cloud storage is essential for backup and general file management. Many businesses use both - DMS for active document processing, cloud storage for backup and general files.

🦆Key Rule - Whatever system you choose, you must be able to find any receipt within 2-3 minutes during an audit. Test this regularly!

Monthly review (minimum viable checklist)

This should be an 'evergreen' list that you revise on an ongoing basis as you develop your routine. If you've been doing your Money Mondays and Treasury Thursdays consistently, this monthly review will take less time. Why? You're just confirming patterns you've already been tracking weekly. On the first business day each month:

- Back up your records and test you can open a random file.

- Skim your P&L and cash; note unusual spikes or dips. Your weekly Treasury Thursday reviews make this step faster. You are looking for monthly patterns, not weekly surprises.)

- Quick GST/HST check: collected vs. ITCs (and PST/QST if applicable).

- Download and file bank/credit eStatements.

- 10-minute business intelligence skim for any new tariff/shipping/input cost updates.

- Adjust upcoming quotes or pricing if costs moved.

Daily habit to build

End-of-day 2-minute process-then-file - Only file items you’ve already coded/posted today. Name the file using your convention, scan paper if needed, and place originals in your monthly envelope. Leave unprocessed items in the Admin Inbox for your next scheduled processing block Money Monday for bookkeeping, Treasury Thursday for cash management, or your chosen times).

- 🦆 Routine Reality Check

Monthly reviews become powerful when they're routine. You're not just checking numbers; you're developing the habit of stepping back and seeing the big picture like CEOs and CFOs do in large companies. This routine will help you spot trends, catch problems early, and make faster decisions when costs shift unexpectedly.

Monthly reviews can feel overwhelming at first. Shrink it. Open your P&L, read the totals line, ask one question. If you are using accounting software, sort the expenses not alphabetically but by largest expense to smallest expense. Concentrate your review initially on the largest expense categories. Next month gets easier.

Your Money Mondays keep your paperwork current and your books up to date. Your Treasury Thursdays track your weekly cash position and help you spot trends early. This monthly review connects the dots between the two, giving you the big-picture view that drives smart business decisions.

This week's tasks

- Create your 7-year record retention system.

- Test that you can actually find and open a receipt from three weeks ago.

- Check to make sure you have last month's bank statements and credit card statements downloaded.

- Build your compliance calendar for the rest of the year.

- Set up your 3-2-2 backup system.

- Micro challenge - Here's your discomfort drill for this week. Perform a 10-minute review. Close the laptop even if you want to keep going. Leave a win for next time.

Habit hook

On the first business day of each month, back up your records, check your profit and loss (P&L), and spend 10 minutes skimming industry updates that affect your business.

Push Through the Discomfort - The 10 Minute Rule

Set a timer for 10 minutes and start your admin task. When it rings, you can stop. Most days you'll keep going because starting is the hardest part. But if you stop, you've still kept your streak alive.

The 30-day reset builds the habits. The ongoing routine maintains them. You'll still have days when you don't feel like doing your weekly reconciliation or monthly review. That's normal. Do it anyway! The discomfort fades, but the business intelligence you gain compounds.

Your Minimum Viable Routine (What Happens After the Reset)

Once you've built the foundation by undertaking the 30 day administration reset, here's what your ongoing routine looks like:

Daily (10 minutes)

- Capture receipts and client notes.

- Post yesterday's transactions.

- Send today's invoices.

- Log mileage if you drove for business.

- Back up all records.

Weekly (30-45 minutes)

- Review receivables; send gentle reminders.

- Move money to tax savings if you didn't automated the process.

- Check GST/HST collected vs. ITCs and move the difference to your GST/HST trust account.

- Clear your Admin Inbox.

Monthly (60-90 minutes)

- Reconcile bank and credit accounts.

- Review your P&L and cash position.

- Business intelligence check: skim updates on tariffs, shipping costs, or key input prices that affect your business.

Quarterly/Annually

- File GST/HST returns on time.

- Pay tax installments if required.

- Year-end tasks: inventory count, information returns, assemble T2125 supporting documents (might not be necessary if you've kept to your daily / weekly schedule throughout the year).

No Tech, Low Tech, Affordable Tech: Choose What Fits Today

Choose your comfort level: Whether you prefer paper and pen or digital tools, the key is picking a system you'll actually use consistently. Behaviour beats features!

Choose your comfort level: Whether you prefer paper and pen or digital tools, the key is picking a system you'll actually use consistently. Behaviour beats features!Here's my philosophy. Choose efficiency and convenience over bells and whistles. If a tool doesn't save you real minutes every week or remove an error risk you actually have, skip it for now. Focus on what you need now, not what you want or would be nice to have.

- 🦆 Routine Reality Check - Behaviour beats features

Most AI-powered tools are built for businesses doing hundreds of transactions monthly. If you're processing 20 receipts a week, a $50/month AI solution is solving a problem you don't have yet. Start simple, upgrade when the manual process actually hurts. - Having said that, I'd also make the case for using a basic accounting subscription. if a basic, affordable tool (like QBO Easy Start) makes you show up every week and stick to the routine, that’s valuable. Reduced friction and better follow-through (it solves your pain points) are legitimate reasons.

A Practical Decision Rule

- Behaviour ROI - If the tool measurably increases your consistency (you keep 'Money Monday', reconcile weekly, and run a monthly P&L), it passes (even if minutes saved are modest).

- Utility rule of two - Keep a paid tool if it gives you at least two of these today: faster capture, fewer categorization errors, easier GST/HST, better collections, simpler year-end.

- 90‑day experiment - Commit to basic accounting software for 90 days. If you complete 10+ weekly sessions, file one GST/HST return (if registered), and use the monthly review twice, keep it. If not, downgrade to spreadsheet without guilt.

What is Behaviour ROI?

You are applying 'return on investment (ROI)' specifically to behaviour change rather than just financial returns. As mentioned above, a tool that reliably helps you stick to your admin routine (consistent 'Money Monday' sessions, regular reconciling, monthly P&L reviews) delivers value even when the time savings aren't dramatic.

- What You're Measuring - your investment which is the cost of the tool (money) + time to learn it; your return which is improved consistency in doing your bookkeeping tasks.

Sometimes the value isn't just 'saves X minutes per week' but 'makes me actually DO the task consistently'. A tool that costs $28/month but gets you to reconcile weekly has positive Behaviour ROI, even if it doesn't technically save time.

When QBO Easy Start makes sense

- You want built-in GST/HST handling without maintaining formulas.

- You’ll actually invoice from it (and use automatic reminders).

- You pay your bills on time (you don't have accounts payable).

- Bank feeds reduce manual entry for you (and you’re okay fixing the odd feed hiccup).

- You like receipt capture attached to transactions for easy CRA drill‑downs and audit ready books.

- You want year-end to be simpler for your tax preparer (exportable reports, searchable history, easier trend tracking).

- The $28/month keeps you consistent versus spreadsheets gathering dust.

Caveats

- Entry-level plans typically don’t include A/P (vendor bills), recurring transactions, projects, or multi-currency.

- Attachments inside QBO should not be your system of record. Keep an independent copy (cloud folder or DMS) for CRA retention and portability.

- Bank feeds can break; know how to do a CSV import as a fallback or enter data manually until fixed.

- Prices can increase. Intuit is bad for this. They increase subscription prices every year. I find the pricing is slowly getting out of my reach for the features I use.

Behaviour beats features. If a basic subscription like QBO Easy Start ($28/month) makes you actually do Money Monday, auto‑tracks GST/HST, and keeps your invoices and receipts organized, that can be worth it even at low volume. Use this quick test:

- Am I more consistent with it than without it?

- Does it make GST/HST and invoicing simpler this month?

- Can I export everything (reports, CSV, attachments) if I leave?

If yes, keep it. If no, go spreadsheet for now and revisit in three months. Start simple, upgrade when the manual process actually hurts.

When a spreadsheet is still a great fit

- Very low volume (a handful of transactions weekly).

- You prefer offline control and a simple scorecard.

- You don’t invoice much (or use e-transfer requests).

- You’re comfortable tracking GST/HST net in a simple tab.

- You want zero subscription overhead right now.

Start simple, upgrade when the manual process actually hurts.

Remember the 5-piece system I introduced earlier in this article? Let's look at how your choice of tech level affects each process.

Refresher of the 5-step process you are creating. You pick your tech comfort level.

Refresher of the 5-step process you are creating. You pick your tech comfort level.For Capturing

- No tech - Physical tray + envelope in your vehicle + paper mileage log. Printed category list with category totals (tape listed) stapled to monthly envelope(s).

- Low tech - Phone camera + single cloud folder + synoptic spreadsheet for recording your transactions.

- Affordable tech - Document management software with your inbox.

For Categorizing

- No tech - very effective, old fashioned, manual synoptic ledger.

- Low tech - Spreadsheet with T2125-aligned categories setup as a synoptic ledger.

- Affordable tech - Entry-level bookkeeping software with or without bank feeds.

For Reconciling

- No tech - Monthly statements + highlighters + calculator + your synoptic ledger.

- Low tech - bank CSV downloads into synoptic spreadsheet.

- Affordable tech - Bank feeds (or manually uploaded bank transaction file) with reconciliation screen.

For Reviewing

- No tech - Create a simple evergreen monthly checklist on paper. Trend track by manually entering a few relevant totals important for being (or remaining) profitable. This helps you learn your business's rhythm which you can monitor for issues.

- Low tech - Create a simple evergreen monthly checklist in your spreadsheet in one tab. Trend track by manually entering a few relevant totals important for being (or remaining) profitable in a second tab. This helps you learn your business's rhythm which you can monitor for issues.

- Affordable tech - Use your software's dashboard highlights and reports including P&L, A/R and A/P aging, bank balances, overdue alerts (only works if your books are up-to-date). Also, log in to your bank and scan bank balances to avoid overdrafts.

Example of a Monthly Scorecard (Trend Tracking)

- Create a 'Monthly Scorecard' on ledger paper or in a spreadsheet (12 columns, one column per month)

- Track 6–10 numbers you actually use:

- Sales

- COGS (if applicable)

- Gross profit (formula: Sales – COGS)

- Operating expenses (total)

- Net income (formula: Gross profit – Expenses)

- Cash end balance

- A/R outstanding

- A/P outstanding

- GST/HST net position (collected – ITCs)

- Owner draws (optional)

- One 'note' column (any pricing/cost changes or other things you noticed)

Where AI Can Help (But Isn't Required)

If you're curious about AI tools, here's where they can actually save time:

- OCR and auto-tagging of receipts.

- Use of 'recurring' transactions features in accounting platforms.

- Drafting polite invoice reminders.

- Suggesting expense categories (you still approve).

- Calendar and checklist automation.

🦆 Cautions - Keep human oversight, confirm where your data lives, and make sure you can export everything if you change tools.

Beyond Basic Backups: Protecting Your Business Data

You've built your 30-day routine, but what happens if your computer crashes on day 31? The CRA requires you to keep business records for seven years, but they don't specify how. They do require it in a format that's "accessible and readable"*. Understanding your three data storage options helps you choose what works for your business, protects you when things go wrong, and keeps you CRA compliant.

*CRA expects records to be kept in Canada and available on request. If you host abroad, ensure you can produce/download copies in Canada on demand; some businesses may need CRA approval to keep primary records outside Canada.

Three Types of Data Storage (And What Each Actually Does)

1. Document Management Systems (DMS)

- Popular choices - LedgerDocs (Canadian), Xero's Hubdoc, Dext (may be a bit pricey)

- Purpose - Smart processing of business documents

- Best for - If you want automated receipt processing

Think of DMS like LedgerDocs or Hubdoc as your smart filing cabinet. They actually read your receipts, extract data, categorize expenses, organize them for you, and push information to your accounting software. The upside? They're built for CRA compliance and make audits much easier, and count as one of your backup copies in the 3-2-2 rule. The downside? They only back up your business documents - if your computer crashes, you still need to reinstall everything and rebuild your setup. As for the monthly fee? If it makes you actually stick to your Money Monday routine, that's positive behaviour ROI.

In short, DMS are intelligent filing systems that help you automate your storage system to bring efficiencies through its push to your accounting software, its search capabilities when retrieving a document, it efficiently helps you comply with CRA document storage requirements while letting you still be in control of the documents are organized.

DMS ≠ system backup; it protects documents, not your computer.

2. Cloud Storage Services

Popular choices - Dropbox, OneDrive, Google Drive, Sync.com, iCloud

Purpose - File access and syncing across devices (not backup)

Best for - Basic CRA compliance and file access

Cloud storage services like Sync.com or OneDrive are more like having a filing cabinet that follows you everywhere. They sync files across your devices and provide online access to your documents. Great for accessing last month's bank statement from your phone, and they definitely meet the CRA's "accessible" requirement. Just remember - when you delete something, it deletes everywhere ... possibly losing previously filed CRA source documents. That's convenient until it's not.

Most cloud drives keep a short version history, which can rescue an accidentally deleted file, but it’s not a true backup. Pair it with a proper backup service or an external drive.

Like DMS, there is a fee but if you take behaviour ROI into consideration, it may not be a factor. However, if you're using cloud storage for document retention, data location matters for privacy and legal compliance. Keep in the back of your mind that Canadian data residency options are limited but with the current trade war and threats made to Canada's sovereignty, this issue may become an issue you need to include in any SWOT (strengths, weaknesses, opportunities, threats) analysis of your business.

3. True End-to-End Backup Services

Popular choices - Backblaze, Carbonite, Acronis, IDrive, Crashplan

Purpose - Complete system protection and disaster recovery

Best for - Can't afford any downtime

True end-to-end backup services like Backblaze are your insurance policy. They take snapshots of your entire system at different points in time. If disaster strikes, they can restore everything (your software, settings, files, and business setup) exactly as it was last week or last month. Hard drive failures and ransomware attacks are real threats. The trade-off? It’s not for day‑to‑day receipt retrieval—that’s your DMS/cloud. It’s for getting your entire system back on its feet when disaster hits.

Real-World Scenarios: How Each Responds

When your hard drive crashes at 2 AM or ransomware locks up your files, that's not the time to discover your backup strategy has gaps. Let's give clear examples on what protects your business and what doesn't.

Scenario 1: Your computer crashes Tuesday morning

- DMS - Your processed receipts are safe in LedgerDocs, but you need to reinstall software residing on your hard drive and recreate your setup.

- Cloud Storage - Recent files are accessible from another device, but your software and settings are gone.

- Backup Service - Complete system restore gets you back to work in hours with everything intact.

Scenario 2 - You accidentally delete three months of categorized receipts

- DMS - LedgerDocs keeps versions; you can likely recover the deleted items.

- Cloud Storage - If the deletion synced, files may be gone (limited recovery window).

- Backup Service - Restore from any backup point before the deletion occurred.

Common Approaches for Solopreneurs

- Basic protection could be (1) cloud storage for document access and CRA compliance, (2) external drive backup or basic backup service.

- Complete protection could be (1) DMS for active document processing and second or third copy of data if using the 3-2-2 backup system, (2) cloud syncing storage for document access, and (3) backup service for complete system recovery (not synced across devices).

- The 3-2-2 rule - Keep 3 copies of critical data including source documents, on 2 different types of media/services, with 2 located offsite and preferably different parts of the country (data servers in the west and the east).

Why 3-2-2 instead of the classic 3-2-1? The current thinking is that in Canada, east–west redundancy matters—if one region suffers a major outage or cyber incident, your second offsite copy in the other region keeps you working.

One local external drive at your office, plus two offsite copies on different services or in different regions (for example, a Canadian cloud provider and an encrypted drive stored with family in another province). If you can’t pick regions with your provider, make the second offsite a different service or a physical drive in a different city.

If 3-2-2 feels heavy today, acknowledge it. Start with 3-2-1 and add the second offsite copy when you’re ready. The goal is resilient access you’ll actually maintain. - Habit building - The best backup system is the one you'll actually use consistently. Pick one approach and test it monthly rather than building a complex system you'll ignore.

- Test your system - Try restoring a file from last month. If you can't do it easily, your backup strategy needs work.

When trade costs shift unexpectedly (or the CRA comes to audit), you need access to your historical data to model pricing changes quickly. A good backup strategy ensures that data is always available when you need it.

Why This Reset Matters More Than Ever

Remember those shifting trade costs you've been tracking? Clean, current books let you model cost changes fast. When a tariff hits your supply chain or shipping rates jump, you need to know immediately what that means for your cash flow and pricing.

Keep an eye on data sovereignty issues when you do your SWOT analysis and preplan how you will handle a scenario (if it arises) where the White House directs cloud providers to stop servicing Canadian clients, wreaking havoc on your operations (worst case scenario planning).

Add this to your monthly routine - spend 10-15 minutes on 'business intelligence lite'. Skim updates on tariffs, check your key input costs, read your industry association's policy bulletins. When your books are organized, you can actually use this information to make smart decisions instead of just worrying about it.

Important CRA Compliance Notes

A few key reminders (always verify current rules at canada.ca):

- GST/HST registration - Generally required when you exceed $30,000 in worldwide taxable supplies in a single quarter or four consecutive quarters.

- Filing deadlines - Self-employed returns typically due June 15, but any balance owing is usually due April 30.

- Installments - May be required when net tax owing on your income tax and benefits return (T1) exceeds certain thresholds.

- Records - Keep for seven years; electronic copies are now acceptable (with a few exceptions) if readable and accessible.

Start by Starting

This is what 'getting your ducks in a row' looks like: organized systems, current books, and the confidence to make quick business decisions. Start by starting!

This is what 'getting your ducks in a row' looks like: organized systems, current books, and the confidence to make quick business decisions. Start by starting!Pick your start date. Put a 30-minute block on your calendar called 'Ducks in a Row'. Make a checklist from this article. Set up that Admin Inbox.

Remember, this isn't about perfect books on day one. It's about building habits so strong that by 12 months from now, you'll be the solopreneur who's got their ducks in a row while everyone else is scrambling.

Consistency beats perfection. Every small habit you build (no matter how simple) moves you closer to audit-ready books and a business that can handle whatever comes next.

Your future self will thank you. Start today.

Ready to dive deeper? Check out my detailed guides on T2125 categories, GST/HST basics, and record-keeping requirements. For more comprehensive bookkeeping guidance, visit bookkeeping-essentials.com by clicking on the link under the site search box (at the top of the page).

* Profit First is a registered trademark in the U.S. and other countries.

Disclaimer: I am not a certified Profit First Professional or associated with Mike Michalowich. I just like the system and introduced some of my client's to it. Get Mike's book to learn more about the system.

Back to top