- Essential Bookkeeping Habits For Audit Ready Books in Canada

- Navigating Change

- De Minimis Exemption Ended

U.S. De Minimis Exemption Ended

4 Strategies for Canadian Small Businesses

By L.Kenway BComm CPB Retired

This is the year you get all your ducks in a row! Start by starting.

Published September 9, 2025 | Updated October 10, 2025 | Revised October 13, 2025

WHAT'S IN THIS ARTICLE

What Just Changed | FAQ | 4 Strategic Options | The Bigger Picture | Fighting Back | 30 Day Action Plan | Survival Tips | Real Stories | Bottom Line and Next Steps

PREVIOUS ARTICLE >> An Introductory Primer On How Tariffs Impact Canadian Small Business

Packages that used to cross duty-free now require payment

Packages that used to cross duty-free now require paymentOverview

U.S. De Minimis Exemption Ended For Canadian Sellers

On August 29, 2025, the U.S. eliminated its $800 de minimis exemption for commercial shipments that allowed small packages to enter duty-free. This affects all Canadian businesses shipping to U.S. customers. Here's what you need to know and do.

This change requires all commercial imports to the U.S., regardless of origin, to face "all applicable duties" and necessitates formal customs entry, impacting Canadian and other businesses involved in cross-border e-commerce.

Important Note

I'm a retired Certified Professional Bookkeeper who helped Canadian solopreneurs stay CRA-compliant. Trade and customs regulations were never my specialty. I'm writing this article to help you figure out what questions to ask your accountant, customs broker, or trade advisor. Sometimes the hardest part is knowing what to ask! Think of this as your prep work for a productive conversation with the right professionals.

Whether you think you can or you think you can't, you're right.

Henry Ford

Dealing With The New Normal of Tariffs Series

Not interested in this article? Where do you want to go next? Click on the picture to go any of these other articles in the tariff series.

If you haven’t read my first article in this series (understanding how tariffs impact your business), start there. This article is about choosing your next step fast.

There's a new change affecting how you ship physical goods to the U.S. that requires your immediate attention. As you work your way through this article, remember services and digital products are not impacted by de minimus.

U.S. De Minimis Exemption Ended

At A Glance: What Just Changed

(And Why It Matters)

For 87 years, small packages could cross into America duty-free. The current threshold for a 'small packages' are those worth less than $800 USD. This rule, called the 'de minimis exemption', made it simple and affordable for Canadian small businesses to sell (and ship) to U.S. customers.

That rule died on August 29, 2025.

More >> Trade Timeline: Key Dates in the 2025 U.S.-Canada Trade Conflict

What This Means If You Ship Physical Goods

Now every package you ship to the U.S. faces duties. These may be charged at the country‑of‑origin International Emergency Economic Powers Act - IEEPA tariff rate, which varies by where the product was actually manufactured - for example, if the goods originated in Canada, your current IEEPA duty rate is 35%. If you're reselling goods made in other countries, your rates may be different and potentially higher. Alternatively, during a six‑month transition period, some shipments may be charged a flat duty based on the applicable IEEPA rate: $80 for rates under 16%, $160 for rates between 16-25%, and $200 for rates above 25%. Carriers may implement one approach or the other by product/route. Ask your carrier or customs broker which applies to your shipments today.

But here's the kicker - you must prepay these duties before Canada Post (or any other commercial shipper) will even accept your package for shipping.

According to Canada Post's August 27, 2025 notice: "Due to the U.S. Executive Order 14324, all U.S.-bound postal shipments must have duties collected at origin effective August 29, 2025. This means every package under US$800 going from Canada to the U.S. must have proof that duties were paid before the shipment can be accepted for delivery."¹

This isn't just a policy change. It's economic warfare designed to make cross-border commerce so expensive and complicated that you either exit the U.S. market or relocate your business there.

Build added costs and processing time into your pricing and timelines for physicals goods. It does not affect services or digital products.

🦆 Waddle you need to watch: Watch for updates about the U.S. appeals court status. While a lower court ruled IEEPA tariffs illegal in May 2025, the August 2025 Federal Circuit allowed them to remain in force until at least Oct 14, 2025, pending a possible Supreme Court appeal. That means the prepayment requirement and current duty approach (transitional flat fees or country‑of‑origin tariffs) still apply today. Treat any change after Oct 14 as upside; plan on the status quo until you receive formal guidance from your carrier or broker.

How It Actually Works

Here's how the transitional flat rate system works in practice: Let's say you're shipping a Canadian-made product worth $25. Normally, a 35% duty would cost $8.75. But under the flat rate system, because Canadian goods face a 35% IEEPA rate (which falls in the "above 25%" bracket), you'd pay a flat $200 fee instead - regardless of whether your product is worth $25 or $250.

This system is intentionally punitive for lower-value shipments. A $25 product faces an effective 800% duty rate ($200 ÷ $25), while a $250 product faces an 80% rate. The goal is clear: make small cross-border shipments so expensive that businesses either exit the market or consolidate into larger, less frequent shipments.

Additionally, according to PwC Canada, "Any carrier transporting international postal shipments to the United States must have an international carrier bond to ensure payment of the duties."⁷ This means your shipping options may become more limited as smaller carriers may not be able to meet these bonding requirements."

I'll admit this confuses me as to why you need prepayment and a carrier bond. I'm going to assume that the exact mechanics of prepayment duty collection and carrier bonding requirements are still being clarified - another reason to contact your carrier directly for current procedures.

Frequently Asked Questions About The End of U.S. De Minimis For Canadian Sellers

What is the de minimis rule?

What is the de minimis rule?

Prior to August 29, 2025, it was a long-standing exemption that allowed goods with a value of less than $800 USD to enter the U.S. without being subject to duties or formal customs entry procedures.

What changed for duty-free shipping to the U.S. on August 29, 2025?

What changed for duty-free shipping to the U.S. on August 29, 2025?

An executive order signed by President Trump removed this de minimis threshold. Now, all previous duty-free shipping of commercial U.S. imports under $800 USD are subject to applicable duties and tariffs. All commercial shipments require formal customs entry, a process previously waived for low-value goods.

How are duties calculated on small shipments now that de minimis has ended?

How are duties calculated on small shipments now that de minimis has ended?

Since the end of the U.S. $800 de minimis threshold on August 29, 2025, all small shipments to the U.S. are subject to duties and customs fees, with fees calculated based on (1) ad valorem duty rate - the Harmonized Tariff Schedule (HTS) or (2) until February 28, 2026 only, country-specific International Emergency Economic Powers Act (IEEPA) tariffs.

- You will need to determine the HTS code and country of origin for your product; then find the applicable duty rate.

- Check if your product's country of origin has any IEEPA tariffs.

- Calculate the ad valorem duty as well as any customs fees.

What's the impact on my Canadian business now that de minimis has ended?

What's the impact on my Canadian business now that de minimis has ended?

Businesses that previously shipped low-value items duty-free now face higher costs due to tariffs and customs clearance fees. Expect the requirement for formal entry to add many logistical hurdles and paperwork for businesses. Canadian e-commerce merchants will see increased costs and complexity with U.S. shipping.

You'll need to adjust your pricing strategy to either absorb the increased costs, pass them to customers, exit the U.S. market, or become CUSMA compliant (and all that involves). Focus on consolidating small shipments to reduce costs because one customs entry fee is more cost-effective than many individual entries.

Remember to use duty and landed cost calculator tools to estimate costs and inform your customers.

What happens to returns and exchanges now that de minimis has ended?

What happens to returns and exchanges now that de minimis has ended?

Now that U.S. de minimis has ended, returns of international purchases are more complex and costly due to potential double taxation (duties on the original shipment and again on the return). You may experience longer processing times, increased paperwork for customs compliance, and higher overall costs. You will likely see brands limit free international returns, shift to local warehousing, or possibly use duty drawback programs to manage these new complexities when possible.

U.S. De Minimis Exemption Ended

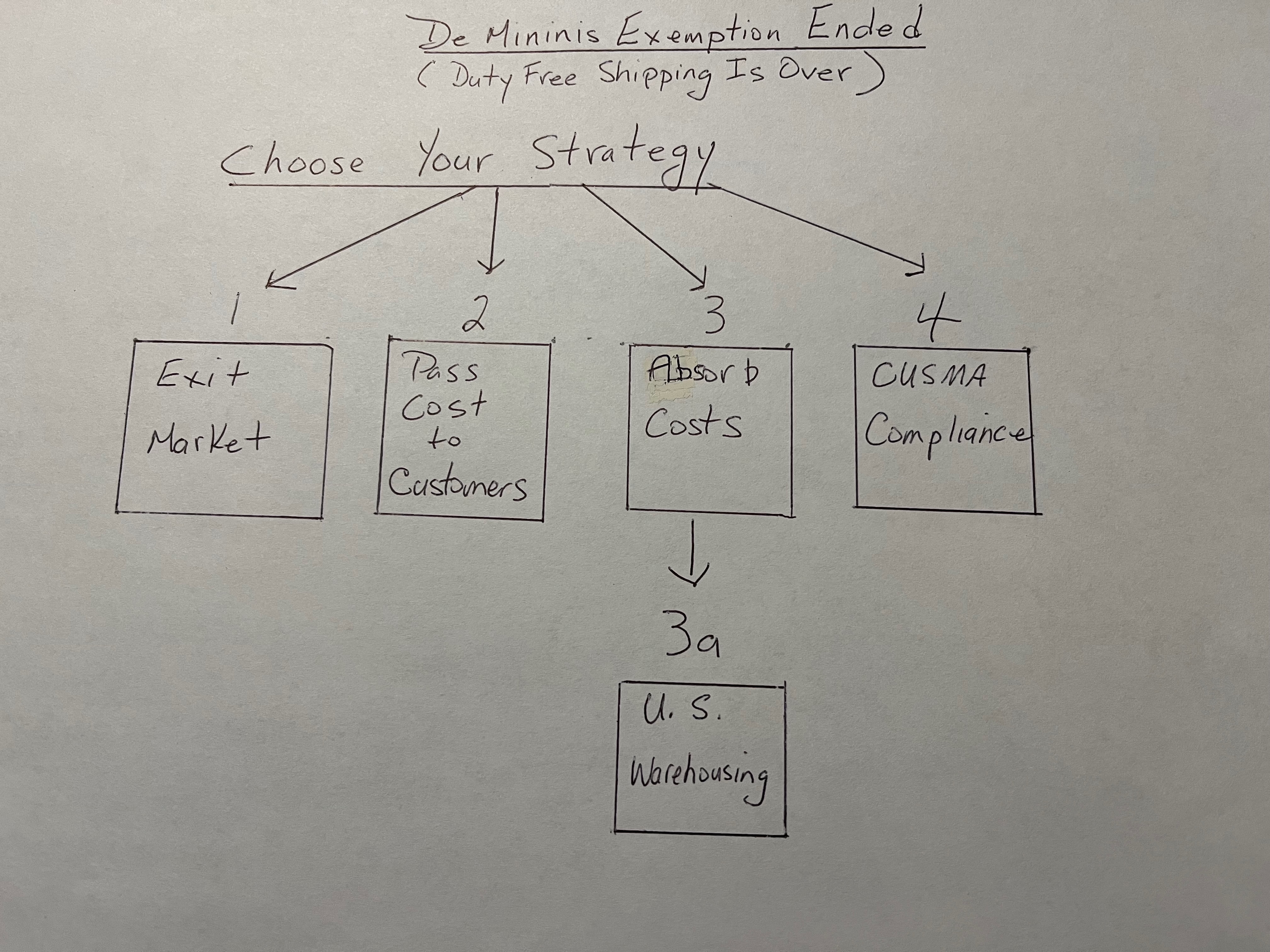

Four Strategic Options

Choosing Your Path

Decision Starter Kit ... Pick a Path

I've quickly sketched your options (as I see them) now that U.S. duty free shipping is over.

I've quickly sketched your options (as I see them) now that U.S. duty free shipping is over.- If U.S. sales are under 30% of revenue or low‑margin, pause U.S. shipping for now and refocus on Canada/other markets.

- If customers are loyal and margin is healthy, test passing through duties at checkout (start at 100%, then test lower).

- If cash flow is strong and you expect a short disruption: Absorb duties temporarily on select SKUs and review monthly.

- If your goods are North American‑made: Ask a customs broker if your products could qualify under CUSMA rules.

Implementation Notes

- General guideline - If your gross margin minus the duty rate is under 20%, test price increases or narrow your U.S. catalog.

- Customer-facing message (for cart/confirmations) - 'Due to new U.S. import rules, orders shipped from Canada may include U.S. government duties. We collect this at checkout and prepay it so your package isn’t delayed. We do not mark up these government fees.'

How Canada's Major Grocers Are Responding

Real Time Scenario

Before diving into your options, let's look at how three of Canada's largest retailers handled the same challenge.

When tariffs hit, Loblaws, Metro, and Sobeys (Empire) faced the same question you're facing now: absorb costs, pass them through, or find another way?

Their multi-pronged response:

- They passed costs to customers. All three retailers took a hard stance on approving price increases from suppliers. "There is no acceptance of increases unless they can truthfully demonstrate where the commodities or the ingredients that are being used are experiencing significant increases," said Michael Graydon, CEO of the Food, Health & Consumer Products of Canada association.¹

- They didn't absorb tariff costs. When asked whether they absorbed part of the tariff costs themselves, Metro and Empire did not directly respond. Loblaw stated clearly: "as a business, our role was not to subsidize U.S. manufacturers by absorbing tariffs."¹

- They diversified away from U.S. suppliers. Executives at all three grocers reported declining U.S. product sales, offset by stronger sales of Canadian goods thanks to the "Buy Canadian" movement. They actively diversified supply sources to include more Canadian and non-U.S. suppliers.¹

Loblaw's purchasing team shifted nearly 25% of its produce sourcing away from the U.S. to other countries by May, and brought on more than 100 new small Canadian suppliers by September.¹

Lindt, which historically sourced about 50% of chocolates sold in Canadian stores from U.S. factories, announced that by summer 2025, all of Canada's supply would come from Europe instead.¹

🦆 The lesson for small businesses

Even billion-dollar corporations with deep pockets chose not to absorb tariff costs. Instead, they combined transparent pricing with strategic supplier diversification—approaches available to businesses of any size.

¹ Ren, Estella. "Tariffs? What tariffs? How Loblaws, Metro and Sobeys are keeping profits high despite Trump's threats." The Toronto Star, October 4, 2025.

Now let's explore how you can adapt these strategies to your situation.

Option 1: Exit the U.S. Market (Temporarily or Permanently)

Finding your way out: sometimes the best strategy is redirecting energy toward markets where you can actually win.

Finding your way out: sometimes the best strategy is redirecting energy toward markets where you can actually win.When this option makes sense:

- U.S. sales are less than 30% of your revenue.

- You can't afford to prepay flat rate $80-200 per package. Country of origin rates may be untenable if not from Canada or the U.S..

- You need time to explore other options.

Questions for your accountant or marketing expert:

- What's the tax impact of stopping U.S. sales?

- How do we handle existing U.S. customer obligations?

- What's our cash flow look like focusing only on Canadian sales?

How to do it right:

- Email U.S. customers immediately explaining the situation.

- Be honest: "U.S. government policies now require us to prepay $80-200 in duties per package".

- Keep customer contact information for potential future re-entry.

- Focus energy on Canadian and other international markets.

What other businesses are doing:

- Some are being completely transparent with customers: "U.S. government policies now require us to prepay $80-200 in duties per package, which we can't sustain."

- LA Coffee Consultant shipped 12 boxes of inventory. After receiving only 2 of 12 boxes from Taiwan, with the remaining 10 marked for disposal, she told Business Insider, "It impacts my decision whether or not to continue my business." She's now evaluating whether importing is viable at all.⁹

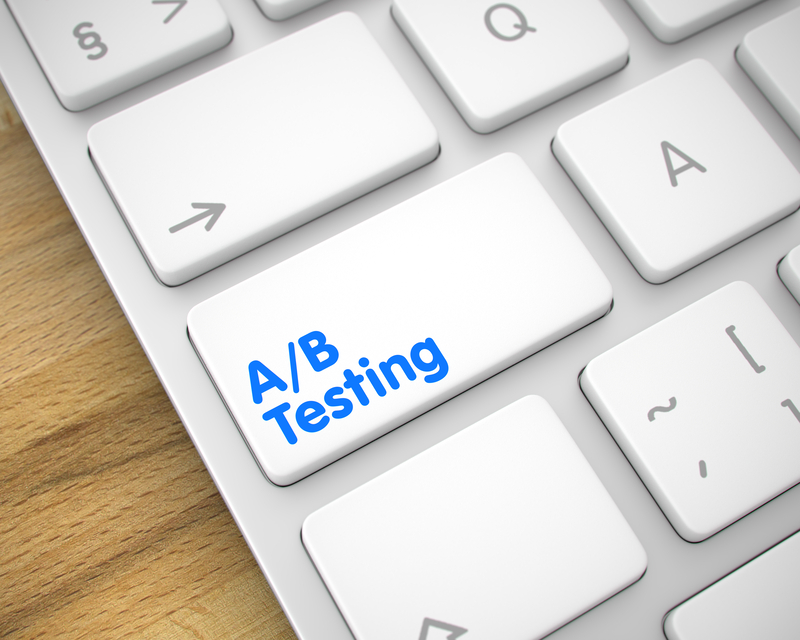

Option 2: Pass Costs to Customers (The Testing Strategy)

Test your way to the right price: start with full cost pass-through, then experiment with discounts to find what works

Test your way to the right price: start with full cost pass-through, then experiment with discounts to find what worksStart by passing through 100% of costs, then test downward (or vice versa). Here's why I think this will work (you know your business and may or may not agree - follow your instincts). Shipping does not attract IEEPA tariffs. For this example, I will ad valorem not flat rate duties.

- Month 1: Full Transparency

Product: Widget $25.00

Shipping: $12.00

Subtotal: $37.00

U.S. Import Duty (collected and remitted on your behalf) @ 35%: $25.00 x 35% =$8.75

Total: $45.75

- Month 2: Test 10% Discount

"Cross-Border Support Discount - We're absorbing 10% of U.S. duties"

We're absorbing some costs to help you deal with new import tariffs!

Product: Widget $25.00

Shipping: $12.00

Subtotal: $37.00

U.S. Import Duty (collected and remitted on your behalf) @ 35%: $25.00 x 35% =$8.75

Cross-Border Support (10% tariff relief): -$0.88

Total: $44.87

- Month 3: Test 20% Discount

"Cross-Border Friendship Discount - We're covering 20% of U.S. duties"

We're absorbing some costs to help you deal with the new import tariffs!

Product: Widget $25.00

Shipping: $12.00

Subtotal: $37.00

U.S. Import Duty (collected and remitted on your behalf) @ 35%: $25.00 x 35% =$8.75

Cross-Border Friendship (20% tariff relief): -$1.75

Total: $44.00

Why start high? You know your customers best on whether this strategy would work but my thought process is:

- You get clean data on true price sensitivity.

- Customers see the real cost of government policies.

- Discounts feel generous rather than price increases feeling punitive.

- You maximize revenue from customers willing to pay full price.

Questions for your accountant or marketing expert:

- How do we structure pricing to be transparent about government import tariffs?

- What's the cash flow impact if we require our customers to payment upfront?

- Should we collect duties at checkout so we’re not out of pocket?

- Alternative Approach - These are complex pricing and cash flow decisions that go beyond my expertise. The key is to work with your accountant or marketing expert to model different scenarios based on your specific margins, cash flow, and customer base. Do you want to test the waters with one loss leader? Do you want to test products simultaneously for faster decision-making? There are so many combinations. Do you want to test at different discount percentages and timing than what I put forth?

What A Big Player Is Doing

When the Star asked ... whether they had absorbed part of the costs from tariffs themselves ...

"As a business, our role was not to subsidize U.S. manufacturers by absorbing tariffs."

Loblaw Companies Ltd., The Toronto Star, October 4, 2025

The reality check your accountant will give you:

- Most consumer products can't survive a 35% price increase. But some can, and you need to run the numbers for your specific situation.

How Businesses Are Testing Carrier Options⁹

- Alex Castellani, Subtext Coffee, Toronto - After weeks of UPS delays in Buffalo and Detroit, combined with customers "paying more in brokerage and tariffs than the entire value of their package," Castellani switched to DHL for US-bound shipments. The carrier change resolved both timing and cost issues.

- Heather Elliott's Comparative Experience - Ordered French cosmetics via UPS and faced an $165 initial charge, then a second $289 charge (including $111 FDA processing fee). Her subsequent Korean shipments via FedEx arrived smoothly with only $27.50 FDA fees, an $83.50 difference on similar products.

- The carrier difference - Business Insider reporting in October 2025 suggests carriers are implementing the new regulations very differently, with UPS appearing to apply stricter documentation requirements and higher broker fees than competitors.

Option 3: Absorb Costs (The Cash Burn Strategy)

Strategic cash burn: absorbing tariff costs while maintaining prices, viable only with strong margins and clear time limits.

Strategic cash burn: absorbing tariff costs while maintaining prices, viable only with strong margins and clear time limits.This option means eating the 35% tariff per package while maintaining current prices.

When this might work:

- You have strong cash flow from other revenue streams.

- U.S. customers represent extremely high lifetime value.

- You're betting on a quick resolution.

The new math makes this option viable for some businesses:

- $25 product = $8.75 in duties (35% × $25)

- $100 product = $35 in duties (35% × $100)

- $250 product = $87.50 in duties (35% × $250)

Questions for your accountant or marketing expert:

- What's our gross margin on each product line?

- Which products can absorb a 35% hit and still be profitable?

- Should we absorb costs on high-margin items but pass through on low-margin ones?

Example scenarios to discuss:

- If you have 60% gross margins, absorbing 35% leaves you 25% to cover overhead.

- If you have 40% gross margins, absorbing 35% leaves you only 5% - probably not sustainable.

- You might absorb costs on premium products but pass through on basic items.

Cash flow questions:

- If we're selling $5,000/month in products to the U.S., we need to prepay $1,750 in duties.

- Should we require payment upfront to cover the duties we have to prepay?

- How does this affect our working capital needs?

Strategic questions for your advisor:

- Should we have different pricing strategies for different product lines?

- Which products are worth keeping in the U.S. market at these duty rates?

- Should we focus on higher-margin items where we can better absorb the costs?

This percentage-based system actually gives you flexibility. You can make different decisions for different products based on their margins.

Real world warning⁹:

Katie Golden's Reality Check - A vintage clothing reseller ordered $179 in used apparel from the UK via UPS. She received a bill for $769 in import fees and broker charges. That's over 4× the order value! I don't know about you, but at that rate, absorbing costs isn't just unprofitable ... I think it's impossible.

This illustrates why the percentage-based duty system requires product-by-product analysis. What seems absorbable at 35% can balloon with broker and processing fees.

Option 3A: U.S. Warehousing (The Infrastructure Play)

Option - Bulk shipping to US warehouse, then individual fulfillment.

Option - Bulk shipping to US warehouse, then individual fulfillment.Some small businesses are exploring U.S. warehouse space to avoid per-package duties entirely. You ship in bulk to a U.S. facility, then fulfill individual orders domestically within the U.S.

The reality check:

- Thousands of businesses globally are competing for limited U.S. warehouse space right now.

- Normal warehouse setup takes months, but most businesses only had weeks to pivot.

- You need sufficient volume to make bulk shipping economical.

- You're taking on U.S. operational complexity (taxes, regulations, logistics).

Questions for your logistics advisor:

- What's our minimum volume to make U.S. warehousing viable?

- What are the total costs including storage, fulfillment, and U.S. tax compliance?

- Can we find available space that meets our timeline?

When this makes sense:

- High-volume, consistent U.S. sales.

- Products with predictable demand patterns.

- Sufficient cash flow to handle upfront inventory investment.

Strategic considerations:

(Remember, every strategic option has trade-offs beyond just the financial calculations.)

- U.S. warehousing means shifting part of your operations outside Canada.

- Consider whether this aligns with your long-term business vision and values.

- Some businesses are choosing to focus on Canadian and other international markets instead.

- Others view U.S. warehousing as a temporary tactical move while building alternative markets.

Option 4: CUSMA Compliance (Your Potential Escape Hatch)

The escape hatch many miss: while others pay 35% duties, CUSMA-compliant products ship duty-free to the U.S.

The escape hatch many miss: while others pay 35% duties, CUSMA-compliant products ship duty-free to the U.S.If 60-75% of your product comes from North America, you might qualify for duty-free treatment under the Canada-U.S.-Mexico Agreement (CUSMA).

Quick assessment:

- Do you manufacture in Canada using mostly Canadian materials? (Likely qualifies.)

- Do you assemble products using North American components? (Possibly qualifies.)

- Do you resell products made elsewhere? (Probably doesn't qualify.)

The investment:

- $200-500 to work with a customs broker to get proper documentation. For most qualifying businesses, this pays for itself in weeks.

- You have to deal with the ongoing administration burden to remain CUSMA compliant. So don't forget to create and maintain your 'origin binder' (physical or digital) per SKU with bills of materials and supplier origin attestations so recertifying is quick.

Here's a real world example reported by Business Insider⁹. Kunal Sharma, (Auto Parts Business, Canada) shipped four car wheels to Texas via UPS in late August. Missing tariff codes resulted in three wheels being returned and the fourth marked for disposal. After escalation to UPS leadership, the fourth wheel was eventually delivered ... but Sharma switched to FedEx for future shipments.

🦆 The documentation lesson: Even businesses shipping eligible products through UPS are facing disposal if paperwork isn't perfect. CUSMA compliance requires meticulous documentation. The alternative (35% duties plus broker fees) makes the investment worthwhile.

The 2026 reality check:

- CUSMA faces review in 2026 and may not survive in its current form. But even if the rules change, the investment likely pays for itself before then. Just make sure the system you setup is flexible and can change quickly.

Understanding The Trade Policy Shift

... a global era of free trade is over and mercantilism is ascendant, with changes that go beyond tariff disputes with the United States.

... What’s going on is not a transition, it’s a rupture.⁸

Prime Minister Carney, September 2025

From Fair Trade To Economic Coercion

THE OLD SYSTEM: Normal trade policy meant open, rules-based international trade where countries weren't unfairly prejudiced against each other, and trade wasn't used as a tool for arbitrary economic or political gain. This predictable system ended when President Trump began his second term in January 2025.

THE OLD SYSTEM: Normal trade policy meant open, rules-based international trade where countries weren't unfairly prejudiced against each other, and trade wasn't used as a tool for arbitrary economic or political gain. This predictable system ended when President Trump began his second term in January 2025. THE NEW REALITY: Economic coercion uses economic pressure (like the new duty prepayment requirement) to force countries to change their policies. As Prime Minister Carney noted, we must now 'buy access' to the U.S. market through compliance.

THE NEW REALITY: Economic coercion uses economic pressure (like the new duty prepayment requirement) to force countries to change their policies. As Prime Minister Carney noted, we must now 'buy access' to the U.S. market through compliance.The Bigger Picture: This Isn't Normal Trade Policy

Remember from my primer on the impact of tariffs where I introduced the concept of business intelligence (gathering information that affects your operations, regardless of whether it's political or not)? Here's how trade theory and experts weigh in on current tariff policy that impacts your planning:

Let's be clear about what's happening. According to textbook (theory) economics, this isn't traditional trade policy aimed at economic efficiency. It's economic coercion designed to force compliance.

As Prime Minister Carney noted: "Under the new U.S. approach, countries must now 'buy access to the world's largest economy' through tariffs, investments, unilateral trade liberalization, and policy changes in their home markets." (Statement by the Prime Minister on CAN_U.S. trade August 22, 2025)

Trade expert Lawrence Herman from the CD Howe Institute warns: "The notion that CUSMA can be modified, adjusted or modernized in a mutually balanced way is a fantasy... Canada may face a future without any kind of a broad-based agreement with the United States."⁵

What this intelligence means for your business planning:

- Build your business expecting that U.S. market access will continue to involve higher costs and more complex requirements.

Questions for Advisors:

- Based on your expert analysis, how should we plan for future U.S. market access?

- Should we assume these costs are permanent or temporary?

- How do we build flexibility to adapt to changing trade relationships?

Planning for Uncertainty:

- I don't know if these policies will change with future administrations - that's beyond my expertise. What I do know is that you need to make business decisions based on current reality, not hopes about future policy changes.

- When you meet with your accountant, ask them how to build flexibility into your business model so you can adapt quickly if conditions change again.

U.S. De Minimis Exemption Ended

Fighting Back: What Small Businesses Can Do

Finding Your Path Forward: From being upfront with customers to exploring new markets, Canadian businesses are navigating trade disruptions by focusing on future opportunities rather than past certainties. The key is looking forward, not backward.

Finding Your Path Forward: From being upfront with customers to exploring new markets, Canadian businesses are navigating trade disruptions by focusing on future opportunities rather than past certainties. The key is looking forward, not backward.I know this feels overwhelming, and you might be wondering if there's anything you can do beyond just adapting your own business.

Here's what I'm reading other business owners are doing:

- Being Honest With Your Customers - Some businesses are being transparent with their U.S. customers about why prices went up - they're literally showing the tariff line item and informing them that 'this is what the government is requiring us to collect'. It's honest, and customers appreciate knowing it's not the business being greedy. It's their government creating the problem.

You might want to test this approach to see how your U.S. customers respond when you're upfront about these government-imposed costs. - The Canadian Advantage - The Carney government is rolling out major support measures for businesses hit by tariffs. While most of these programs target bigger companies, there's a real opportunity for solopreneurs right now. Canadians are actively engaged in supporting Canadian businesses - both as a response to the trade situation and the government's "Buy Canadian" messaging.

This isn't just about patriotism - it's about discerning business timing. Market more zealously to Canadian consumers right now while they're actively looking to support homegrown businesses. When you're also looking for suppliers or partners, consider choosing Canadian companies over U.S. ones where it makes sense. This momentum may also affect long-term buying habits as it will be tough to restore our previous level of trust with the U.S. administration. - Strength in Numbers - Here's something interesting I'm noticing. Business owners are talking to each other more. They're sharing strategies, commiserating, and sometimes even partnering up to share costs or find alternatives. There's real power in not going through this alone.

Some are joining organized efforts - boycotts of U.S. suppliers where alternatives exist, sharing their stories with trade organizations and politicians. Your voice matters, especially when it's part of a chorus. - Looking Beyond the U.S. - And here's where it gets really interesting - businesses are exploring new markets. Mexico, for instance, still falls under CUSMA, so Canada-Mexico trade remains preferential. The EU markets are opening up thanks to our trade agreement there. Even Asia-Pacific countries are actively seeking alternatives to U.S.-dependent supply chains through the CPTPP.

What it comes down to is this disruption might actually force you to discover opportunities you never would have considered otherwise. Sometimes the best business moves come from necessity, not choice.

U.S. De Minimis Exemption Ended

Your 30-Day Action Plan

Take It One Step at a Time: Stay calm, move forward. Transform overwhelming trade disruptions into manageable weekly steps. Focus on the stone you're on, then the next one - don't try to leap across all at once.

Take It One Step at a Time: Stay calm, move forward. Transform overwhelming trade disruptions into manageable weekly steps. Focus on the stone you're on, then the next one - don't try to leap across all at once.Week 1: Assessment

- Calculate what percentage of revenue comes from U.S. sales.

- List your average order values and monthly U.S. shipping volumes.

- Model cash flow impact of each strategic option.

Week 2: Decision

- Choose your strategy based on your specific numbers.

- If testing pricing, set up your testing sequence.

- If pursuing CUSMA compliance, contact a customs broker.

- If exiting market, draft customer communications.

Week 3: Implementation

- Execute your chosen strategy.

- Update your website and ordering systems.

- Communicate changes to customers.

- Begin exploring alternative markets.

Week 4: Monitoring

- Track customer response and business metrics.

- Adjust strategy based on real results. Keep or pivot (double down on what worked; pause what didn’t).

- Plan the next phase based on what you learn.

Additional Considerations to Discuss with Your Advisors

As you work through these strategic options, remember to ask your accountant about ...

- The tax deductibility of duty payments - they're legitimate business expenses incurred to earn revenue.

- Also discuss what records you'll need to maintain for duty payments and any CUSMA documentation requirements, as proper record-keeping will be crucial for both tax and compliance purposes.

- Ask your customs broker or trade advisor about proper product classification - misclassifying products could lead to delays or rejections at the border, which is the last thing you need when customers are already dealing with higher costs and prepayment of duties.

- Finally, check with your insurance provider about whether your current shipping insurance coverage is adequate given the new duty prepayment requirements - this could affect your risk exposure.

U.S. De Minimis Exemption Ended

Survival Tips: Building Resilience

Guidance through uncertainty: use clear markers (cash buffer, lower debt, spread risk, document systems) to stay resilient. The inukshuk pictured here is an Inuit wayfinding symbol.

Guidance through uncertainty: use clear markers (cash buffer, lower debt, spread risk, document systems) to stay resilient. The inukshuk pictured here is an Inuit wayfinding symbol.Nobody has a crystal ball for what's coming next in these trade tensions. But there are some basic business principles that help small businesses weather uncertainty, regardless of what form that uncertainty takes.

Get Your Financial House in Order

This is not the time for a small business to be carrying unnecessary debt ... especially as you are still likely recovering from the effects of the COVID disruption. I know it's tempting to leverage up when opportunities arise, but right now?

Following Prime Minister Carney's approach of "spend less, invest more," this is the time to cut unnecessary expenses and build your financial resilience. Minimize debt wherever you can and start building cash reserves if you haven't already. Think of it as your 'sleep-well-at-night' fund for whatever comes next.

Also, hold off on any major investments that depend heavily on the U.S. market until this all shakes out. I'm not saying avoid growth; just be smart about where you're placing your bets. Focus your investments on building your Canadian customer base and operations.

On a positive note, the federal government has increased BDC loan caps from $2 million to $5 million for small businesses, recognizing the financial pressures from trade disruptions.⁸ If you need working capital to navigate these changes, this might be worth exploring with your accountant.

Spread Your Risk Around

Think about these trade tensions like managing risk in your customer base. Are you aware that it is recommended keeping any single customer below 15% of your total sales, and your top five customers under 50% combined? The same principle applies to countries.

Just like you wouldn't want one customer representing 40% of your revenue (because what happens if they leave or go bankrupt?), you don't want one country representing too much of your market either. We're seeing this scenario play out right now with these new tariffs and trade policy changes making Canadian products less competitive in the U.S. market.

For most Canadian solopreneurs serving primarily domestic customers, now's the time to double down on building that Canadian market presence - these customers are right here at home and aren't subject to foreign trade policy changes. And here's some good news: all levels of government are currently working to reduce internal trade barriers within Canada, which should make it easier and cheaper to trade across provinces and territories. So while international markets are getting more complicated, the domestic market is actually opening up more opportunities. Hey, it's a bright spot!

As your business grows, diversify your customer base across multiple countries, not just to the U.S.. Yes, it's more work, but it's insurance against exactly the kind of disruption we're seeing now.

The same risk management thinking applies to your suppliers too. Don't let yourself become too dependent on any single source, especially if they're in a country where trade relationships might be volatile.

Stay Nimble

Just like compliance is your competitive advantage, flexibility is your friend right now. Document your supply chains - not just for compliance with CUSMA, but so you actually know where your vulnerabilities are. We're already in the middle of trade disruptions, so as you review your current systems, you should be actively reaching out to non-U.S. suppliers this week, not someday when it's convenient.

Start making those calls now. Get quotes, samples, and lead times from Canadian and other international suppliers. Even if you can't switch immediately, you need to know your options and what it would take to make the transition.

Most importantly, always develop systems that can adapt quickly when the rules change. One of the advantages of being a small business is you can pivot faster than large businesses. In times of global economic transformation like we're seeing now, the rules will change (and more than once while things work themselves out). The question is whether you'll be ready when they do.

In short, prepare now so you are ready to act when needed.

The Hard Truth

Some small businesses won't survive this period. That's not failure. That's the reality of economic warfare. If your business model was entirely dependent on easy U.S. market access, you may need to make difficult decisions about the likelihood of your business survival rate.

But the businesses that do survive will inherit market share from those that don't. Building resilience now positions you to thrive when conditions improve.

Moving Forward With Confidence

This situation feels overwhelming because it's unprecedented in modern times. But businesses have survived economic disruptions before by staying flexible, making data-driven decisions, and focusing on what they can control.

What you can control

- Your response strategy.

- Your cost structure.

- Your market diversification efforts.

- Your customer and supplier relationships.

What you can't control

- U.S. government policies.

- When this situation might improve.

- How your competitors respond.

Focus your energy on what you can control. Make decisions based on your specific situation, not fear or emotion.

U.S. De Minimis Exemption Ended

Real Stories: How Businesses Are Responding

On the ground: real Canadian businesses are adapting to new shipping rules in real time as U.S. de minimis exemption ends

On the ground: real Canadian businesses are adapting to new shipping rules in real time as U.S. de minimis exemption endsGlobal News, CBC News, and the National Post have been doing a great job of hunting down real life examples of how ending the U.S. de minimis exemption is affecting small businesses in Canada. Here is a summary of a few examples from their reporting showing the range of responses.

Joey Walsh from Hockey Stick Man puts it bluntly: "As an e-commerce business in Canada, the de minimis exemption is everything. It's absolutely everything. I'm fearful for everybody's businesses now that it's being removed."²

Jess Sternberg from Free Label Clothing in Vancouver built her U.S. customer base to 45% of total sales. When the rule changed, she made a tough decision: "We have cut off all of our shipping to the United States because, right now — with the amount of risk and lack of information on shipping to the States — we can't justify it."³

Darya Kosilova's Vancouver-based vintage store, Cherish the Label, has drawn attention from celebrities like Hailey Bieber, with nearly 90% of sales going to the U.S. As a curator of vintage clothes, she faces a unique challenge: "I can't easily provide the required documentation to prove where components of my sales items were made" for CUSMA certification.⁶

Meanwhile, Jenn Harper from Cheekbone Beauty chose to absorb the 25-30% cost increases. "We're doing this on a temporary basis to see how much it actually is going to impact our bottom line."³

Lucie Quigley from Gutter Saver Pro in Nova Scotia makes her products in Canada with Texas-made plastics and has CUSMA certification. Despite qualifying for zero tariffs, she's still concerned: "I either have to pay for clearance on every shipment, and the pricing around that is not very transparent... or I have to look at finding a warehouse in the U.S."⁶

Kim Doherty from Fleece and Harmony in P.E.I. reports: "My U.S. orders have probably declined by about 25 per cent since the whole tariff talk has started."²

The Canadian Federation of Independent Business warns that "one in three Canadian small/medium enterprises will be impacted with this change."²

U.S. De Minimis Exemption Ended

Bottom Line and Next Steps

Focus on what you can control ... choose your strategy, execute, measure, refine

Focus on what you can control ... choose your strategy, execute, measure, refineThe ongoing trade tensions and de minimis elimination represents a fundamental shift in North American trade relationships. It's designed to be painful for Canadian businesses (and other countries globally) and force difficult choices.

But it's not insurmountable. With clear thinking, strategic planning, and realistic expectations, many businesses will find workable paths forward.

The key is to act quickly, test systematically, and build resilience for whatever comes next.

Your Next Steps ...

- Complete your financial assessment this week.

- Choose your strategy based on data, not emotion.

- Test your approach systematically.

- Build alternative market relationships.

- Connect with other businesses facing similar challenges.

🦆 Quacker Lessons: This is a marathon, not a sprint. The businesses that pace themselves and build sustainable strategies will be the ones still standing when the dust settles.

🦆 Duck Note: Personal exemptions remain for American travelers returning with up to $200 in personal items or gifts under $100, but these don't apply to business shipments.⁷

Sources:

1. Canada Post. "U.S.-bound postal shipments must have duties collected at origin effective August 29, 2025." August 27, 2025.

2. Rabinovitch, Ari. "Duty-free shipping to U.S. ends Friday. Canadian businesses are 'fearful'." Global News, August 29, 2025.

3. Benchetrit, Jenna. "Small businesses that relied on duty-free U.S. shipping wonder if they can survive without it." CBC News, August 29, 2025.

4. Canadian Federation of Independent Business. "What Canadian businesses need to know about the loss of the U.S. De Minimis exemption." August 28, 2025.

5. Herman, Lawrence. "Let's Move Past the CUSMA Renewal Fantasy." CD Howe Institute, August 20, 2025.

6. Moran, Tracy. "Trump killed a tariff exemption for small shipments and now Canadian businesses are scrambling." National Post, August 28, 2025.

7. PwC Canada. "Tax Insights: US eliminates de minimis shipment exemption ─ What it means for Canadian exporters." Issue 2025-27, August 7, 2025.

8. The Logic. "Carney puts EV mandate on ice, announces $5B for industries hit by tariffs." September 3, 2025

9. Business Insider (paywall). "UPS customers told their US-bound packages are marked for destruction." October 10, 2025